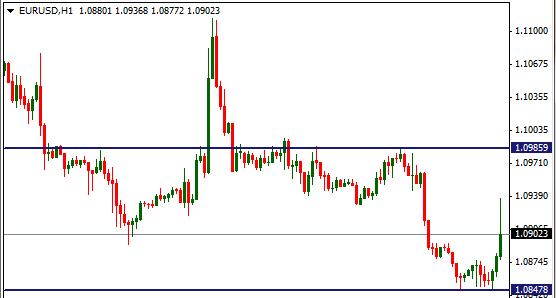

Yesterday, the US dollar strengthened across the board following comments from Fed member Lockhart encouraging a September interest rate hike. EUR/USD fell from 1.095 to bottom at 1.088 and continued to trade lower in today’s session reaching 1.0847 (see chart). This morning's decline is also influenced by PMI data indicating a slowdown in Europe's rate of expansion.

If Friday's NFP data is not as expected it may greatly influence EUR/USD price activity. If the numbers are better than expected, it can be interpreted as a final trigger for the Fed to pull interest rates higher in September. If data is worse than expected, price action will depend on by how much worse it is. A slightly poorer result may postpone a move by the Fed and uncertainty in the market regarding a September hike may emerge. If results are very bad, a hike in September will become unlikely. Either way, worse than expected data may weaken the dollar.

Today, the 1 week at-the-money EUR/USD options indicate 11.8% volatility which implies an average daily move of around 0.75% (82 pips) over the next week. When trading options, you are also trading the underlying asset’s volatility. An assessment on volatility direction is just as important as assessing the market direction. Regardless of market direction, if you believe volatility will rise you may buy options to trade this. If you believe volatility will drop and the market will stabilize, you may sell options to trade this.

If you believe that between today and the end of the trading week on Friday (after NFP data) EUR/USD is more likely move-up and become more volatile, you may take advantage of this through buying a Call option. To learn more about buying Call options on MT4 click here.

Choosing an at-the-money (ATM) versus an out-of-the-money (OTM) option depends on how much premium you want to risk and how volatile you think the market will become. For OTM options, the further away the strike of option is from today’s market price, the more the market will need to move for the option to expire in profit.

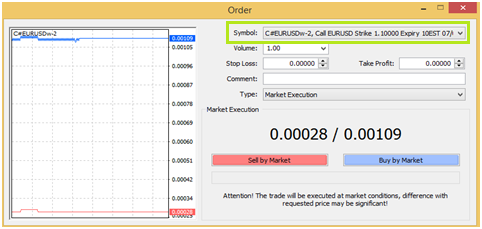

Buy example on MT4:

A Call that expires on Friday at 14:00 GMT with a strike at 1.1000 (OTM) can be found on MT4 as symbol name C#EURUSDw-2. The cost to buy 1 lot of this symbols is $100.9 (i.e. the option's ask price is 0.00109), this is also your maximum risk.

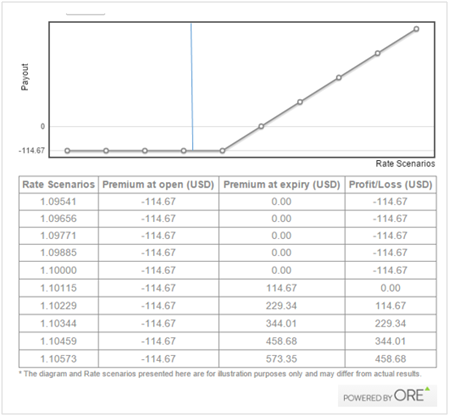

On expiry, if EUR/USD is trading above the 1.10 strike price, you will profit the difference minus the cost of the option. In fact, your break-even point at expiry is strike price + option price = 1.1000 + 0.00109 = 1.10109

Below you can see a chart & table of this trades profit/ loss scenarios over a range of EUR/USD rates at expiry.

On the other hand, if you believe the pair will trade lower and volatility will drop you may consider selling a Call option. Selling a Call option will mean that you receive premium and as long as EUR/USD doesn’t increase in volatility or trade at higher in price, you will profit at expiry. However, note that if EUR/USD does trade at a higher price, above 1.10 you may make a loss and to manage your maximum loss you may use a stop-loss order.

Lastly, if you expect volatility to increase but you do not have a view on direction you may buy a Call and a Put option at the same time. This is a popular option strategy known as a 'Long Straddle'. The Call will rise in value if the market rises and the Put will rise in Value if the market falls. As long as the market moves a significant distance in either direction, the strategy can return a profit. If the market stabilizes and trades in a range then a loss is made, this loss is limited to the total cost of buying the options.

To practice trading options on MT4 click here.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.