The currency markets are anticipating a huge sterling volatility spike in the immediate aftermath of the election vote, according to ORE, a leading options software technology company.

There is plenty of market chit-chat over the concerns and uncertainty around the UK elections. Neither Cameron nor Miliband are reining and an outright victory is becoming less likely. Trying to predict this election is one thing, but putting your money on it is another.

Options are a hot topic leading up to the UK election, because they are used to trade volatility as well as direction, investors are entering option trades to protect their existing Sterling positions or to benefit from changes in volatility. Since the price of options depends on the marketplace's expectation of volatility, it's possible to analyze options over different durations to build a bigger picture of market consensus.

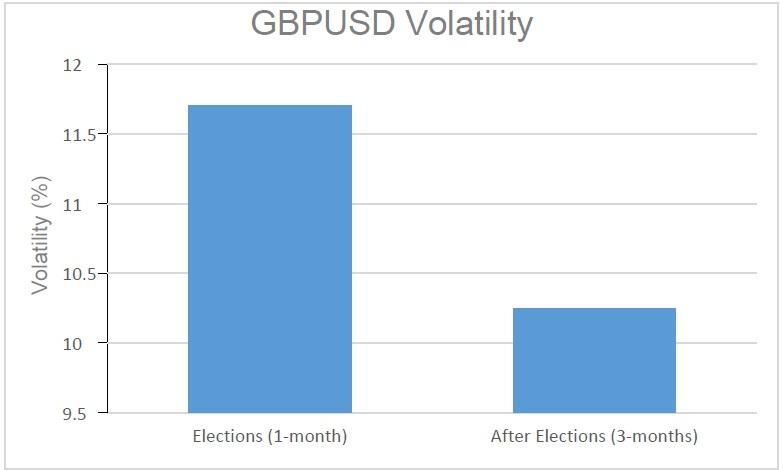

When analyzing GBP/USD option prices, an alarming volatility spike emerges; the market expects volatility until the week after the election result (1-month from today) to be higher than the volatility up until polling day and also, higher than several weeks after the elections.

What does this mean? When an outcome is uncertain, markets become more volatile. In this case, consensus is that the election result is unclear and a situation, such as a hung-parliament, is being priced in. In the longer term, once election results are out and their implications are known, investors are expecting more price stability.

How to trade it? If uncertainty persists leading up to the election and subsequently the result causes instability in the UK's longer term economic outlook, such as a threat of the UK leaving the EU, the volatility of GBP/USD in the longer term (3-months) may catch-up with the 1-month volatility. Buying options allows traders to benefit from increasing volatility. Assuming the GBP will weaken, we present a trading idea involving Put options on the GBP.

The Position

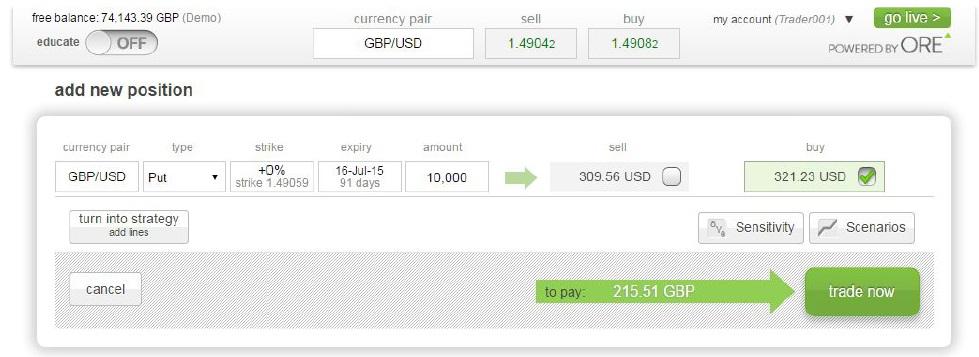

Buy a 3-month at-the-money GBP/USD Put option for the amount of 10,000 GBP. The option costs 321 USD (215 GBP) - This is your maximum risk in the trade. The image below shows how the trade is set-up.

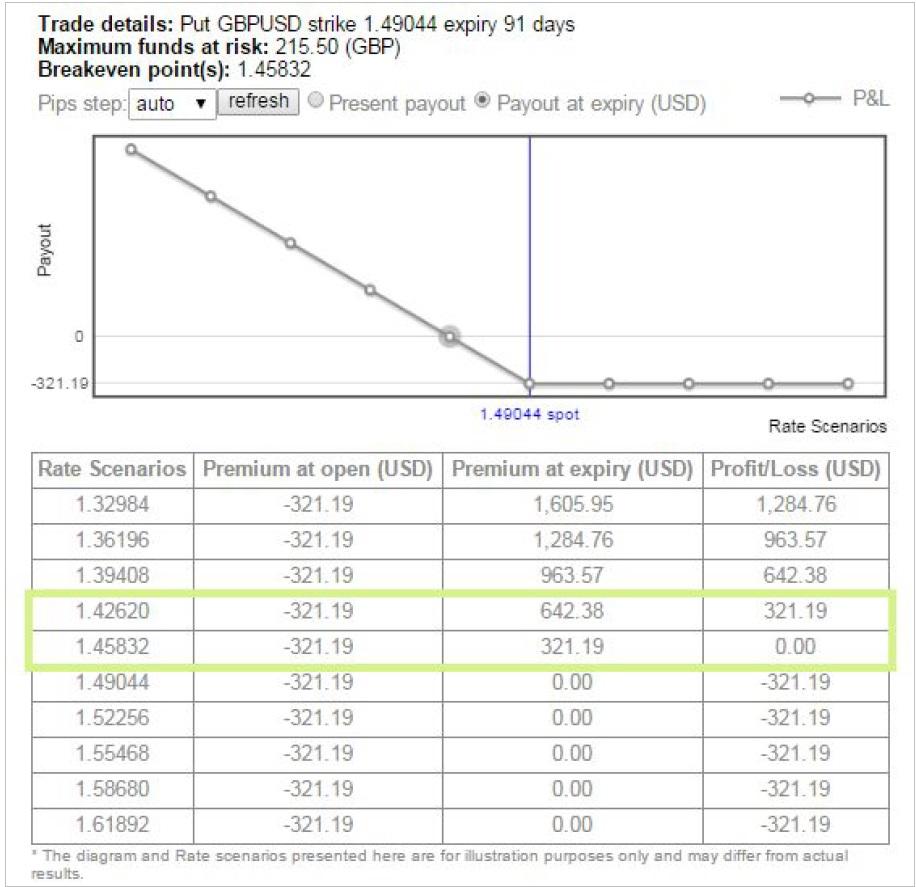

The scenario chart and table below shows the option's payout at expiry on July 16th, 2015, over a range of market rates. The break-even point is 1.4583 and below this a profit is made with 100% return at 1.4262.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.