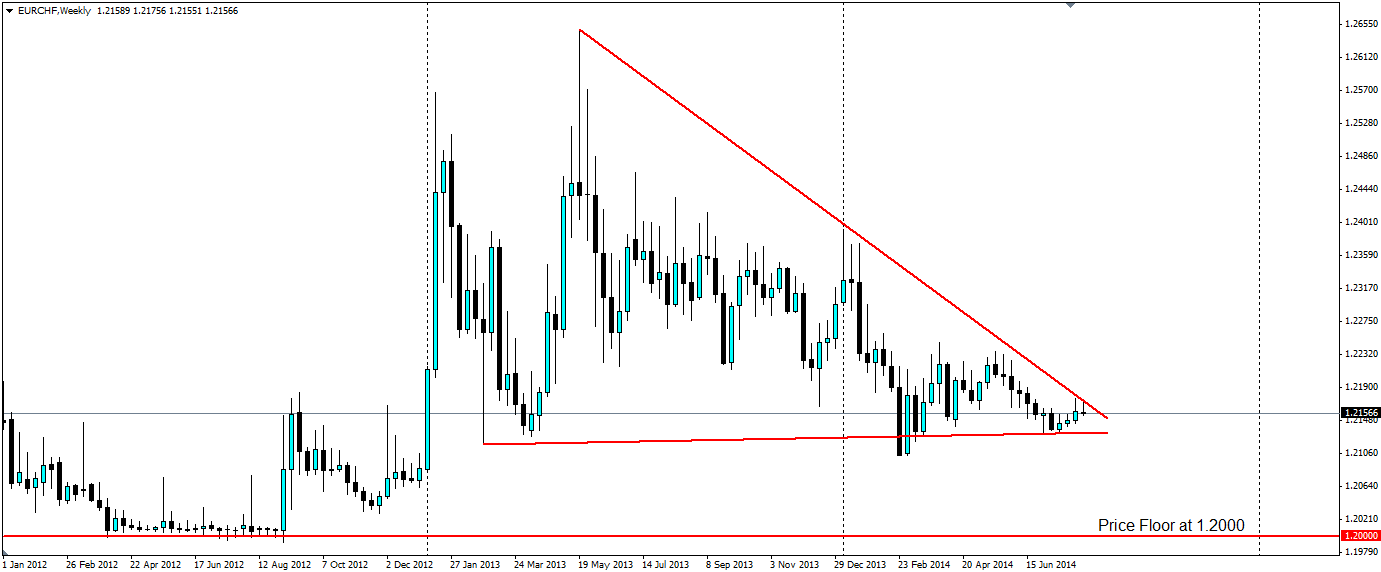

Over the last 18 months a huge triangle has formed between the Euro and the Franc. With a price floor in place, a breakout lower for the EURCHF will not be going any lower than 1.20, however, a breakout higher could be large.

In early 2013, the EURCHF pair was extremely volatile as the EU emerged from the sovereign debt crisis that threatened to break up the Euro zone. At the peak of the crisis the price floor at 1.2 Euros per Franc between the two was put to the test as capital fled the EU for the safety of the Swiss Alps. The Floor was put in place by Switzerland’s central bank (the SNB) to combat falling inflation. Since interest rates were already at zero, they saw the price floor as the most appropriate strategy to prevent deflation by keeping the currency artificially weak and therefore imports artificially high. The SNB even pledged to “defend the floor with unlimited reserves”.

Once confidence returned the capital outflows led to extreme volatility between the pair which has slowly been diminishing. The stimulus in the EU has led to the descending bearish trend as the return differential between the two currencies diminishes. Also at the first signs of a crisis the pull of the ‘safe haven’ title the Franc affords leads to capital outflows from the Euro zone.

If we see more stimulus from the ECB, which is a distinct possibility given the falling inflation rate has fallen to just 0.4%, we will see a breakout of the support that forms the bottom of the triangle around 1.2132. The ECB is meeting at the end of this week, so we will know where they stand by then. A movement lower will be cut short by the price floor at 1.2000, making it a 132 pip movement at maximum. From here, it’s a pretty safe long given the stance of the SNB and their “unlimited reserves”.

A breakout to the upside is a possibility if inflation returns to the EU. We are seeing some positive signs in the form of Services PMIs from Germany at 56.7 and France at 50.4, and also Spain’s unemployment rate coming down to 24.5% along with the EU wide unemployment falling to 11.5%. Furthermore, it looks like the Swiss economy is feeling a bit of stress with the KOF economic barometer falling to 98.10 from 100.50, however we will know more by the end of the week when Swiss CPI and Unemployment is reported.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades at around 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD remains on the defensive around 1.2500 ahead of BoE

The constructive tone in the Greenback maintains the risk complex under pressure on Wednesday, motivating GBP/USD to add to Tuesday's losses and gyrate around the 1.2500 zone prior to the upcoming BoE's interest rate decision.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.