Oil charts are really interesting if you are into technical movements, they seem to swing wildly on a variety of news, but they also seem to show great pattern and for the most part obey key rules when it comes to movements.

Oil movements were heavy during 2008 and there was massive volatility as people looked to commodities as tangible assets that had value in the face of everything falling apart. I don’t blame them, but oil over a hundred dollars a barrel is uneconomical in the present marketplace and was certainly uneconomical during that period in time.

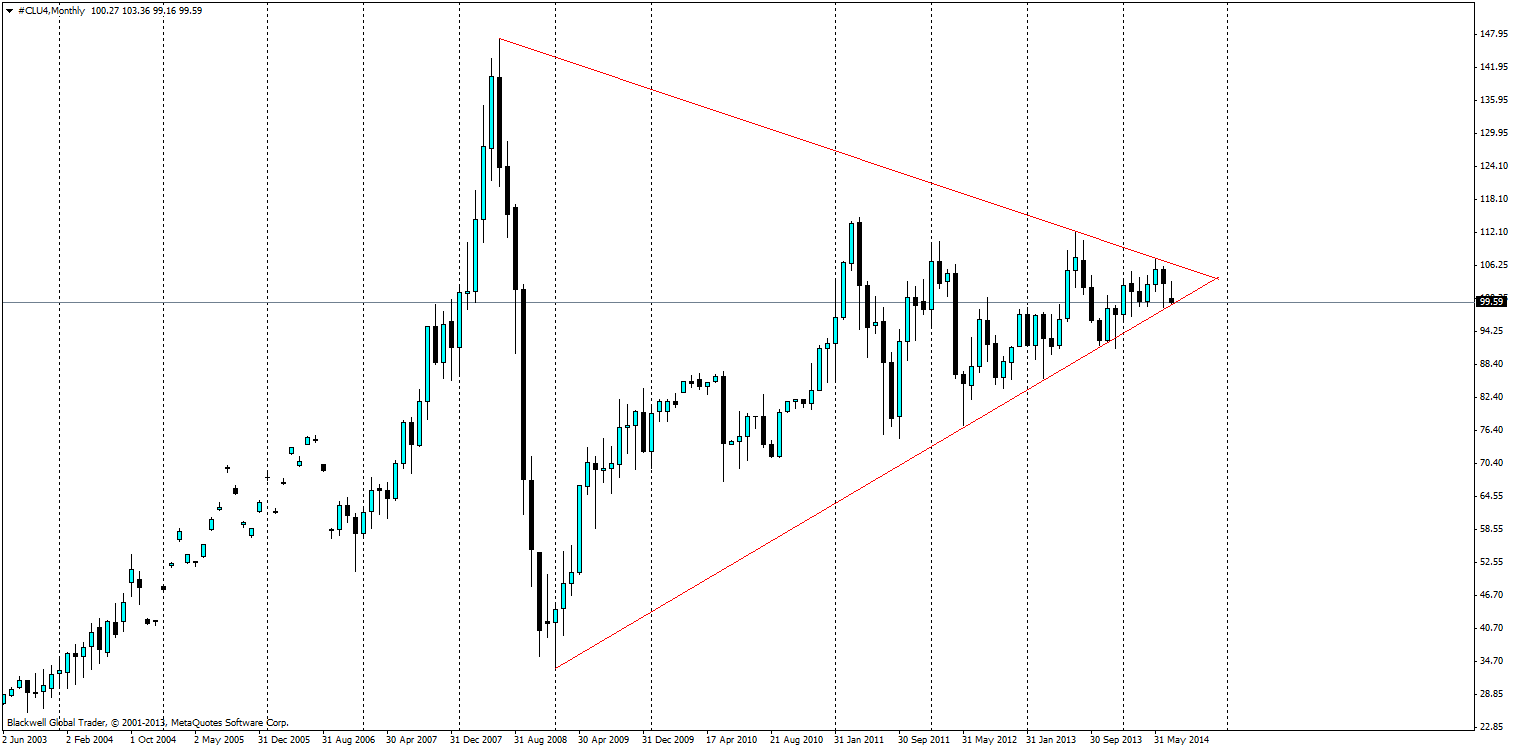

But, to get back to the main point, what I am talking about is the massive pennant pattern which has formed on oil charts over the last 6 years, and I believe something has to give in the coming months as a result of the pattern converging.

Currently there is only one day left on the chart, and a move higher could certainly be on the cards in the coming month as it looks to push off the trend line and back to around the 100 dollar barrel mark.

While so far I have talked up the prospects of 100 dollar barrel of oil, I am against it strongly in the long run. While it may be the lifeblood of the world at this present moment; the advent of fracking has been heavy on the oil market, as oil previously too hard to extract now becomes more accessible.

With the market going forward believe that oil will drop lower and Bloomberg forecasts also point to oil dipping longer in the long run over the coming years, the question is when will the market wake up to this key point and we stop seeing the bulls fighting the future of oil.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.