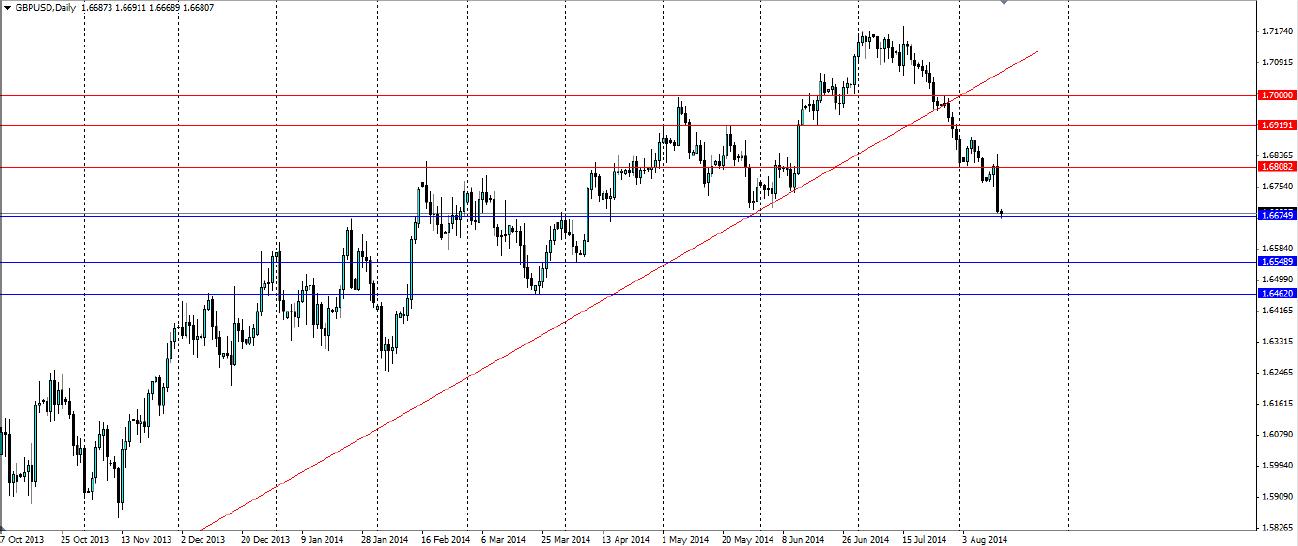

The GBPUSD pair took a massive hit yesterday when the Bank of England downgraded wage growth forecasts. Is this the signal the Sterling bears had been hoping for? Or is this an opportunity for the bulls to regroup?

The headline figure from the Band of England inflation report yesterday was that the BoE has halved its wage growth forecast. It now expects wages to rise at just 1.25% this year. Wages have slowed to their slowest rate since 2001 (when records began) at just 0.6%. The bank also said it will put more weight on wages in its assessment of spare capacity in the labour market.

The market took this as an indication that predictions of an interest rate rise later this year or early next year were too optimistic. Essentially, it was a very bearish signal for the market and the Pound Sterling was punished accordingly. The news was not all bad though. If we look a little closer there are actually some reasons to be optimistic and could bring the bulls back into the market.

What did not make the headlines was that the Bank of England upgraded their estimate for economic growth this year from 3.4% to 3.5% and its 2015 forecast was lifted from 2.9% to 3.0%. Furthermore the BoE believed the amount of spare capacity in the economy narrowed to 1.0% from 1-1.5%. This should give anyone bullish on the sterling cause to hope that these good figures will eventually feed through to wage and CPI inflation.

We cannot overlook the good result for unemployment also released yesterday. The headline rate fell from 6.5% to 6.4% and the claimant count fell by -33,600 vs an estimated fall of -30,000. Adding more optimism was the fact that the BoE’s medium-term equilibrium rate of unemployment was reduced to 5.5% from 6.5%. Logic would suggest that in an improving labour market, wages will eventually feel upward pressure. This may not materialise for some time, butit will give the bulls some encouragement.

It will pay to keep an eye on the preliminary GDP data that is due out tomorrow. This is expected to show the UK economy grew at 0.8% in the second quarter of this year. Anything to the upside of this will no doubt bring the bulls back into the market.

The fall in the pound yesterday was justified as the outlook for interest rates became a little bleaker. Looking further into we see there are reasons to remain optimistic about the future of the pound and the bullish sentiment is sure to return.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.