Market Commentary

Welcome to the new week. Today is the first full session since last Wednesday, with US participants back in the markets following the Independence Day holiday last week.

Today’s session started off with moderate declines for European equities. With the exception of misses on German Industrial Production for May and Spanish Industrial Output for May, today’s session has largely been devoid of data or notable events.There is no economic data scheduled for the rest of the session. In addition, US data is going to be limited this week as the Q2 earnings season kicks into gear. The release of FOMC minutes on Wednesday is arguably the most important event of the week for US markets.

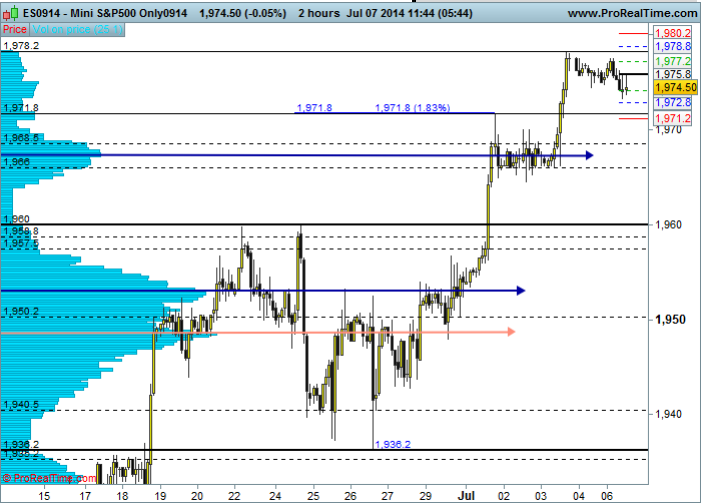

Intraday Strategy: E-mini S&P

The E-mini S&P has been confined to a tight range since the ascent to new highs for the year last week (following payrolls data on Thursday). Although momentum has been very weak in the US equity futures markets since last Thursday, prices in E-mini S&P are being accepted at current levels.

Taking into account a quiet session ahead and little change from last week in terms of fundamentals, we feel that equities can maintain positive momentum. Our strategy for today’s session entails buying into a pullback to 1968.50, which is just above the short-term value area (1967.00).Intraday Strategy: DAX

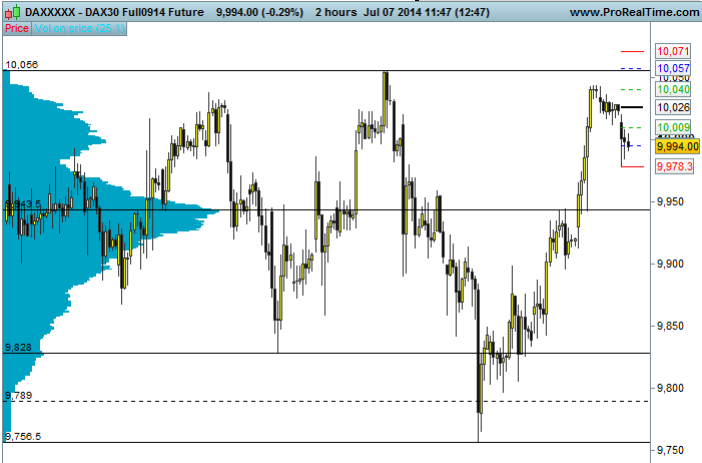

The DAX gapped lower this morning following the release of German Industrial Production for May. While the data was disappointing (M/M –1.8% vs. prev. –0.3%) and back to May 2013 levels (Y/Y 1.3% vs. prev. 1.3%), this slowdown was largely expected following a strong first quarter. IFO and ZEW surveys indicated the upcoming slowdown in the second quarter at the beginning of June.

Our approach today entails buying into a pullback to the 2nd July high.Intraday Strategy: EUR/USD

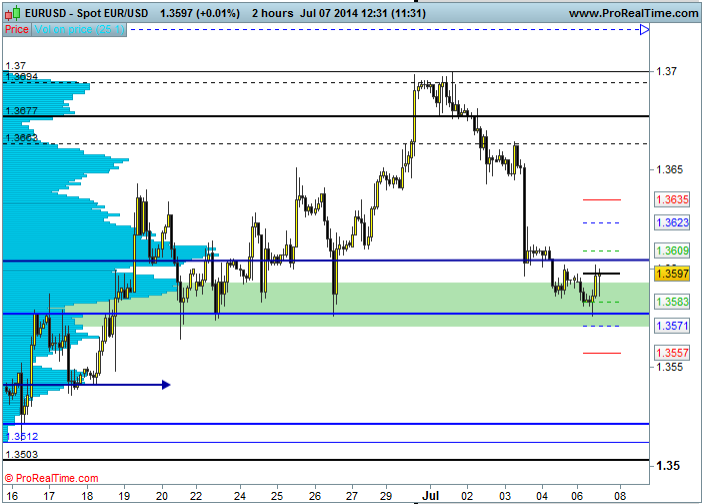

The EUR/USD gathered downside momentum last week as the week progressed. While some of the initial declines were prompted by strengthening USD (in response to strong US data), the main downside extension materialized during the ECB press conference. More precisely, it was the announcement that TLTRO uptake would be close to EUR 1tn vs. the original estimate of EUR 450bn.

