The oil market has been very volatile in recent months, if not weeks. But there is certainly no reason to take your eye off the ball when it comes to oil markets.

There has been a lot of talk about fundamentals in the market, and so far they really have very little impact in the long run apart from the fact that demand is just not there. Many have talked about OPEC and Saudia Arabia and for the most part that should not worry the market unless anything does happen and it has not so far.

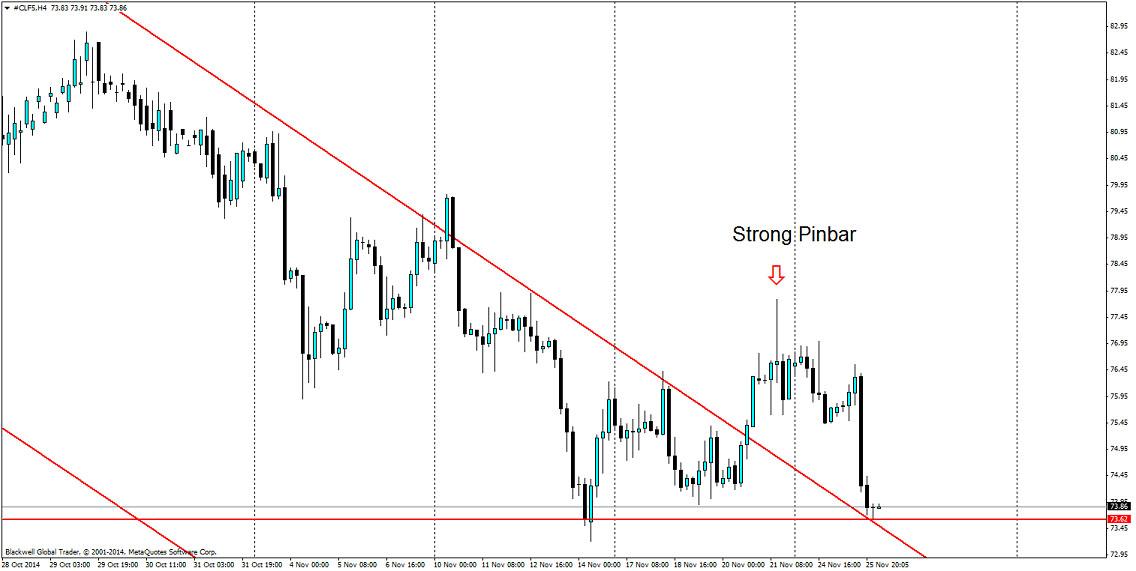

On the charts is where it matters, and what we have seen is a trending market step up the pace and become steeper and more aggressive as of late. However, last week we saw a slight reprieve and a possible false breakout which has since looked to start falling again as demand is still not there in the market.

When looking for price targets 73.62 is the support floor, which is holding up quite nicely at present, it’s likely it may act as solid support for some time. However, market pressure lower is still there and we may be looking for the next major level for oil. This level can be found at 68.56 and is likely to be a strong turning point for oil if we get there, and we may actually find some more bulls in this market for a change.

On the H4 chart, we can see the price action as it pushes the bulls out of the market. We’ve seen a strong pin bar on the charts, followed by aggressive selling as a result and that level holding up as a strong area of resistance.

Overall, oil looks to still be under the pump and until we saw a confirmed amount of momentum driving higher oil looks likely to stay under the bears control. If you’re an oil trader, I would strongly be looking to the sell side of things in the short term, as it looks like the bulls are still not there for traders.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.