Yesterday’s comments by Federal Reserve Chairwoman gave further confirmation of the Fed’s intent to raise interest rates in December, sending the US Dollar higher against most major currencies. The Euro fell sharply on the back of Yellen’s words, but that wasn’t the only factor. Earlier on, ADP Employment data showed reasonably strong job growth, a reason Yellen has given that would be fundamental in their decision to raise interest rates. Purchasing Managers Index data was also released at the time of Yellen’s speech at 59.1 which was much higher than the expected at 56.9, denoting a sharper than forecast increase in economic activity. All these factors yesterday drove EURUSD from its open at 1.09599 to the day low of 1.08430. The Euro has been in a Bear trend since its most recent high on October 15th at 1.14941. The previous ECB monetary policy meeting on October 22nd saw the Euro decline in one day alone more than 300 pips, going from an open of 1.13370 to a close 1.11069. The fall was mostly on the back of comments by ECB President Draghi stating that if needed there would be an increase in quantitative easing.

Tomorrow will see the release of US Non‐Farm Payroll data, the forecast number is 180k new jobs after the previous month’s data at 142k. A higher than expected number should give the US Dollar more momentum and send EURUSD further south, it might even be enough if the number meets expectations. Whereas it would take a much weaker than expected number to see the Bear trend reversed, even if for just a day or two. One poor set of data would not change the fundamentals of this pair, but it may cause a correction.

If you think EURUSD may rise in price you can buy a Call option to take advantage of such a move. This option gives you the right to buy EURUSD at a set price (strike), for a specific period of time (expiry) for an amount of your choice.

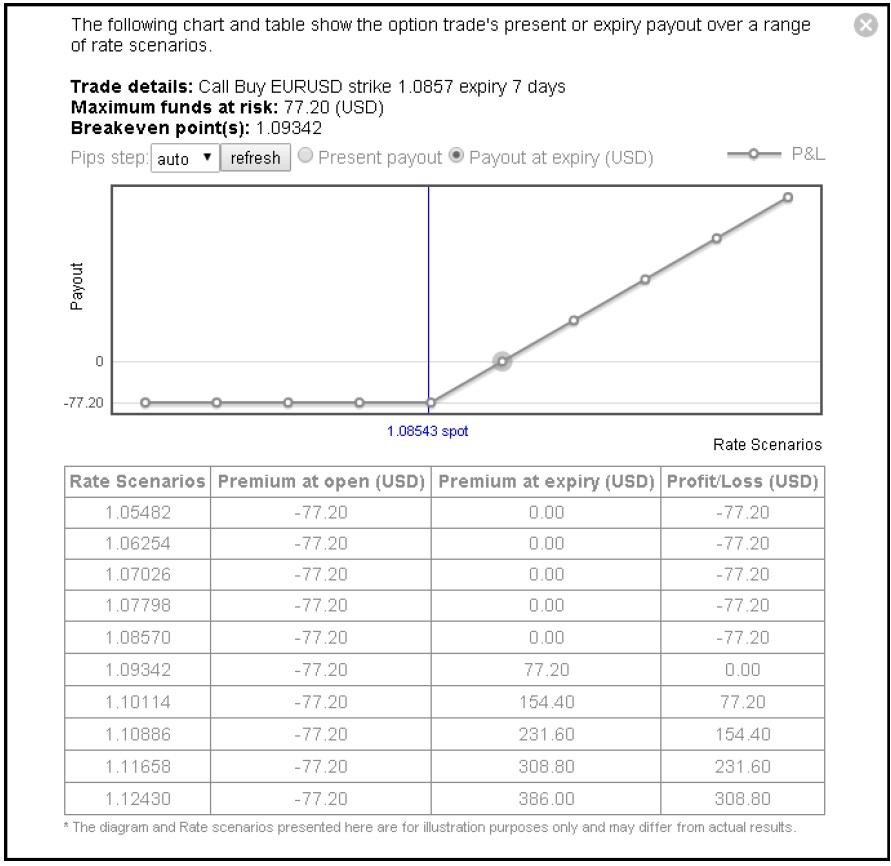

From the screen shot below you can see that a EURUSD Call option, strike 1.0857 with expiry in 7 days for Eur10,000 would cost $78.57.

