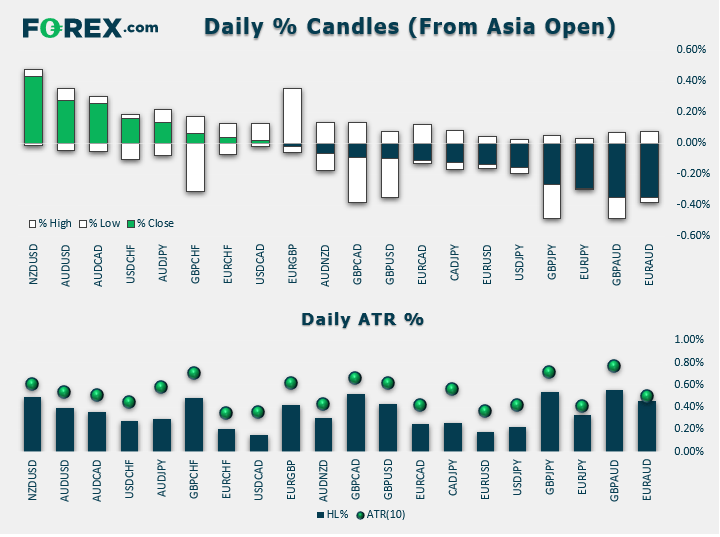

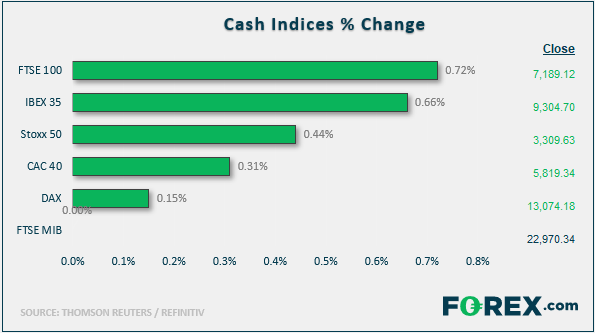

Market update at 13:00 GMT: Commodity dollars were leading in FX with euro and pound being the laggards. Stocks were higher, gold and oil flat.

Investors are awaiting key employment data from North America, with the US non-farm payrolls and Canadian employment reports both due at 13:30 GMT. NFP expected to print 181K on the headline front while average hourly earnings are seen rising 0.3% month-on-month in November compared with 0.2% the previous month. Canadian employment is seen rebounding by 10K after an unexpected drop in the previous month. Given the BOC's hawkish rate hold in mid-week, a strong Canadian jobs report could see the commodity dollar outshine its southern neighbour - and especially if oil prices were to spike higher in the aftermath of the OPEC+ decision.

The so-called OPEC+ group are meeting to discuss production cuts in an effort to head off global oversupply in 2020 and sustain prices. According to Reuters, citing sources, Saudi Arabia and Russia have won the backing for deeper output cuts from OPEC and allied oil producers. Collectively, they have apparently agreed to an extra 500,000 barrels per day (bpd) in cuts for the first quarter of 2020. Oil prices were little-changed following a sizeable rebound over the past few days.

Jeremy Corbyn, the Labour Party leader, says he has a confidential government report that reveals "cold, hard evidence" that there will be "customs declarations and security checks" between Northern Ireland and Great Britain, under Boris Johnson's Brexit deal. PM Johnson and Corbyn will go head-to-head in a live TV election debate at 20:30 GMT on BBC One tonight. Meanwhile in France, President Emmanuel Macron faced the biggest protest since he took office more than two years ago, as hundreds of thousands took to the streets in protest of the controversial pension reform bill. Labour unions have extended their protests until Monday.

There is no end in sight for the recession in Germany's manufacturing industry. Fresh data this morning revealed an unexpected 1.7% monthly drop in industrial output. The falls were concentrated in production of capital goods, including tools, buildings, vehicles, machinery and equipment. This comes on the back of woeful figures published on Thursday that showed manufacturing orders fell by 0.4% in October. The German economy narrowly avoided a technical recession in the last quarter, but with manufacturing activity continuing to deteriorate, this could spill over to services and hurt employment, resulting in another quarter of negative economic growth.

Another major country trying to avoid a recession is the world's third largest economy, Japan. Prime Minister Shinzo Abe has launched the nation's first fiscal stimulus since 2016. After months of underwhelming data, Mr Abe revealed a larger-than-expected ¥13.2tn ($121bn) package. The large fiscal stimulus package is introduced to help repair typhoon damage, upgrade infrastructure and invest in new technologies. This comes as Japanese exports are continuing to shrink while the recent sales tax hike continues to bite the consumer - the latest data showing household spending plummeted 11.5% last month or 5.1% on a YoY basis.

Stocks remain supported for the time being. Trump remains upbeat on US-China trade talks, saying they're "moving along very well". But he's been saying this for a year now, so make of that what you will – words of my Asian colleague Matt Simpson.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.