Prices witnessed a sharp recovery after setting a new multi-year bottom on Jan 20. The recovery triggered a speculation that a bottom is in place and a major corrective rally is in the making. However, here we are again with prices sliding fast.

One of the major reasons for a sharp recovery in last two weeks was the talk of a joint production cut. Russia, Iraq and Iran took turns to say they are ready for a joint effort – OPEC and non-OEPC production cut. However, it is easier said than done and markets seem to have realized this again. Even the OPEC delegates and Saudi officials said they are not in talks with non-OPEC producers.

Still, the speculation refuses to die completely. Every now and then there is a talk of a joint production cut or even an individual effort – Saud production cut. Here is why, the speculation refuses to die and pops its head every now and then –

- Supply-Demand mismatch: Crude oil supply in the market has reached 96.9 million barrels per day during the past three months. On the other demand is well short of the supply. As per the International Energy Agency forecasts, demand stands at only 94.7 million barrels per day. This means an excess supply of 2.2 million barrels per day.

- Oil fell to $25/barrel and the market is still suffering from 2 million b/d of oversupply.

- Economic woes – As per OPEC figures, oil exports by member countries in 2015 fell to $964.6 billion dollars, $135.4 billion lower than 2014. This is a challenging scenario for OPEC members whose economies are deeply dependent on their oil income,

- Saudi under pressure – The OPEC’s strongest member Saudi is under pressure. If reports are to be believed, the Kingdom can sustain the ongoing price war for couple of years more, given its 660 billion forex reserves, however, budget deficits are on the rise and there is growing speculation that it may have to end its currency peg.

- Iran plans to boost its exports to 2.3 million barrels per day in the next fiscal. The country suffered from sanctions since 2012 and is in no mood to accept production cuts. This also means the gap between supply and demand would rise even further.

- Neither it is possible to bring OPEC and non-OPEC producers on a common terms.

What happened in last supply driven oil bust?

- Demand was muted for several years, in part because of conservation measures embraced by the US after the Arab oil embargo in the 1970s.

- Oil output outside OPEC grew rapidly. Production in the North Sea surged. Output in China, Oman and Mexico increased, while US also started producing more oil.

- In response, Saudi announced a production cut in order to support prices. The US EIA report shows Kingdom’s output fell from 10 million barrels a day in the early years of the decade to 2.3 million in August 1985.

- However, the move hurt Saudi as it started losing oil market share and thus it started pumping oil again in November 1985. This resulted in a more severe oil price drop –from over $30 a barrel in November 1985 to nearly $10 by July 1986.

- Prices spiked in 1990 after Iraq invaded Kuwait.

- It will lose its market share and may have to face more economic problems than it is facing now

- Iran and other weaker nations would exploit the opportunity by pumping more oil

At the most, a technical correction could be seen, but by large prices may establish a $20-25 range above multi-year lows. Overall, we are unlikely to see oil move back above $50 anytime soon as –

- Oversupply will persist

- Low possibility of production cut

- Demand to stay weak until China has rebalanced itself successfully from an export driven to consumption driven economy. (Aggregate demand deficiency likely to stay intact until China rebalancing is successful).

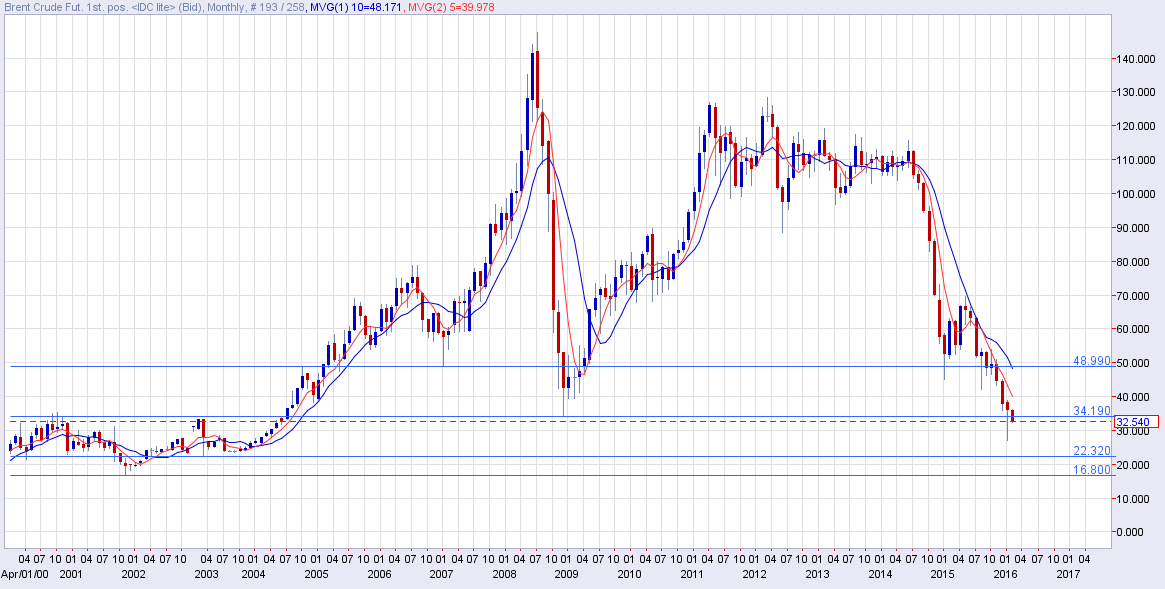

Brent oil monthly chart

- Prices are back below Dec 2008 low of $34.19

- Next major support levels are - $27.08 (latest cyclical low), $22.32 (Mar 2003 low), $16.80 (Nov 2001 low).

- Major resistance levels are - $39.32 (Feb 2009 low), $42.19 (Aug 2015 low), $46.24 (Sep 2015 low), $45.16 (Jan 2015 low), $48.99 (Jan 2007 low).

- A major technical correction could run out of steam at a major hurdle at $48.99 (Jan 2007 low), following which prices may remain range bound largely.

- Global slowdown, excess can very well result in a drop to $16.80 levels this year.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.