Crude Oil had a particularly bad start to the year going from its open on January 4th at $38.34 per barrel to its most recent low of $27.70 in the first three weeks. It has since turned the bear trend around, at least for now as it at $38.52. The market, however, has still not changed completely, and most analysts are waiting for further evidence before calling it a new bull trend.

The price of Oil has been helped over the past weeks as Stock markets in the US and Europe have shown signs of recovery. The S&P 500 has gained 8.2% over the since February 11th, which also coincided with a strong rally in Oil price as it moved from a low of $28.36 to its most recent high at $39.70. Oil production from the US has also been on the decline since October 2014 when there were 1,931 Gas & Oil fields combined. The rig count has been decreasing as it follows the downward movement of Oil price. As of March 4th, another 13 Gas & Oil rigs have been closed, sending the total count to 489. Oil rigs saw a reduction of 8 to bring total oil rigs down to 392, the lowest level since 2009.

Such a drastic reduction in production capability has also been offset in some ways by reduced demand especially from some developing countries, like China and Brazil. Another factor keeping Oil supply plentiful is Iranian Crude is available and being exported across the globe. Iran’s Crude Oil production is forecast to increase to 3.1 million barrels per day, from 2.8 million pre-sanction production. It is expected to increase further in 2017 to 3.6 million barrels per day.

OPEC has recently decided not to cut production quotas, and it may be a while before that action is taken. Supply would seem set to remain high, and it would probably take a significant expansion in global economic activity to change the medium-term trend for this commodity.

If you think volatility for Crude Oil will rise over the next week, then all you may buy a Straddle strategy which consists of simultaneously buying a Call and a Put option with the same strike, expiry and amounts.

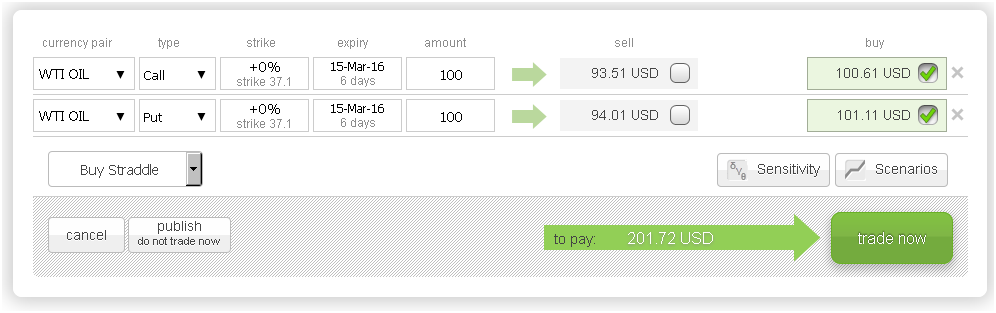

The screenshot below shows a Buy Straddle with $37.10 Strike, 6-day expiry and for 100 barrels would cost $201.72, which also be the maximum risk.

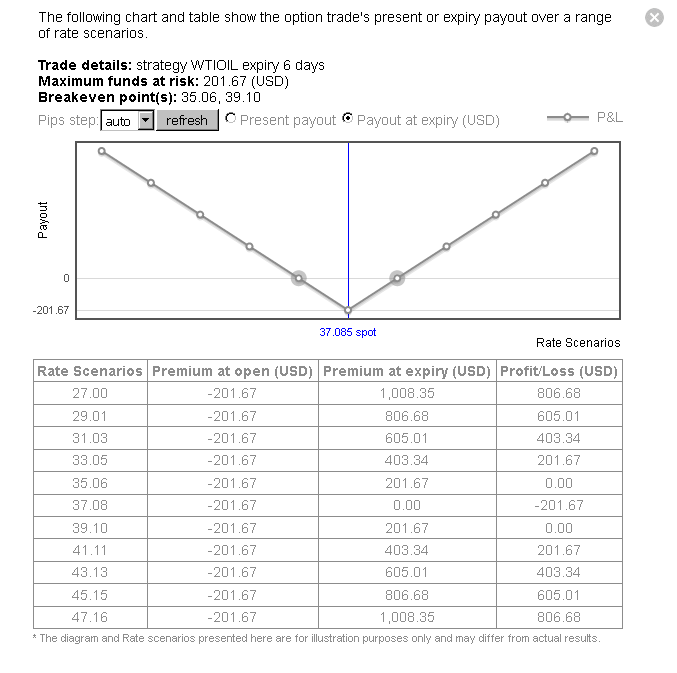

This screenshot shows the profit & loss profile of the above Buy Straddle strategy, just click the Scenarios button.

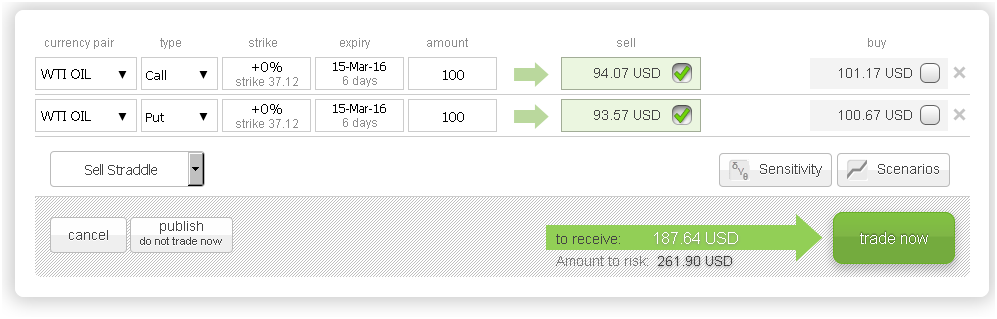

On the other hand, if you think volatility will remain flat or decrease then all you may sell a Straddle strategy, which consists of simultaneously selling a Call and a Put option with the same strike, expiry and amounts. The screenshot below shows a Sell Straddle with $37.12 Strike, 6-day expiry and for 100 barrels would create revenue of $187.64, with a total risk of $261.90.

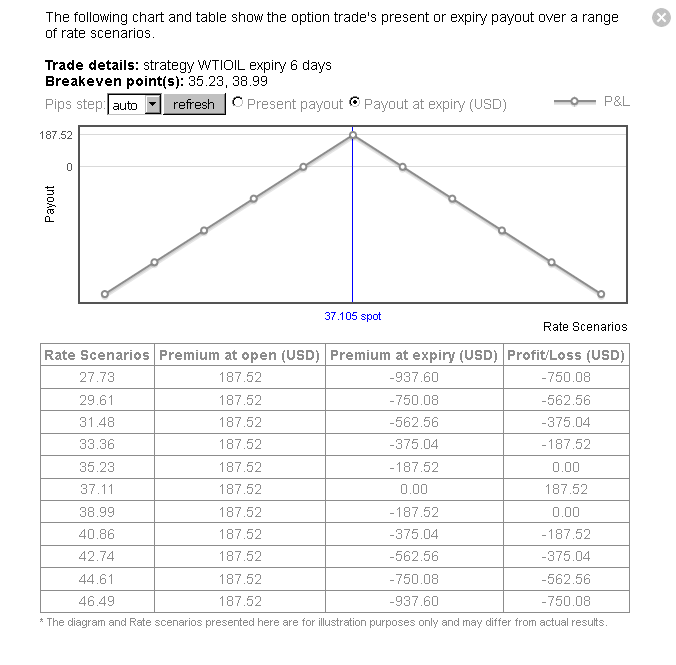

This screenshot shows the profit & loss profile of the above Sell Straddle strategy.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.