Price action is stabilising so far today following the early morning pullback to mid-June levels of resistance which were subsequently appreciated as support in the latter part of June.For today’s session we aim to buy into a pullback to the lows of the day, targeting the 1.36 handle and a potential extension to R2.

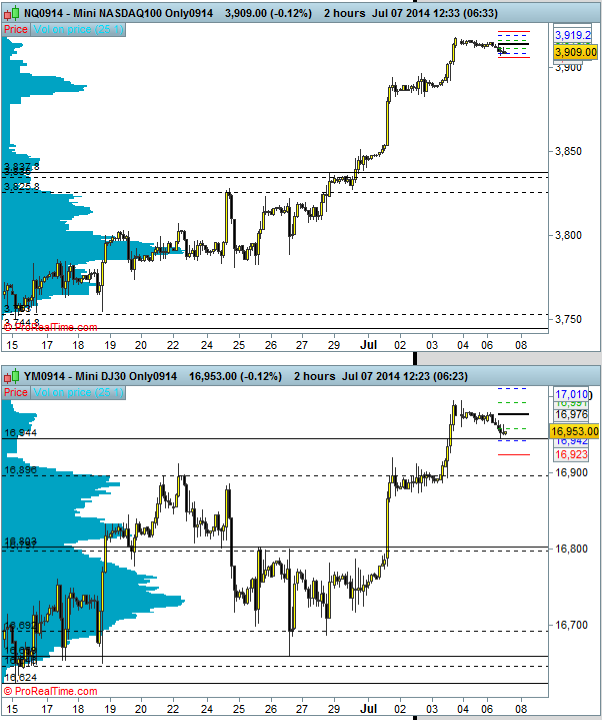

Technical Analysis: Nasdaq and DJIA

Nasdaq and DJIA futures continue to trade sideways to lower from the latter part of last week due to cash equity trading session closes for the US Independence day holiday.

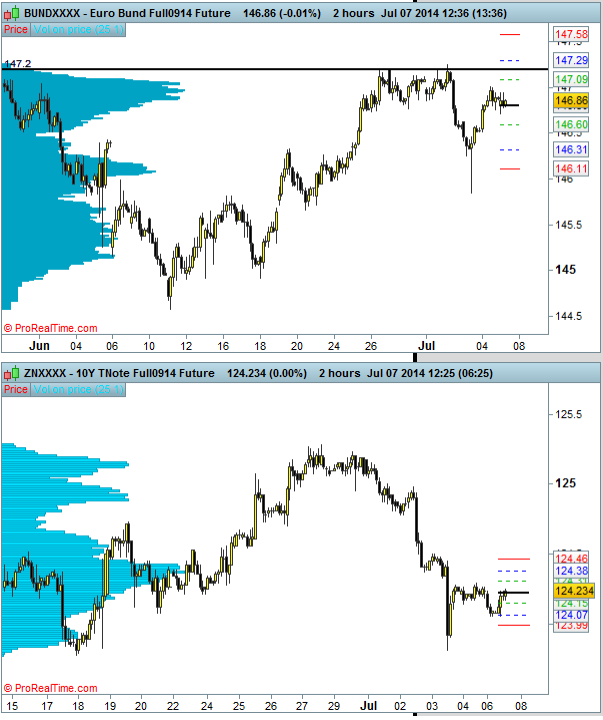

Technical Analysis: Bund and US 10-year T-note Futures

German yields rose in the run up to the ECB press conference last week yet managed to stabilize in the latter part, with Bund trading near all-time highs again. US yields rose along the mid– to long-end of the curve following strong employment data.

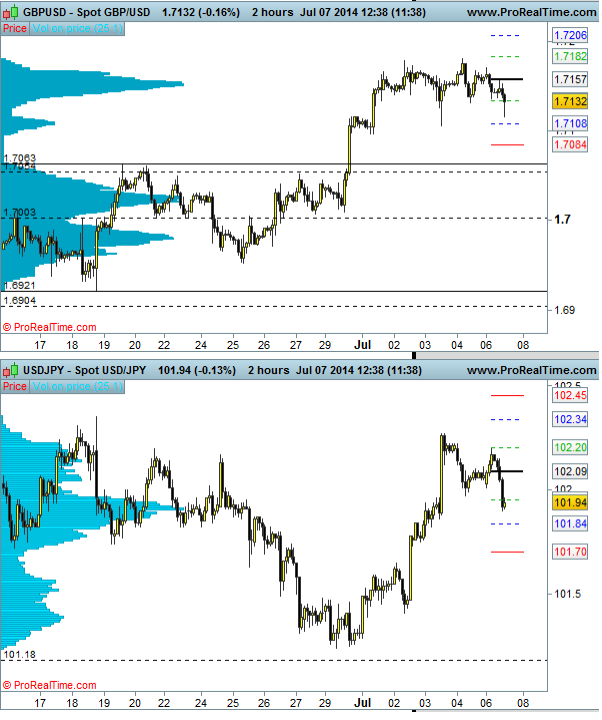

Technical Analysis: GBP/USD and USD/JPY

GBP/USD continues to trade sideways in a phase of consolidation while the JPY is consolidating last week’s losses (which materialized primarily as a function of strengthening USD).

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.