Outlook:

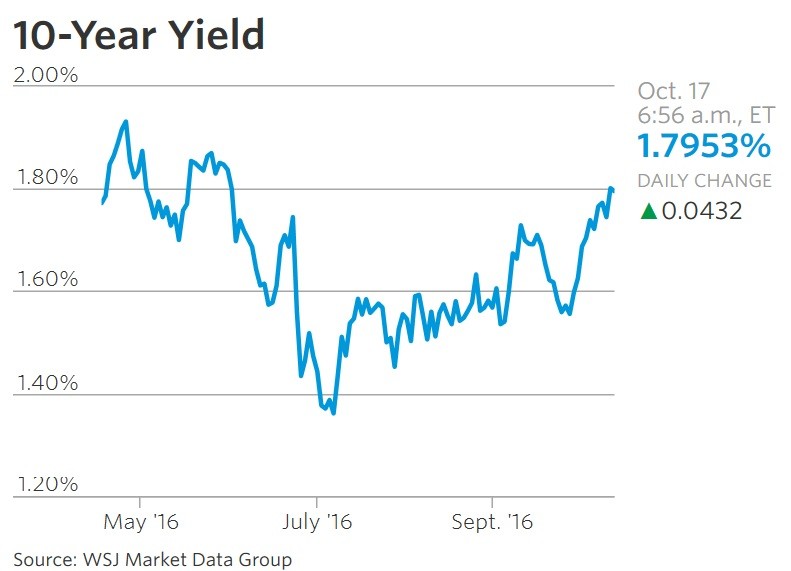

The r ise in the dollar can be attr ibuted to widening and deepening acceptance of the Dec rate hike and the upward creep of the 10-year yield to 1.814% overnight, from 1.361% only three months ago (July 16). It's a welcome shift in every way, not least because you don't get rising yields in a moribund or recessionary economy.

But it's critical to acknowledge that the latest rise does not mean the "super-cycle" of low yields is over. The new likely range is higher, to be sure, but not "high" in any historical perspective. The WSJ's excellent bond reporter says analysts expect a range of 1.6% to 2% for the rest of the year, having seen 1.40- 1.75% in Q3. In a nutshell, normalization is going to take a far longer time.

And the dollar is at risk, so to speak, from other yields. The ECB meets Thursday and may or may not extend QE, but don't forget the "taper" talk recently. It was silly then but won't be silly at some point. Overnight the US yield rose 46 points and the Bund only 24 points, but that ratio can shift in favor of the Bund if the ECB seems happy with new inflation data and if Draghi starts making hawkish noises (he speaks today). It's a delicate balance.

And the wild rise in the UK yield is very bothersome. It looks like a classic textbook case of overshooting. Inflation will inevitably be on the rise in the UK from devaluation alone, and the BoE is willing to accept some overshooting on that front. We still have high uncertainty over whether the May government is indeed embracing a "hard Brexit," meaning giving up a lot or even all favored access to European markets to get full control of labor movement. The uncertainty is as bad as the prospect. We cheered the orderly transition to a new government on the shock of Cameron's resignation, but market confidence in the new government is shriveling by the day. It gives PM May a real problem—disclose the master plan (if there is one) and tell everyone your negotiating stance, or allow confidence to erode further?

We hardly ever flag a specific data point as a market-mover (because traders are fickle) but tomorrow's UK inflation data could be one. The FT reports Sept CPI is forecast from 0.6% now to 0.9%, which will be the highest since Nov 2014. Oxford Economics thinks it will be worse--1.3%, or more than double August. The spread between regular and inflation-adjusted 5-year notes was already at 3.5% last week. The UK has already seen a dramatic rise in imported food, and input prices as measured by PPI are at a 4-year high in August. Pantheon Economics says "Early next year, inflation will be breathing down the Monetary Policy Committee's neck. CPI inflation likely will have returned to the 2 per cent target in January, on track for 3.5 per cent by the end of 2017." The BoE may be willing to let inflation exceed the 2% target, but by as much as 1.5%?

The BoE's own forecast is for inflation to hit 2.4% in 2018. What if it's 3.5% by 2017 instead? This is the proverbial genie being let out of the bottle. Today Deputy Gov Broadbent said the currency is a useful shock absorber for the economy, but that suggests the shock literally gets absorbed like a giant spring and goes no further. But currency devaluation is not the end of a road, it's the beginning of a road. Consider the Nov 1967 devaluation from $2.80 to $2.40. The UK spent the 1970's in a total funk that led directly to Thatcher in 1980. The term "shock absorber" is deeply misleading.

We get US CPI tomorrow.

