The yellow metal has extended its losses this morning, now trading at $1179. The Gold Volatility Index is at 16.88 which is a relatively low level for the year, see graph below.

There are some major data releases and other global news on the front line this week; the Greece situation continues, Iranian nuclear program, EU Consumer Price Index (CPI), US Non-Farm Payroll (NFP) and more.

Gold Volatility Index Chart:

To trade an expected increase in volatility you may buy options because an option's value increases as volatility rises. But also note that Gold is trading at a 10 day low (see chart below). If you expect Gold price to rise and/or volatility to increase then buying a Call option is a suitable trade because a Call option's value increase as market price and/or volatility rises.

The position:

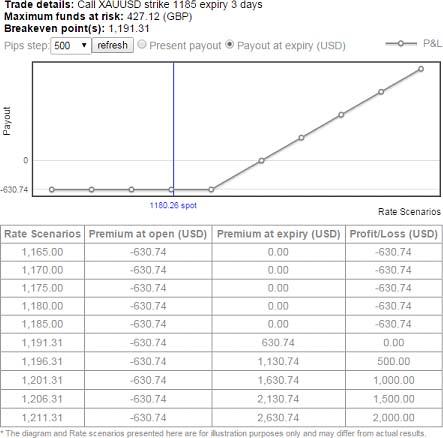

Buy a short-term, XAU/USD Call to expire this Friday at 14:00 GMT, with strike equal to $1185 (out-of-the-money). The option can be traded on MT4 using symbol C#XAUUSDw-2 or on ORE's web platform. The cost of this option on a 100 units (1 lot on MT4) is approximately $600 and this is your maximum risk for the position. Your upside is unlimited.

Web-platform Symbol:

MT4 Symbol:

The below chart and table shows the option trades payout at expiry over a range of market rates:

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.