Another failure at 1.4598 in the making?

At the moment, the odds do appear in favour of another failure to rise over and above 1.4598. The cable has witnessed the longest rally since April 2012 and appears due for a technical correction. On the other hand, we have Swiss franc being favoured as a safe haven currency amid Greek impasse.Safe haven demand for CHF could spike ahead of June 30

The Greek deal appears still far away and the June 30 deadline would most likely be put to test. Consequently, we are likely to see the safe haven Swiss Franc continue to receive fresh bids. The safe haven trade may intensify further into the next week in case the deadlock persists, especially since the EUR is likely to be sold as we move closer to June 30 deadline. A sharp sell-off in the EUR would only add to the bids on the CHF.Furthermore, the British Pound also stands to lose in case of a Greek led risk aversion in the financial markets.

SNB intervention unlikely in short-run

The Greece issue is still playing itself out. Amid all the chaos and rumours surrounding the deal/no deal, any kind of intervention from the SNB to halt appreciation of in the CHF is unlikely to have a lasting impact. Hence, surprise rate cuts on the part of SNB or stealth interventions are unlikely so long as the Greece issue lingers. Verbal interventions are likely, although we did not see it having any impact on the CHF today, after SNB’s Jordan expressed readiness to act if the CHF continues to strengthen. However, Jordan also acknowledged the fact that CHF is being favoured as a safe haven currency, indirectly stating that the bank would like the Greece issue play itself out before making a move. Consequently, the doors are wide open for the CHF to extend gains against major European currencies including the GBP.On account of these factors, the GBP/CHF pair could witness a failure to take out 1.4598 on weekly chart and begin its slide to 1.4350 next week. Still, the bearish idea is at a risk of quick-fix short-term solution to Greece issue ahead of June 30. Such an event could easily result in GBP appreciation (as EUR rallies) and CHF depreciation (loss of safe haven appeal and EUR rally), taking the GBP/CHF pair above 1.4708 (Apr. 29 high).

