Market Commentary

Markets are recovering from last night’s FOMC statement and Janet Yellen’s press conference. Essentially, the Fed left the language in their communique unchanged, thus prolonging the status quo as the central bank nears the end of it’s accom-modation cycle. While asset purchases are due to come to an end in the latter part of October, the FOMC is still intent on reiterating that interest rates will remain low for a considerable time period after QE termination.

While equities reacted in a more straightforward fashion, the response to FOMC has not been uniform across a range of assets. Yields on US government bonds edged higher mildly, Eurodollar-implied rates for Dec 2016 expiry shifted higher from 208.50 bp to 228.0 bp since FOMC, and USD strength-ened.

ECB conducted its first disbursement of TLTRO funds this morning, allotting EUR 82.6 bn vs. expectations of EUR 135.0 bn. The operation prompted a muted response in the markets, with lesser than expected allotment reported to be a function of constraints imposed by stress tests conducted for EU banks.

The main event for the latter part of the week will be Scot-land’s vote on independence, with results expected on Friday morning.

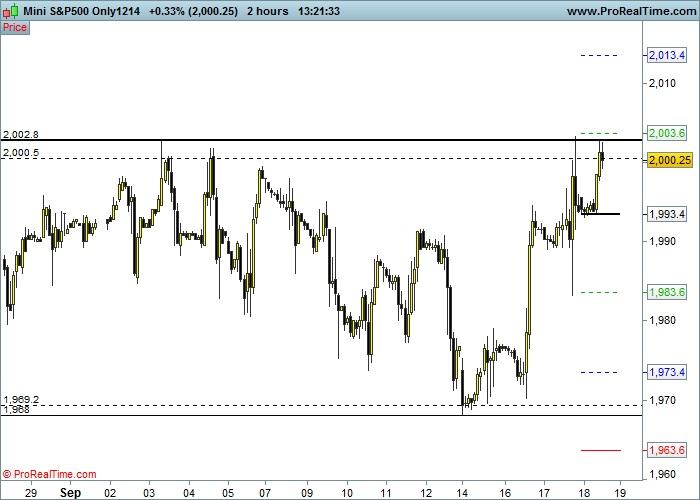

Intraday Strategy: E-mini S&P

The E-mini S&P erased all of the downside sustained since the August Nonfarm Payrolls data on the 5th September: initially fol-lowing the news of a CNY 500 bn liquidity support from the PBoC and a further extension followed last night as the FOMC kept their stance at status quo. E-mini set a new high for the year, albeit briefly last night and is consolidating within the vicinity of yester-day’s lofty levels currently.

Our strategy for the day ahead entails buying into a pullback to the pivot, targeting a re-test of the highs of the year and a potential ex-tension to R2.

Intraday Strategy: EUR/USD

The EUR/USD finally broke out of its range (which has been in place since the beginning of the month) in the latter part of yester-day’s session. The main catalyst for the sudden bout of volatility came in the shape of USD strength post-FOMC.

Our strategy for the day ahead entails selling into a pullback to R1, targeting a fade to the pivot and a potential further extension to the lows of yesterday’s session.

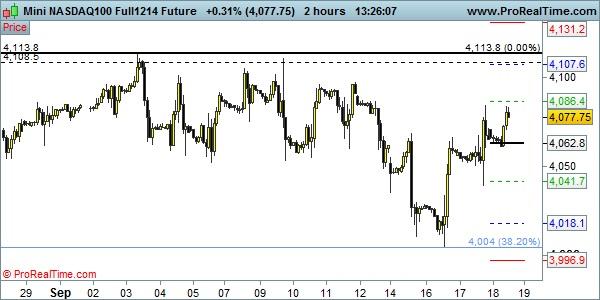

Technical Analysis: Nasdaq and DJIA

Nasdaq and DJIA retracing the majority of recent losses since the start of the month, albeit to a lesser extent than the S&P 500.

Technical Analysis: Bund and US 10-year T-note Futures

10-year German and US yields pushed marginally higher following the FOMC last night.

Technical Analysis: GBP/USD and USD/JPY

Sterling has been strengthening this morning following the latest poll release which suggested a tilt towards the “NO” vote. USD strength against JPY not showing signs of abatement following yesterday’s rally.

City Trading & Investment Ltd are an incorporated entity registered in England & Wales. Company registration number is 08677745. Registered address: 37th Floor, One Canada Square, Canary Wharf, London, E14 5AB. Trading futures contracts on margin carries a high level of risk and may not be suitable for all investors. This excessive leverage can work against you at a significant capital cost. Before deciding to trade futures products you should carefully consider your investment objectives, level of experience and risk appetite. It is possible that you may lose some or all of your initial capital/investment and, there-fore, you should not invest money or financial assets that you cannot afford to lose. You should be aware of all of the risks associated with futures trading and trading financial instruments in general. You should seek advice from an independent financial advisor.

Any opinions, news, research, analyses, prices or other information contained in these reports is provided as general market commentary and is for educational purposes only. The content does not constitute investment advice in any shape or form. City Trading & Investment will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. The content of this report do not constitute an offer to sell or solicitation of an offer to buy any securities or financial instruments. Furthermore, the content of this report does not constitute advice or a recommendation with respect to such securities or other financial instruments or investments.

The content on this report is subject to change at any time without notice, and is provided for the sole purpose of assisting the educational appetite of traders. City Trading & Investment has taken reasonable measures to ensure the accuracy of the information within this report; however, it does not guarantee accuracy and will not accept liability for any loss or damage which may arise directly or indirectly from the content of the report or from your inability to access the report, or for any delay in or failure of the transmission or the receipt of this report. Furthermore, no part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of City Trading & Investment Ltd.

This report is not intended for distribution or use by any person in any country where such distribution or use would be contrary to local law or regulation. None of the services or investments referred to in this report are available to persons residing in any country where the provision of such services or investments would be contrary to local law or regulation. It is the responsibility of the readers of this report to ascertain the terms of and comply with any local law or regulation to which they are subject.

Investment asset valuations and pricing can go up and down. Investment price fluctuations can be violent and can result in the loss of some or all of your initial investment/capital. The financial assets referred to in this research and the potential income or losses from them may also fluctuate violently as described. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of original capital may occur. Certain transactions, including those involving futures, options, and other derivatives, give rise to substantial risk and are not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.