Crude oil had a rollercoaster ride yesterday, going from $42.86 a barrel at noon to $41.22 in the space of 3 hours to then be back up again at $43.00 after the following 3 hours. The market has settled down since that flurry, and has been trading in a tight range between $43.17 and $42.59 during the Far East trading session. The low volatility is due to the fact that tomorrow we have the crude oil stocks data released by the Energy Information Agency (EIA) at 3:30 PM.

The consensus forecast is at 1.7 million barrels, which is a sharp reduction to the previous release that was 4.224 million. Even though a decrease in stocks is expected it would probably send price further south if the actual number released is higher than the forecast. A much lower number than expected could give the black gold a lift and send price back up.

Fundamentals for this commodity do not seem to have changed, so it is difficult to believe any rally in price will be sustained. Supply is not going to weaken despite a falling price, especially from emerging countries or OPEC. The US is about to overturn the 1970s law prohibiting the export of crude oil and Iran is about to add its production also to world supply. Add to that there are more oil fields being discovered around the world and a not so strong global economy means that demand is not picking up but supply keeps increasing. Goldman Sachs in a report in September issued a forecast for Crude Oil possibly reaching $20.00 a barrel due to increasing excess supply and lingering demand. At the time of the report, September 11, WTI closed at $45.17 a barrel.

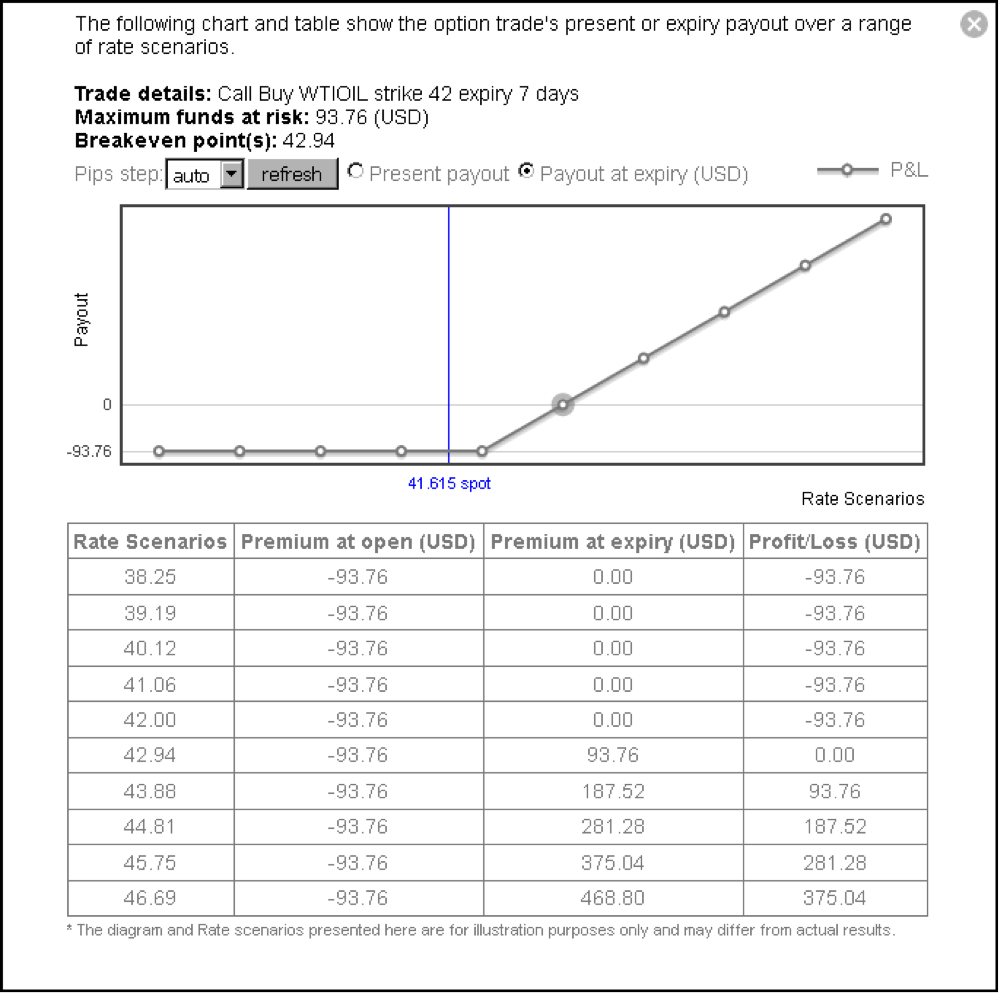

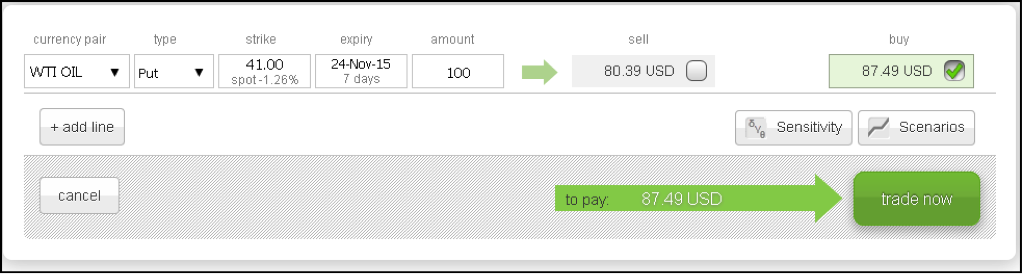

If you think Crude Oil will continue its fall in price then you can buy a Put option which gives you the right to sell Crude Oil at a set price (strike) for a set date (expiry) for an amount of your choice.

