Tomorrow, at 13:30 GMT, the anticipated US NFP will be released and the word on the street is that we might see some disappointing numbers. Regardless if the “street” is right or wrong, there is no doubt that these are interesting levels and with a continuous decline driving the pair down, betting on the pair’s temporary rebound is not a far-fetched assumption.

An attractive way to leverage this unique opportunity with a limited loss and no fear of being stopped out of your position, is buying options. In this case, two out-of-money Calls (OTM options are options that their strike is further away from the spot). This position will begin profiting if the pair’s closer to the money strike is reached and will increase its profit once the strike of the other option is reached and exceeded. The leverage for this position is 1:240 with the total amount being 200K (each option is on the amount of 100K) and your premium at open is $835.

The idea behind this position is that if we encounter a rebound from these levels due to weaker than expected NFP data combined with these already extreme levels, the move up can be dramatic.

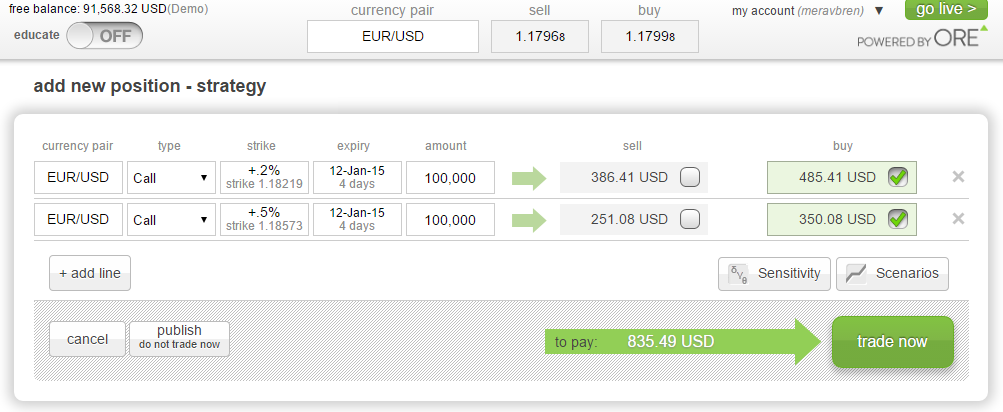

Below you can find a position involving the two OTM Calls. One with strike 1.18219 and the other 1.18573. The strikes, number of Calls and amount on which each Call is on can be adjusted according to the amount of risk you wish to take.

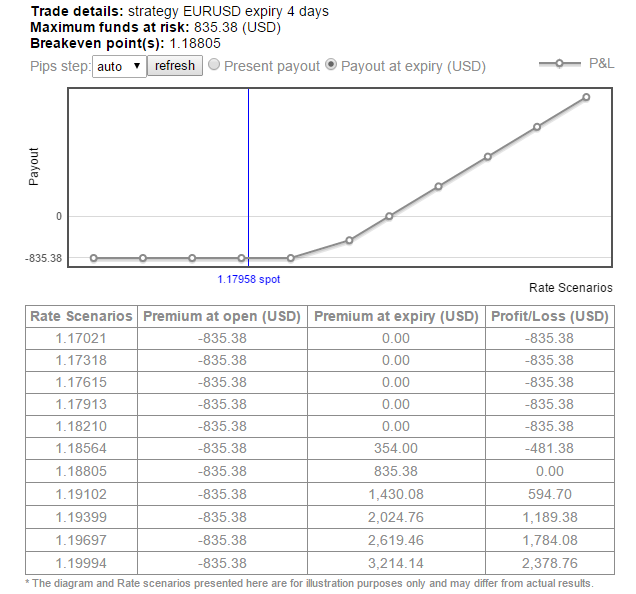

In the graph and table below you can find the different rate scenarios at expiry. Your maximum funds at risk equals $835. Your breakeven level equals 1.18805 and notice how your profit increases by 70% with every 29pips step.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.