Gold had a busy time last week, it opened at $1,215.69 an ounce last Monday to then rally to $1242.93 on Tuesday, and it then tested a low of $1,208.88 on Friday. The performance of this shiny metal has been subdued over the past weeks compared to the beginning of the year. From January 4th it jumped nearly 19% in the space of 6 weeks, when in it touched $1,263.63. Since then it tested a new most recent high on March 10th at $1,273.29 but has been trading in a zig zag pattern to the downside.

Gold price benefitted from the stock market sell‐off that hit exchanges globally at the beginning of the year. As the precious metal is considered a safe haven it found renewed bullish momentum to buck its multi‐year long bear trend. Dovish talk from the Federal Reserve then helped keep the momentum going. More recently however, the stock market has begun to perform well on the back of expectations of a slower pace in the Federal Reserve’s tightening of monetary policy. The stock market rally has softened the strength of the rally in Gold, and further positive performance in stocks may weigh on Gold price.

The long‐term bear trend that had been afflicting Gold was mainly driven by supply surplus created during the prolonged rally that took price to levels just short of $2,000 an ounce. Last year, the World Gold Council Reports that supply increased by its slowest rate since 2008, at 1%. However, demand was flat for the full year of 2015, but the last quarter showed an increase in demand of 4% year‐on‐year. Central banks bought 33 tons and investment managers bought another 25 tons in the 4th quarter of 2015 alone.

Negative interest rates being pursued in major economies such as Europe and Japan may give this metal renewed appeal, as traditional investments such as bonds offer ever smaller yields. Nevertheless, Gold price may continue falling until it finds renewed support.

If you think the price of Gold will rally over the next week then you may buy a Call option which gives you the right to buy Gold at a pre‐set price (strike) on a pre‐set date (expiry) and for a specific amount.

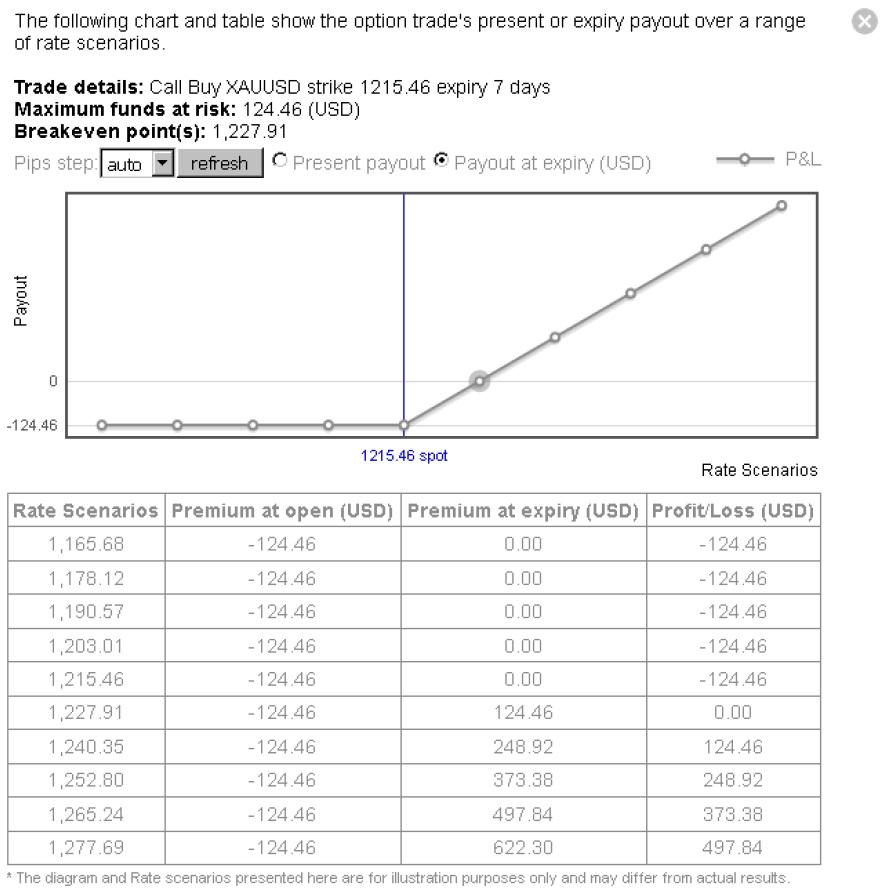

The screenshot below shows a Gold Call option with a $1215.45 strike, expiry 7 days and for 10 ounces would cost $124.43, which would also be the maximum risk.