The screenshot below shows a Put option on WTI Oil with a strike at $41.00, expiry 7 days for 100 barrels would cost $87.49, which would also be the maximum possible loss.

The screenshot below shows the profit and loss profile of the above option.

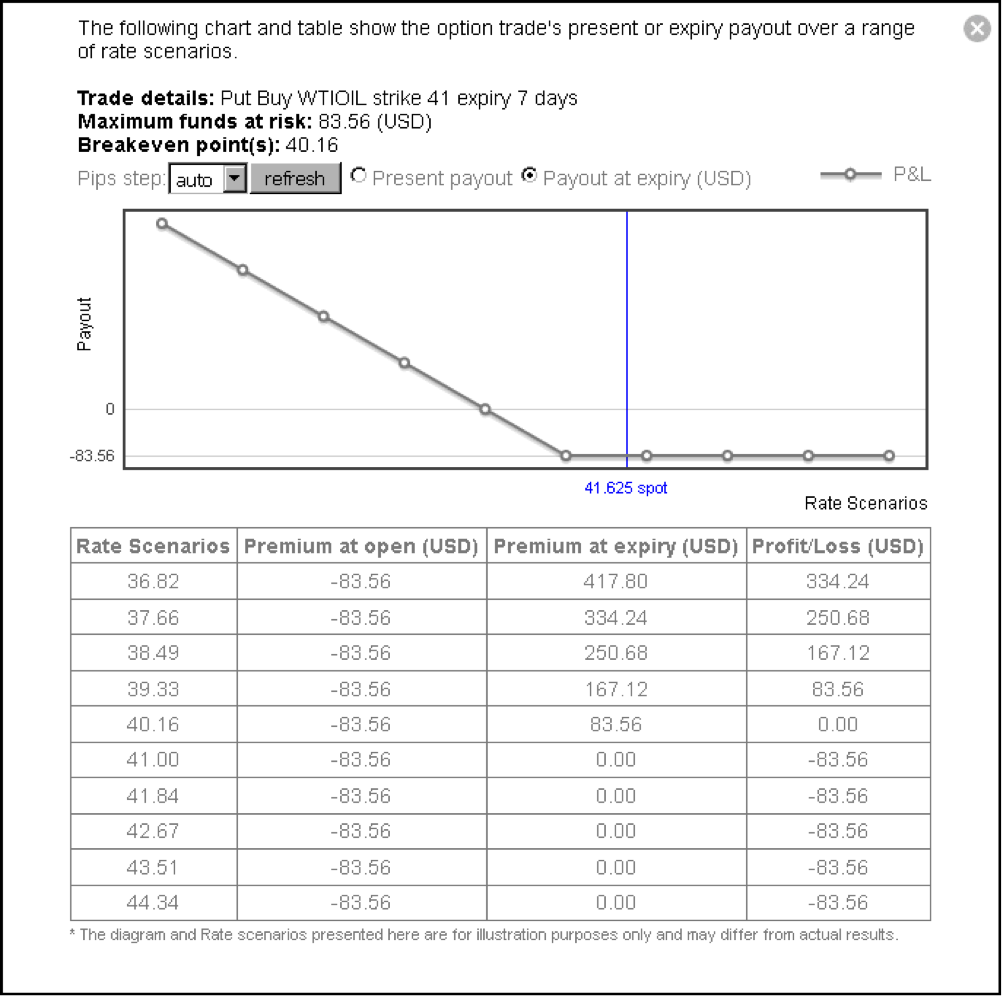

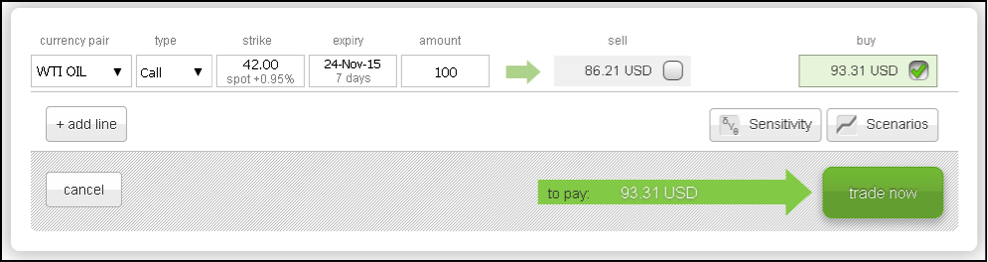

If on the other hand you feel Crude Oil will rally in price over the next week you can buy a Call option which gives you the right to buy Crude Oil at the strike price for an amount of your choice on expiry.

The screenshot below shows a Call option on WTI Oil with a $42.00 strike, expiry 7 days for 100 barrels would cost $93.31, which would also be the maximum possible loss.

The screenshot below shows the profit and loss profile of the above option.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.