Today at 21:00 GMT the Reserve Bank of New Zealand will announce its interest rate decision, followed by a press conference and monetary policy statement. Consensus is that rates will be left unchanged at 3.5%. That being said, market pricing suggests around a 50% chance that we will see a rate cut of 0.25% to 3.25%.

In Australia, more important data regarding the employment situation will be released at 01:30 GMT tomorrow. Expectations are for the unemployment rate of 6.2% to remain steady and for a rise of 11K employees.

Earlier today during the Asia session, the AUD/USD has traded to lows of 0.7636 following comments from the Reserve Bank of Australia’s chief Stevens on a further weakening AUD and the possibility of more easing if necessary. Not long after, the pair has bounced back and exceeded the 0.77 mark due to positive comments from Bank of Japan that drove the USD/JPY strongly lower. This had a broad effect on the USD. AUD/USD is now trading near session highs at 0.77625, levels seen previously June 4th.

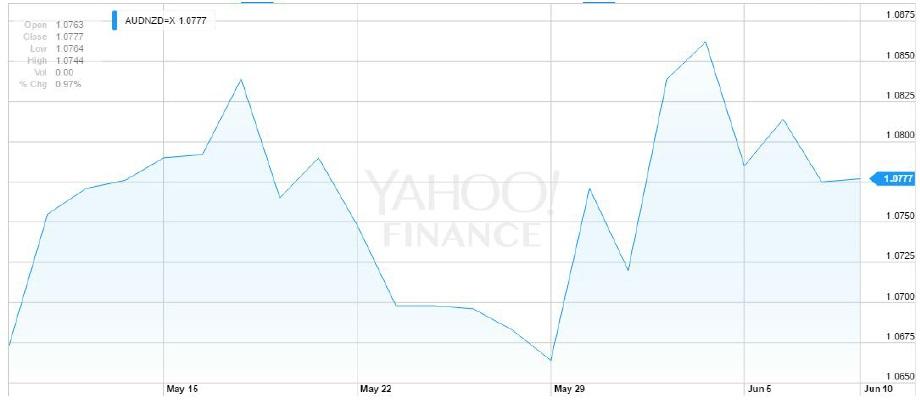

Below is the AUD/NZD trading chart in the past month. Its range was 200pips between 1.0664 may 29th and 1.0862 on June 4th. The volatility expected between now and Friday June 12th is 24.5%, indicating over 1.5% daily move.

This level of volatility in any pair, is considered high. When trading options, a trader can decide in advance to risk the amount invested in the position without risking anything beyond the cost of the option. Similar to buying a stock, if you pay $20, you can lose only that amount as it cannot go below the price of 0. Buying a Call or Put option will give you the right to buy or sell (respectively) the chosen pair, in this case AUD/NZD, at the strike rate defined within the time frame of the option’s duration.

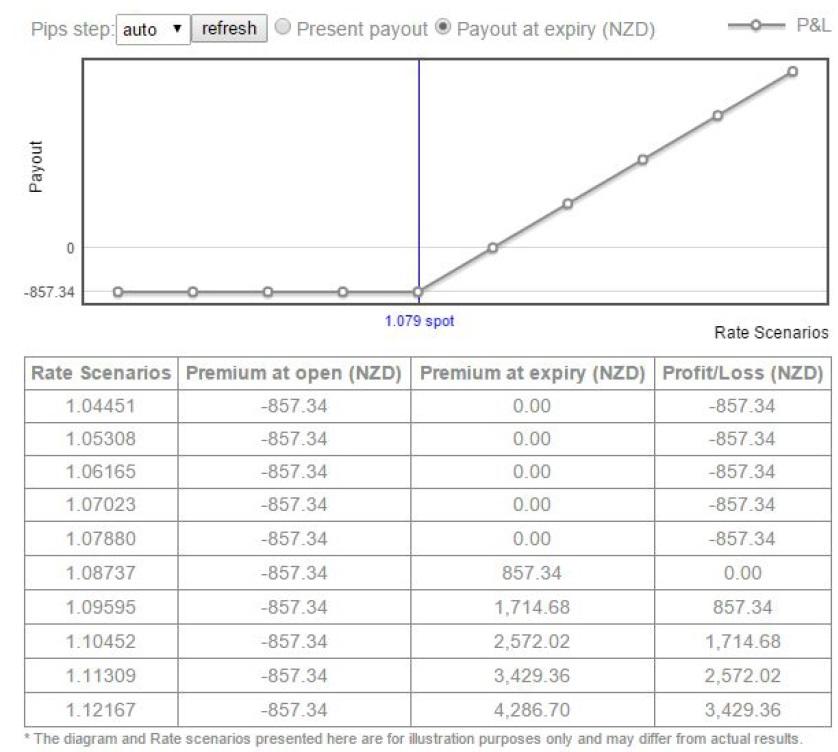

At the time of writing, the AUD/NZD Call with an at‐the‐money strike (strike = spot = 1.079) to expire post the news on June 12th , costs 857 NZD. You can view its payout scenario table and graph below.

