The GBP/JPY pair has been stuck largely in the range of 184.0-185.00 since last couple of sessions, as the pair fails to sustain gains above185.00, while fresh demand around 183.50 ensures it sustain above 184.00 on the daily closing basis.

The pair could test 182.50 levels in the short-term as–

Pound unresponsive to positive data – The British Pound has repeatedly failed to strengthen in the past week or so on the upbeat PMI numbers. Moreover, the currency failed to extend gains above 1.55 against the USD despite Bank of England policymakers, in the last week, indicated next policy move as an interest rate hike.

UK Gilt yields fail to support gains in the Pound – Since last week, we failed to see an uptick in the UK 10-year Gilt yields each time the Pound rallied against its G-7 peers. The 10-year yield faced rejection at the 38.2% retracement of the down trend from 2.602% (Oct 2014 high) to 1.337% (Jan 2015 low) located at 1.822%, despite the hawkish comments from BOE members and an upbeat economic data in the UK.

Given this, it is unlikely we could see a sharp positive reaction in the gilt yields and British Pound even if the UK Services PMI due tomorrow prints higher than expectation of 57.5.

The 10-year Gilt yield could push higher above 1.822%, however the US yields too are likely to move higher ahead of the US non-farm payrolls data on Friday. The jobs data in the US in the last three months was stellar. Hence, markets are likely to push up Treasury yields and the US dollar ahead of the Friday’s NFP report.Yen relatively resilient - The Japanese Yen is likely to remain relatively resilient as the equity markets are showing signs of risk aversion. The surprise interest rate cut in China over the weekend failed to trigger a rally in the riskier assets across the globe. Furthermore, the UK’s Ftse trading at record highs, is more vulnerable to a technical correction, which too could weigh over GBP and support the Yen.

Election uncertainty could weigh over Pound - The prospect of May's general election, leaving a hung parliament in which no party has a majority is already starting to weigh on the Sterling. This could have been the major reason behind Pound’s failure to respond to the BOE members hawkish comments and an upbeat economic data. Hence, Pound, once again, is unlikely to respond much to a better-than-expected services PMI data tomorrow. However, a weak data could trigger a major downside reaction in the GBP pairs.

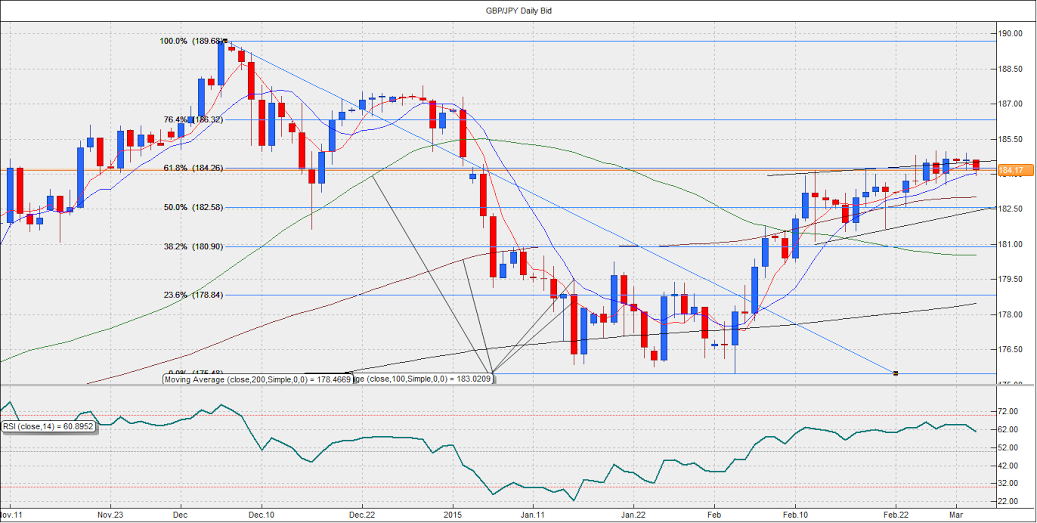

On Technical grounds, the pair has repeatedly failed to extend gains even after breaching the channel resistance on a couple of occasions. With the repeated failure at the channel resistance currently located at 184.58 levels, the pair appears more likely to test the 100-DMA at 183.02. Moreover, a failure to sustain above 61.8% Fib retracement (189.68-175.48) located at 184.26, could push the pair down to 182.58 levels (50.005 Fib retracement).

Thus, selling pressure can be anticipated at the current level of 184.20, which could push the pair down to 182.58 levels. The bearish view is at a risk of daily close above 185.00 levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.