This screenshot shows the profit and loss profile for the above Gold Call option, just click the Scenarios button.

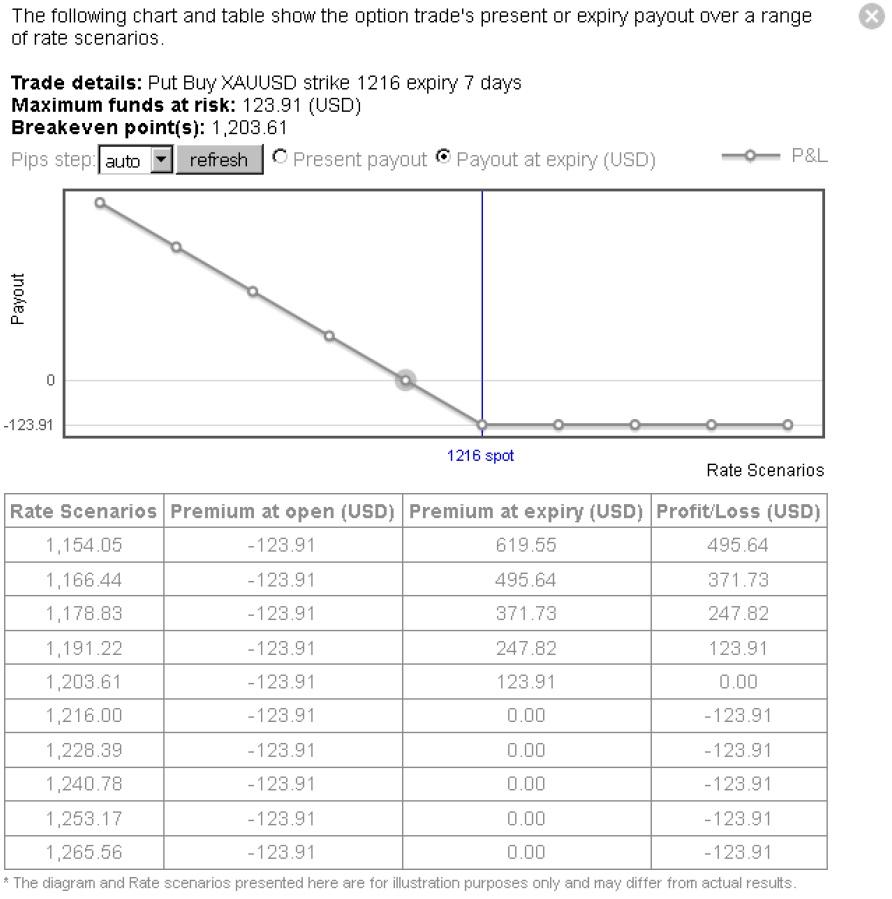

On the other hand, if you think the price of Gold will fall over the next week then you may buy a Put option which gives you the right to sell Gold at a specified strike, expiry and amount.

The screenshot below shows a Gold Put option with $1215.52 strike, expiry 7 days and for 10 ounces would cost $123.85, which would also be the maximum risk.

This screenshot shows the profit and loss profile of the above Gold Put option.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

AUD/USD: Further losses retarget the 200-day SMA

Further gains in the greenback and a bearish performance of the commodity complex bolstered the continuation of the selling pressure in AUD/USD, which this time revisited three-day lows near 0.6560.

EUR/USD: Further weakness remains on the cards

EUR/USD added to Tuesday’s pullback and retested the 1.0730 region on the back of the persistent recovery in the Greenback, always against the backdrop of the resurgence of the Fed-ECB monetary policy divergence.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

Bitcoin price dips to $61K range, encourages buying spree among BTC fish, dolphins and sharks

Bitcoin (BTC) price is chopping downwards on the one-day time frame, while the outlook seen in the one-week period is a horizontal trade. In this shakeout moment, data shows that large holders are using the correction to buy up BTC.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.