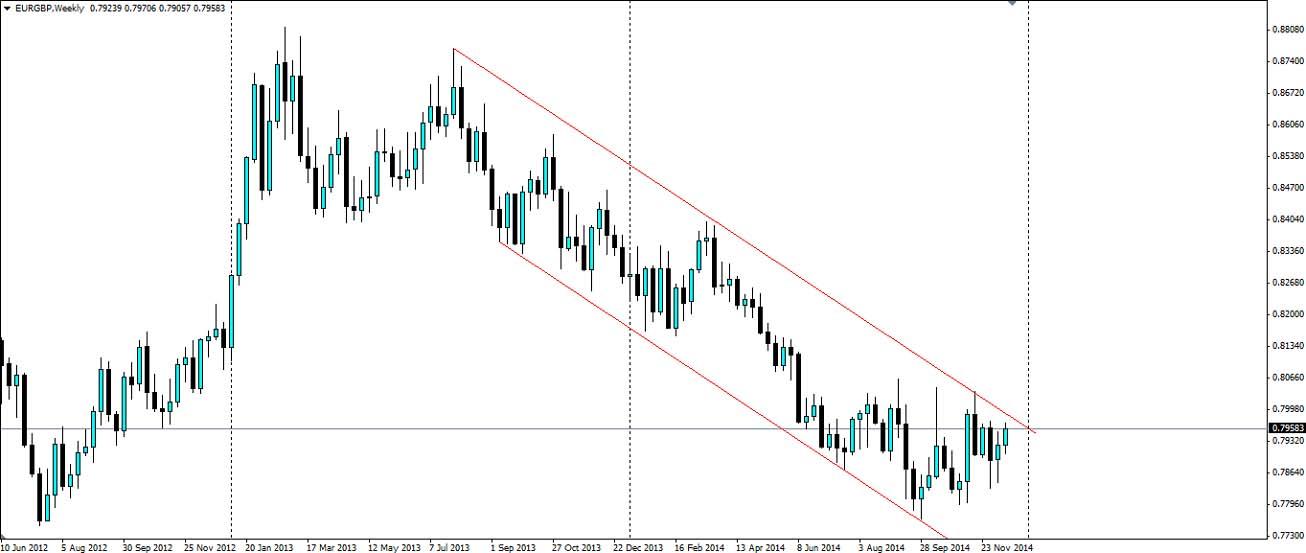

The Euro versus the Pound has been in a bearish channel for over a year and it looks likely to hold if we see another test of the upper level. With a big week ahead for both currencies, this could be an important technical pattern.

The channel on the above EURGBP weekly chart has been tested on numerous occasions and has so far held firm. With growth and inflation rates in the UK at much higher levels than in the EU, it is easy to see why the channel has formed.

The week ahead could certainly increase volatility between the pair and that could lead to a test of the upper level. If fundamentals hold their current state, we will see the channel hold and the Euro weaken against the Pound.

From the Euro’s side of things the Greek general election is the biggest item of note and it takes place on Thursday. The party leading the polls, Syriza, has vowed to end austerity and any co-operation with the EU and IMF lenders. If elected, Greece could end up exiting the Euro which could start a chain reaction. The Euro could certainly take a dive on the election results.

Before the election, Manufacturing and Services PMI results will be released for France, Germany and the Euro. The ZEW institute will also release their German Economic Sentiment report, which could shift the Euro.

The UK has a plethora of economic data out this week. Later on today the Bank of England will release its Financial Stability Report along with the results of the bank stress test. Shortly after UK inflation figures will be released and could see the pound tumble if CPI is less than the 1.2% the market expects.

Wednesday will see the Unemployment rate and the Monetary Policy committee voting breakdown, which will give an indication of the stance of each board member. We also have Retail Sales figures to round out the week.

The EURGBP pair has found a bit of resistance at the present level after a touch off the 200 day moving average. If volatility increases as expected, look for the upper level of the channel to act as solid dynamic resistance. If the price breaks out, it will find resistance at 0.79958, 0.8033 and 0.8083. If the channel holds as expected, price will look to find support at 0.7909, 0.7851 and 0.7800.

The EURGBP pair is currently in a bearish channel. With a big week of news ahead for both currencies, volatility will increase, but the channel is likely to hold firm, sending the pair lower.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.