Sterling is a special case because of Brexit. It would be silly to see inflation rising everywhere— wouldn't it? Inflation is not a contagious disease but rather a function of the matrix of costs, including inputs and labor. Inputs may be imported but labor is domestic, suggesting firms will curb wages to equilibrate totals costs before they will raise output prices. The problem, of course, is that wages are "sticky" downward and thus output prices must rise. Those who don't foresee their standard of living falling because of Brexit are living in an alternative universe. It's a high price to pay to avoid seeing women in holier-than-thou hijabs.

Bank of America ML goes so far as to say impending inflation in the UK will soon be seen everywhere and it's time to get out of financial assets and into hard ones, like real estate, commodities and gold. According to the FT, this is a cyclical thing and encouraged by central banks retreating from QE and a recovery in prices in China, too. Real assets have been highly correlated with inflation since at least 1950. Well, gold has been under the 200-day moving average for 7 days. It's probably as good a proxy for this thesis as any.

We are leery of forecasting the dollar as on a surefire, straight-line trajectory upward. There's just too much than can intervene, including the ECB sounding less dovish later this week. We are in a slow period right now as everyone awaits fresh data. We could even get a Tuesday pullback.

Fun Tidbit: One house of the state par liament in New South Wales passed (unanimously) a motion to declare Donald Trump a "revolting slug unfit for public office."

The last presidential debate is on Wednesday, Oct 19. It will be a terrible ordeal to watch, not least because Trump will repeat his stupid conspiracy theories and lower the level of discourse even further, which hardly seems possible, with unspeakable vulgarity. We keep hoping that the American public, which is overall still fairly straight-laced if not outright puritanical, will reject Trump for his lack of decency and civility. The 1960's baby boomer generation may have started the rebellion against "bourgeois" standards and manners, but they know what they are. The newer generations don't even know what they are. It's a little interesting that Trump, who accuses others of what he himself is guilty of (lying, fraud), wants a drug test. More than one commentator noted Trump's snuffling during the last debate, possibly a sign he had been snorting something. Is there a bridge too far for the fans?

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 104.12 | LONG USD | WEAK | 10/06/16 | 103.50 | 0.60% |

| GBP/USD | 1.2170 | SHORT GBP | STRONG | 09/10/16 | 1.3041 | 6.68% |

| EUR/USD | 1.0989 | SHORT EUR | STRONG | 09/19/16 | 1.1168 | 1.60% |

| EUR/JPY | 114.42 | LONG EURO | WEAK | 10/06/16 | 115.78 | -1.17% |

| EUR/GBP | 0.9030 | LONG EURO | WEAK | 09/19/16 | 0.8564 | 5.44% |

| USD/CHF | 0.9889 | LONG USD | STRONG | 09/19/16 | 0.9804 | 0.87% |

| USD/CAD | 1.3161 | LONG USD | STRONG | 09/15/16 | 1.3203 | -0.32% |

| NZD/USD | 0.7123 | SHORT NZD | STRONG | 09/19/16 | 0.7305 | 2.49% |

| AUD/USD | 0.7603 | SHORT AUD | STRONG | 09/24/16 | 0.7618 | 0.20% |

| AUD/JPY | 79.16 | LONG AUD | STRONG | 10/06/16 | 78.48 | 0.87% |

| USD/MXN | 19.0352 | LONG USD | STRONG | 05/06/16 | 17.9418 | 6.09% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD: Yes, the US economy is resilient – No, that won’t save the US Dollar Premium

Some impressive US data should have resulted in a much stronger USD. Well, it didn’t happen. The EUR/USD pair closed a third consecutive week little changed, a handful of pips above the 1.1800 mark.

Gold: Metals remain vulnerable to broad market mood Premium

Gold (XAU/USD) started the week on a bullish note and climbed above $5,000 before declining sharply and erasing its weekly gains on Thursday, only to recover heading into the weekend.

GBP/USD: Pound Sterling remains below 1.3700 ahead of UK inflation test Premium

The Pound Sterling (GBP) failed to resist at higher levels against the US Dollar (USD), but buyers held their ground amid a US data-busy blockbuster week.

Bitcoin: BTC bears aren’t done yet

Bitcoin (BTC) price slips below $67,000 at the time of writing on Friday, remaining under pressure and extending losses of nearly 5% so far this week.

US Dollar: Big in Japan Premium

The US Dollar (USD) resumed its yearly downtrend this week, slipping back to two-week troughs just to bounce back a tad in the second half of the week.

Vertiv Holdings explodes higher, but can bulls break through this resistance ceiling?

Vertiv Holdings, LLC (VRT) is a provider of critical digital infrastructure and continuity solutions. The stock just delivered one of those rare trading days that gets everyone's attention. VRT rocketed 24.49% higher yesterday, closing at $248.5, so what's the technical picture telling us here?