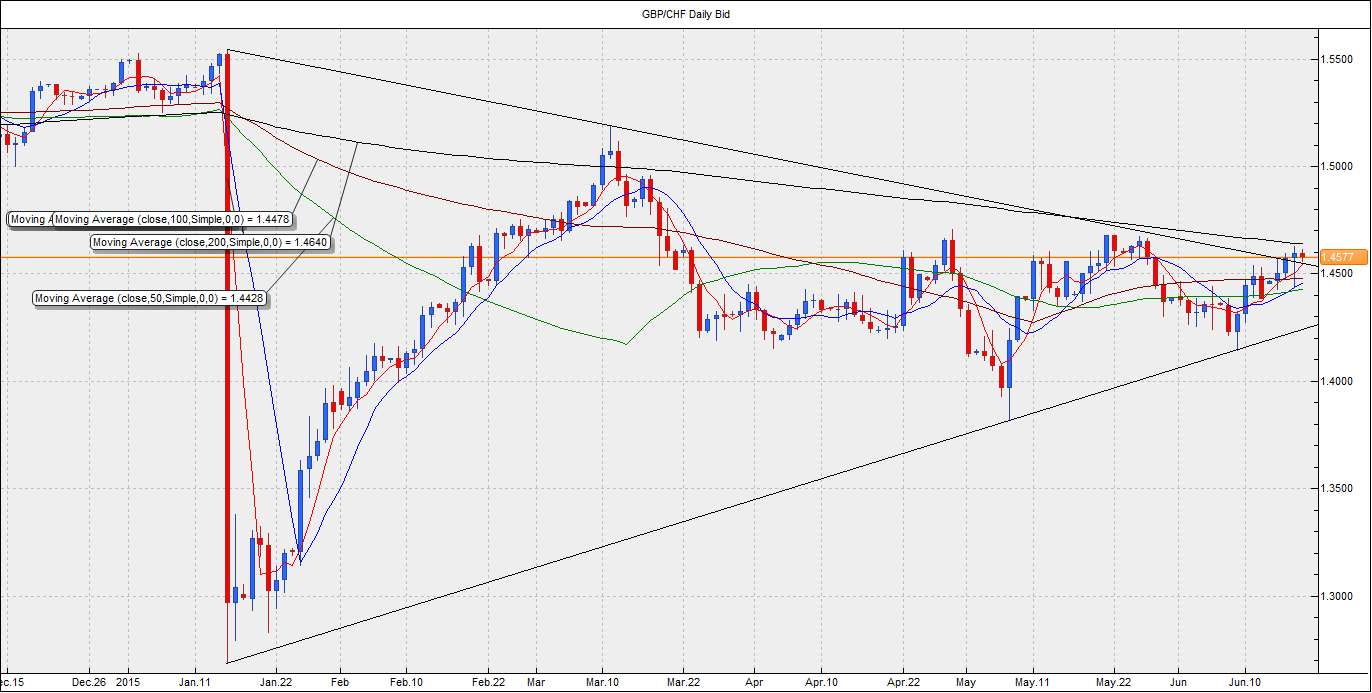

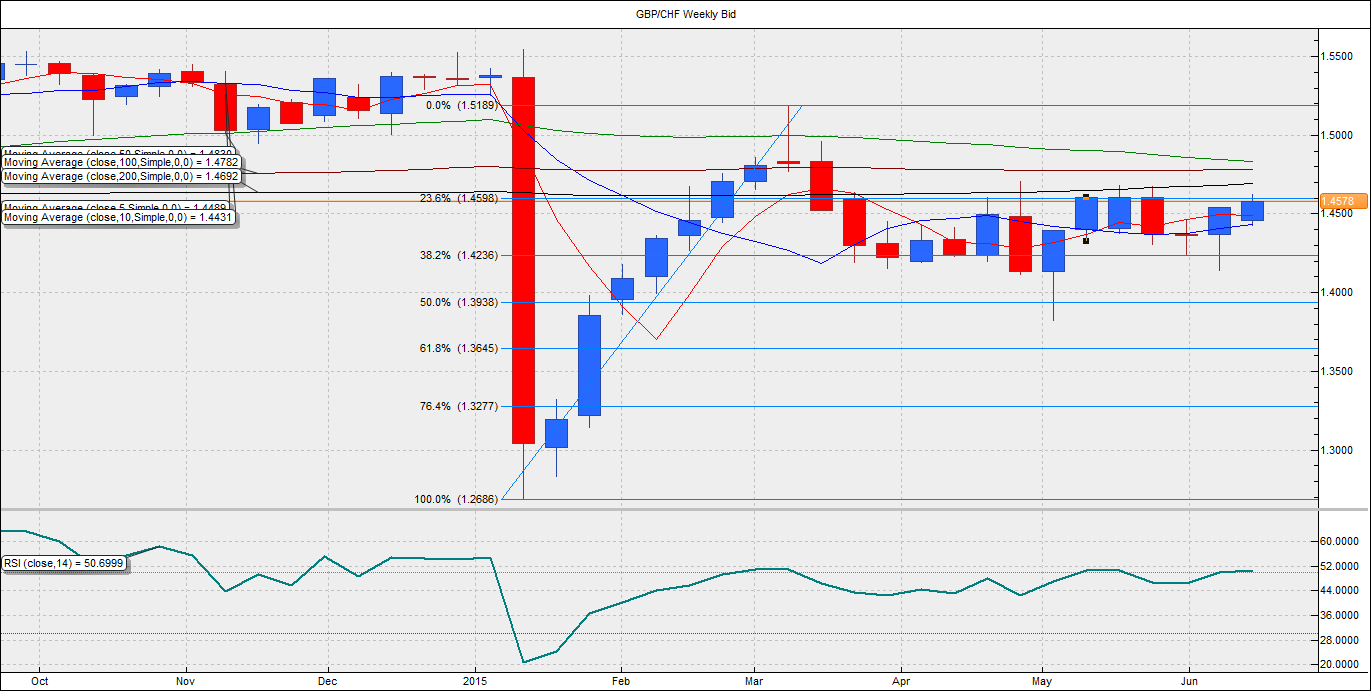

GBP/CHF Technicals – Daily Chart & Weekly Chart

- The daily chart shows, a Symmetrical triangle has been breached on the higher side, thereby opening doors for an immediate upside target of 1.4708 (Apr. 29 high)-1.4755 (Feb. 26high).

- However, the gains are being capped at 1.4598 (23.6% Fib R of 1.2686-1.5189). Multiple resistance is also seen in the range of 1.46-1.4640 (200-DMA).

- There have been repeated failures on the weekly chart since mid-April to extend gains over and above 1.4598.

- This, coupled with bearish macro factors mentioned above could lead to a sell-off from the current levels to 1.4350

- On the other hand, only a convincing weekly close – at least above 1.4640 (200-DMA) could result in a rally to 1.4755-1.4940 (Nov. 19 low).

Recommended Content

Editors’ Picks

AUD/USD: Further losses retarget the 200-day SMA

Further gains in the greenback and a bearish performance of the commodity complex bolstered the continuation of the selling pressure in AUD/USD, which this time revisited three-day lows near 0.6560.

EUR/USD: Further weakness remains on the cards

EUR/USD added to Tuesday’s pullback and retested the 1.0730 region on the back of the persistent recovery in the Greenback, always against the backdrop of the resurgence of the Fed-ECB monetary policy divergence.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

Bitcoin price dips to $61K range, encourages buying spree among BTC fish, dolphins and sharks

Bitcoin (BTC) price is chopping downwards on the one-day time frame, while the outlook seen in the one-week period is a horizontal trade. In this shakeout moment, data shows that large holders are using the correction to buy up BTC.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.