The screenshot bellows shows the profit and loss chart for a range of prices in EURUSD, as can be seen your maximum possible loss is limited to the cost of the option at $78.57.

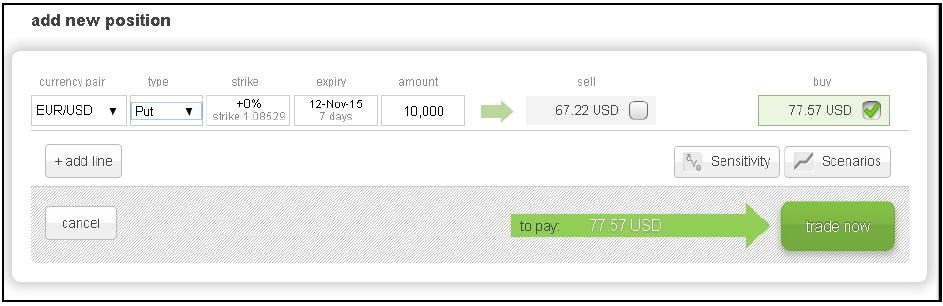

If on the other hand you think EURUSD may continue falling in price then you can buy a Put option, which gives you the right to sell the pair at a predetermined strike for a specific expiry in an amount of your choice. The screenshot below shows that a EURUSD Put with strike 1.08529 and expiry in 7 days for Eur10,000 would cost $77.57.

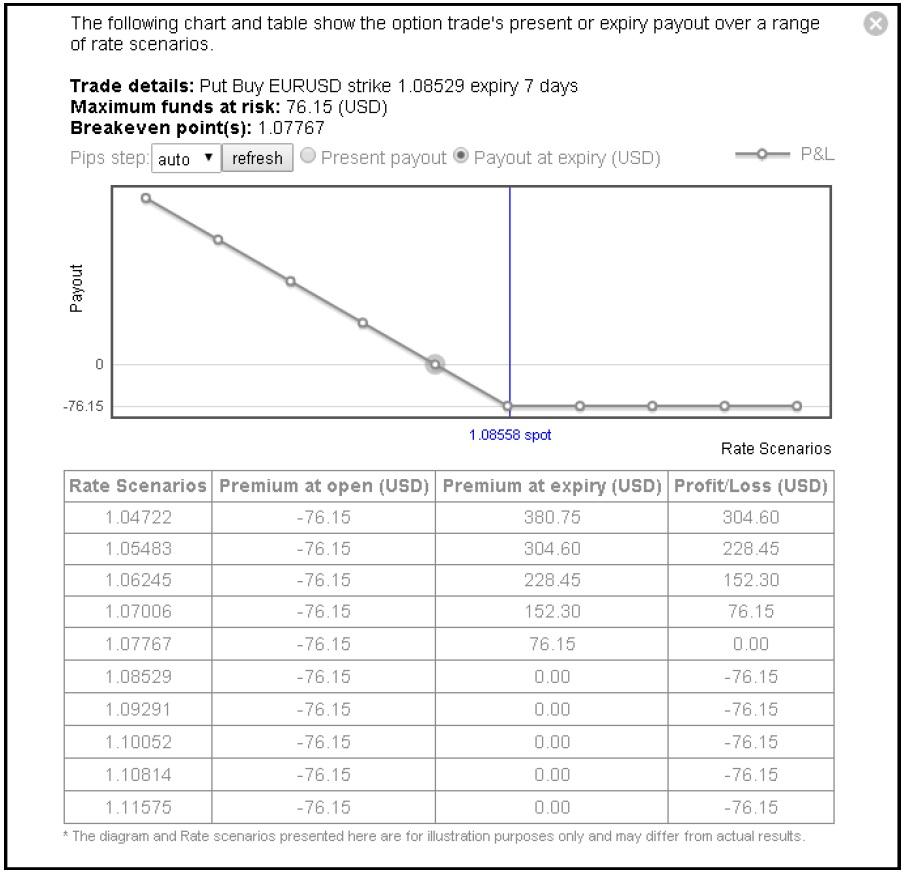

The screenshot below shows the Profit and loss scenario for the Put option mentioned above. As you can see the maximum possible loss is limited to the cost of the option.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.