Despite the sharp fall in commodity prices, especially milk, the NZ dollar has remained “unsustainably” high according to the RBNZ.

GROWTH EXPECTATIONS:

GDP figures surprised the markets in this quarter as it lifted to 1.0% q/q, well above the forecasted 0.7%. This came as a surprise to the market, but domestic growth has remained strong in the face of falling export prices. GDP y/y fell to 3.2% (exp 3.3%), which was more in line with what was expected in the long run for the NZ economy.

Commodity prices have continued to tumble, led in part by further drops in milk prices, which showed a drop of 48% in 2014. The ANZ commodity index has also experienced falls for the past quarter, however, these look to be slowing compared to other months. Many are now expecting for milk prices to find a floor and hopefully push higher in the coming quarter.

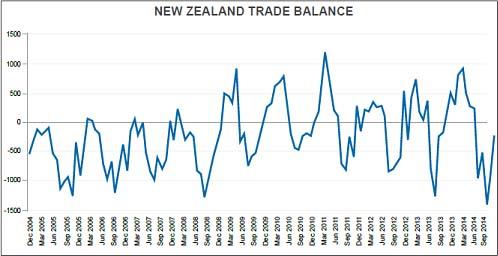

Trade balance data was seen in the last quarter to be worsening with strong falls of -1350M (NZD) and -908M from October to November. This was finally reversed with a stronger return of -213M for December’s release. However, with weak commodity prices, it’s likely that trade balance data will continue to be much weaker compared to previous years’ levels.

Unemployment continued to improve in the previous quarter with the Unemployment Rate dropping to 5.4%. This bodes well for the economy as it is well below the average of 6.27%. However, wage growth has been mixed for the most part, and many economists are surprised that we have not seen a more robust pick up in wage growth.

MONETARY POLICY:

The Reserve Bank of New Zealand is expected to possibly lift interest rates in the coming year, however, they will likely be cautious to do so unless they see a rise in inflation figures for the country as it so far has been weaker than expected (0.3% q/q). This is possible, though as the RBNZ has commented on domestic growth remaining strong and elevated for some time, we could see expectations rise for further interest rate rises.

However, it’s likely they will not be on par with the raises in 2014. The main headache for the RBNZ has been the currency with repeated calls of “unsustainable and unjustifiable” in relation to the currencies present value relative to commodity prices. At present, the RBNZ would like to see the currency drop further and may try to talk it down further, especially as the AUDNZD starts to approach parity and threaten economic exports between NZ’s largest economic trading partner.

FISCAL POLICY:

The New Zealand government and treasury had forecast a surplus for the year 2014, however, with the large drop in commodity prices in the primary sector, it managed to miss a surplus altogether. Initial forecasts from the treasury now show the government once again walking on a shoestring in the coming year of 2015.

FX OUTLOOK:

The New Zealand dollar has dropped as expected in our previous quarterly report. The months ahead for the start of 2015 look unlikely to be much different if we see weak data on the back of commodity prices. However, there is the possibility of future interest rate rises and it is likely that the market will be pricing this in. So we expect the NZD to remain in the 80-70 range for some time, with a dip lower but certainly not breaking out.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.