Notice that is the pair will trade to 1.09595, you will profit 100% of the premium paid. Note that if the pair trades higher and/or volatility in the pair rises, the value of your option will rise as well, prior to its expiry date. You can then chose to close your position for profit before the option expires.

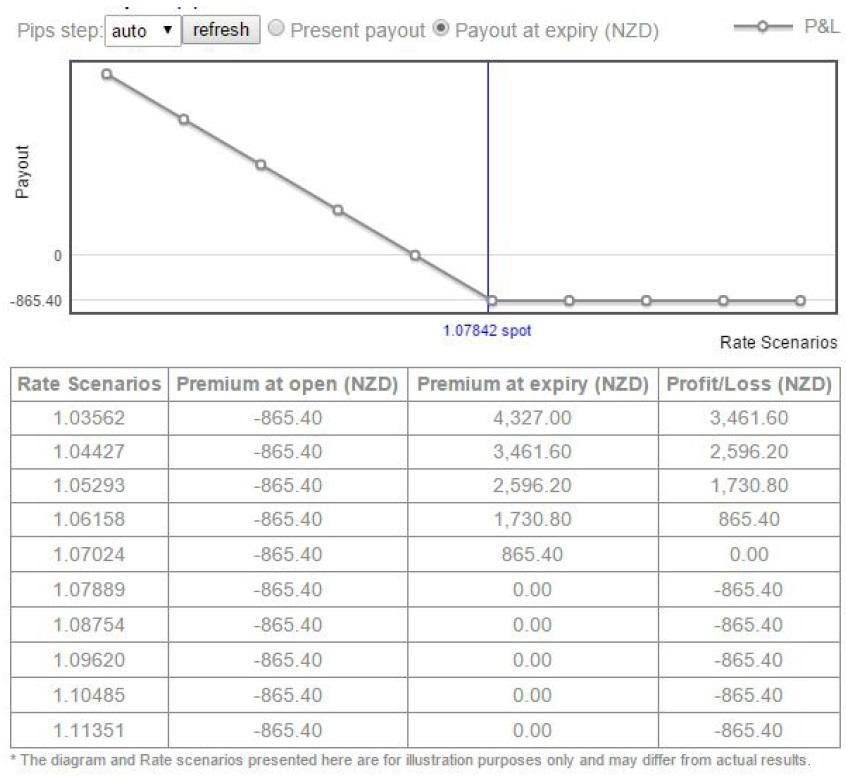

If you have a negative outlook as to the data effecting the pair and its direction, you may choose to buy a Put option.

The AUD/NZD ATM (now at 1.07842) Put with same date expiry as the Call, costs 865 NZD. On expiry, if the pair will trade down to 1.0616, you will profit 100% on the premium paid to purchase this Put option.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

AUD/USD weakens further as US Treasury yields boost US Dollar

The Australian Dollar extended its losses against the US Dollar for the second straight day, as higher US Treasury bond yields underpinned the Greenback. On Wednesday, the AUD/USD lost 0.26% as market participants turned risk-averse. As the Asian session begins, the pair trades around 0.6577.

EUR/USD stuck near midrange ahead of thin Thursday session

EUR/USD is reverting to the near-term mean, stuck near 1.0750 and stuck firmly in the week’s opening trading range. Markets will be on the lookout for speeches from ECB policymakers, but officials are broadly expected to avoid rocking the boat amidst holiday-constrained market flows.

Gold price drops amid higher US yields awaiting next week's US inflation

Gold remained at familiar levels on Wednesday, trading near $2,312 amid rising US Treasury yields and a strong US dollar. Traders await unemployment claims on Thursday, followed by Friday's University of Michigan Consumer Sentiment survey.

Bitcoin price drops, but holders with 100 to 1000 BTC continue to buy up

Bitcoin price action continues to show a lack of participation from new traders, steadily grinding south in the one-day timeframe, while the one-week period shows a horizontal chop. Meanwhile, data shows that some holder segments continue to buy up.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.