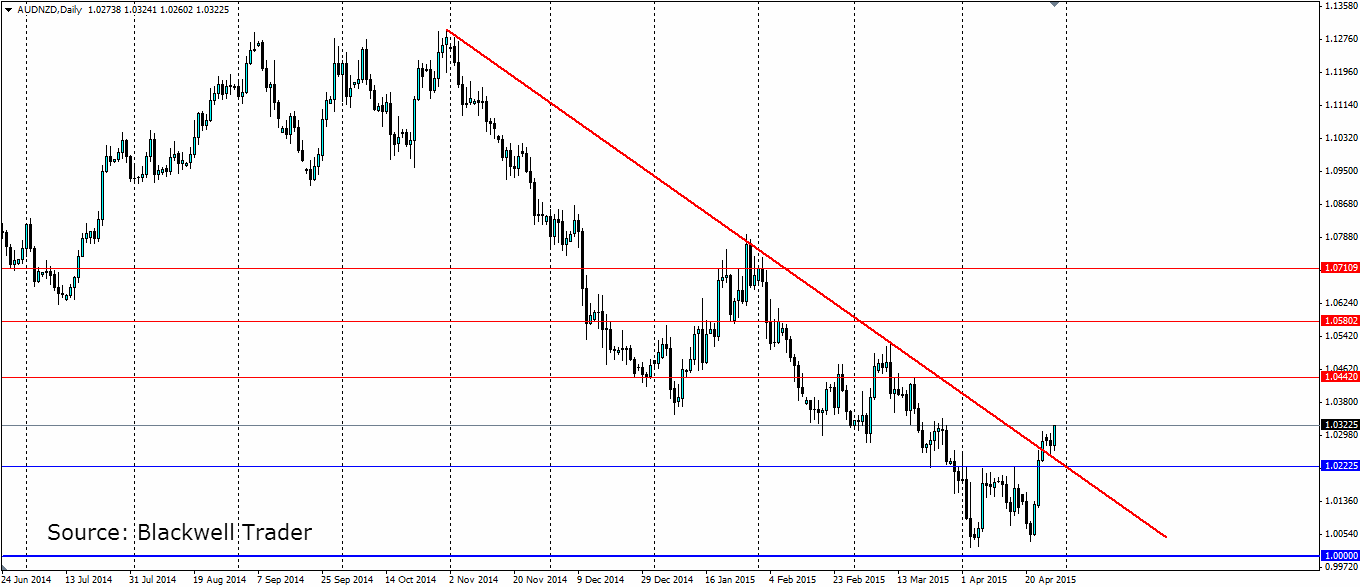

The Aussie Dollar came very close to parity with the Kiwi dollar thanks to expected cuts in interest rates. But the parity party in NZ never got started with the pair lifting from the lows and breaking out of the bearish trend.

The pair has been in a bearish trend since the beginning of November last year when the market first started to speculate about an interest rate cut from the RBA. We did eventually see one cut from the RBA in early February, and the market has been expecting another one this year. Just a few weeks ago the market was pricing in an 80% chance of a rate cut at the May 5th meeting, which has now fallen to 52% with the Aussie gaining strength accordingly.

The main reason for the turnaround is the fact that Australian employment figures have not been as dismal as many had expected. The Unemployment rate surprised the market as it dipped from 6.3% to 6.1%, after hitting a high in Feb of 6.4%. Retail sales too have surprised the market as they lifted in April by 0.7% m/m vs the expected 0.4%. The Trade Balance was another economic indicator that did not fall as much as expected. All of these point to a halt in the economic slide in Australia and the RBA will be encouraged to keep interest rates on hold.

On the other hand we have the Reserve Bank of New Zealand, which for a long time was seen as the hawks of the South Pacific. Governor Wheeler is keen to cool the domestic housing market, but at the same time he is concerned the slowdown in China could cause a recession in New Zealand. In recent weeks the market has begun to speculate that the RBNZ could hint at a rate cut of its own. We believe there is little chance given the overheated housing market, but nonetheless, the speculation is causing weakness in the Kiwi.

This turnaround has left the AUDNZD pair looking rather bullish as it pushes higher out of the bearish trend. If the markets expectations continue in their current forms we could see this pair retrace the majority of this trend over the course of the next two months. The pair will look for resistance at 1.0442, 1.0580 and 1.0710 as it moves higher, otherwise support will be found at 1.0222 and of course the psychological level at parity (1.0000).

The Aussie has found some strength recently against the Kiwi dollar as the market reassesses its positions of the respective monetary policy outlooks. Parity for now looks to have been dodged.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.