The anticipated US employment data is expected tomorrow, Friday at 12:30 GMT. The data will be released while the US and most of the European markets are closed for Good Friday.

Important data releases during the holidays may result in extreme market volatility or extreme stability in the days after. It is rarely in-between. This is due to the fact that traders can’t react to the news at the time of the event and are forced to wait until markets re-opened. If the data released is an unexpected figure, the markets tend to re-open with gaps lower/higher with no in-between trading. Often market participants reactions are over-inflated and price gaps are more extreme than the news, however once the market has calmed the price finds its “real” level to reflect the release.

There are position decisions to be made prior to a holiday weekend when highly important news is due. The decisions include, closing an open position to avoid the risk of huge loss, hedging existing positions to avoid risk in the short-term but maintain a wanted longer-term investment or, placing new positions with a known amount at risk for a possible high return.

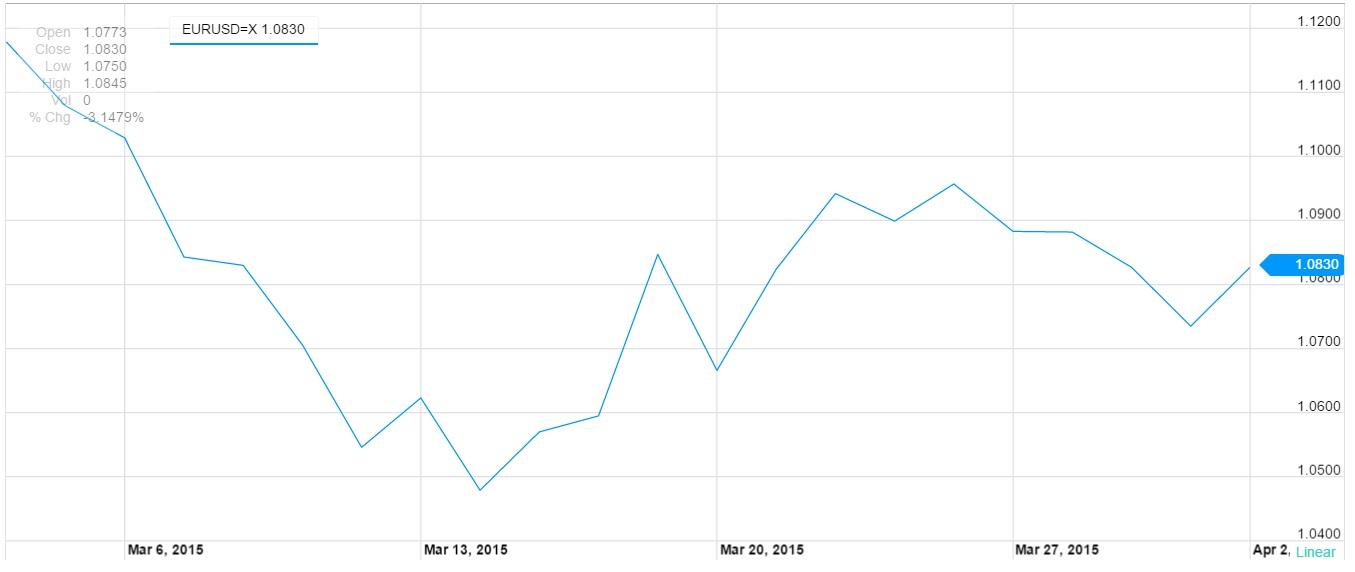

If you are currently hold a long EUR/USD position and want to negate the risk of loss, consider buying an OTM (out-of-the-money) Put option to expire after the holiday on Tuesday 7th of April. EUR/USD has traded back and forth in the past month and is currently around the middle of its range at 1.0830. One month ago it was trading above 1.11 and days later it fell below 1.05. See the EUR/USD chart below.

A lot has been going on with Greece’s instability, Iranian nuclear program, European Central Bank's (ECB) and Federal Bank's monetary outlook and more. A few days ago the EUR/USD option's implied volatility was very high (above 18%, meaning around a 1.125% range was expected per day), it has since dropped to around 14%. This is most likely due to investors closing positions prior to the holiday weekend.

The lower volatility means it is cheaper to buy options and there may be good opportunities. However, we must consider that we could see a further drop in volatility. Still, buying an option in order to hedge an existing positions is a fair price.

Hedged Position Example:

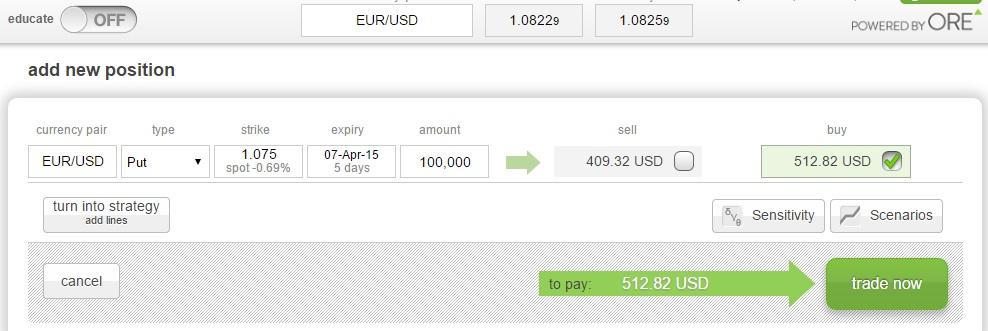

If you are long 100,000 EUR/USD from a rate of 1.0826and you want to negate risk, you can buy a Put option with the strike equal to the rate you want to insure.

In the below example, we us a Put option to hedge our spot position in case of a decline below 1.0750. The further away the strike is from the spot rate, the cheaper the option. Since we are looking to be hedged in case of extreme volatility, we would like to pay as little as possible for the option and still be protected. We are not concerned with minor swings; as mentioned before, big news over the holidays is an all or nothing situation. The image below shows the Put option trade.

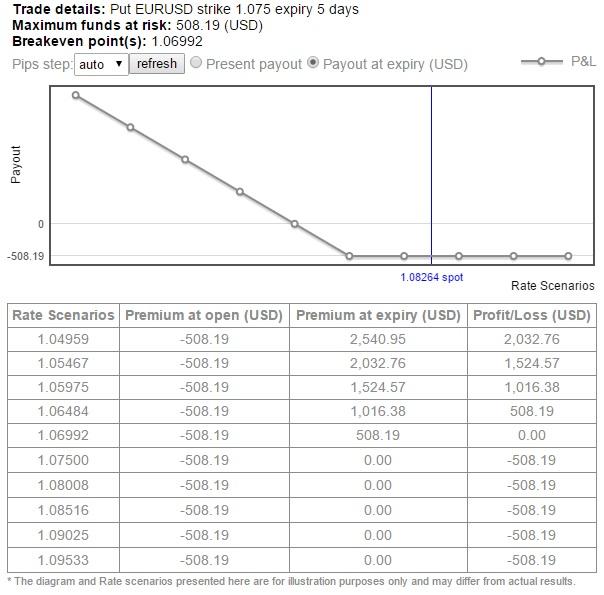

The below chart and table shows the option trade's payout over a range of EUR/USD market rates. Since the option is OTM, the payout will grow at a faster rate below the strike point. At rate 1.0597, the option's profit equals $1016 and your long spot position's loss is $2289 (calculated from entrance point1.0826), hence your spot position will be at a 50% loss versus a 100% loss if the hedge was not in place. The lower the spot position trades, the higher the hedged percentage will be.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.