The silver market can be rather confusing for a lot of traders, but there is hope that it’s not too hard to understand as it bounces around on technical patterns on the chart.

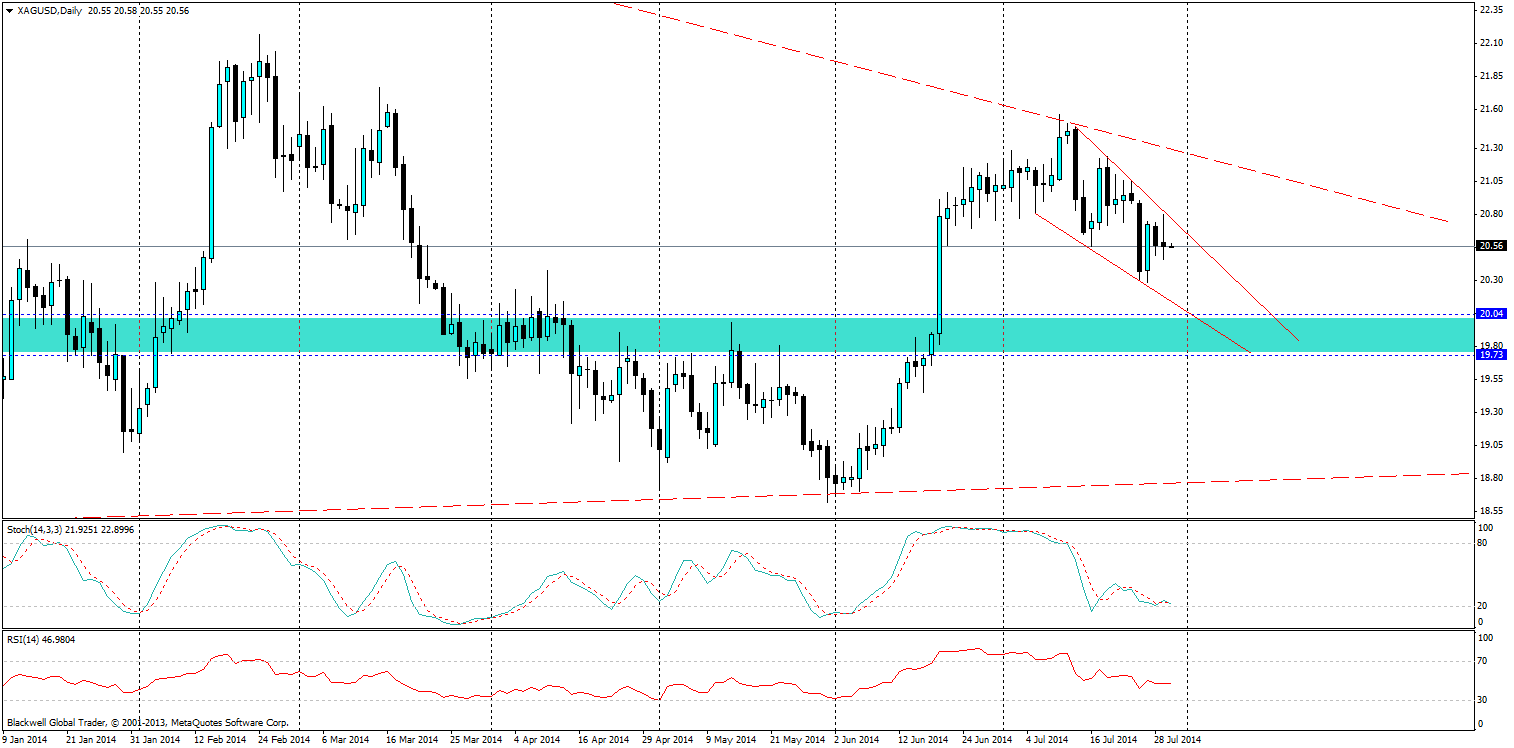

After a strong touch on the bearish trend line silver has looked to range back downwards in a descending wedge, and that’s not surprising given that markets are starting to look up at the U.S dollar. All forecasts this week are expected to show positive results for the U.S economy, whether that is actually true remains to be seen. But, it’s a positive sign when forecasters are looking forward with some optimism.

So with a descending wedge, it generally means that we will see a bullish breakout higher at some point. Currently the market is at 20.57 and further lows look very much possible. I am targeting the 20.04-19.73 area which has shown in the past to be a turning point with high volume and liquidity in the market. Traders will be looking to target this area as well.

Movements lower though could struggle if U.S. data is weaker than expected, however, the current trend line will likely trap movements higher in the event of weaker U.S. data.

Overall, bearish sentiment remains in the short term until we get below the present 20.00 dollar an ounce mark, and strong U.S. data will help extend this push lower. A strong non-farm reading might even push it completely into the range we are targeting and in turn help provide a breakout of the present descending wedge.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.