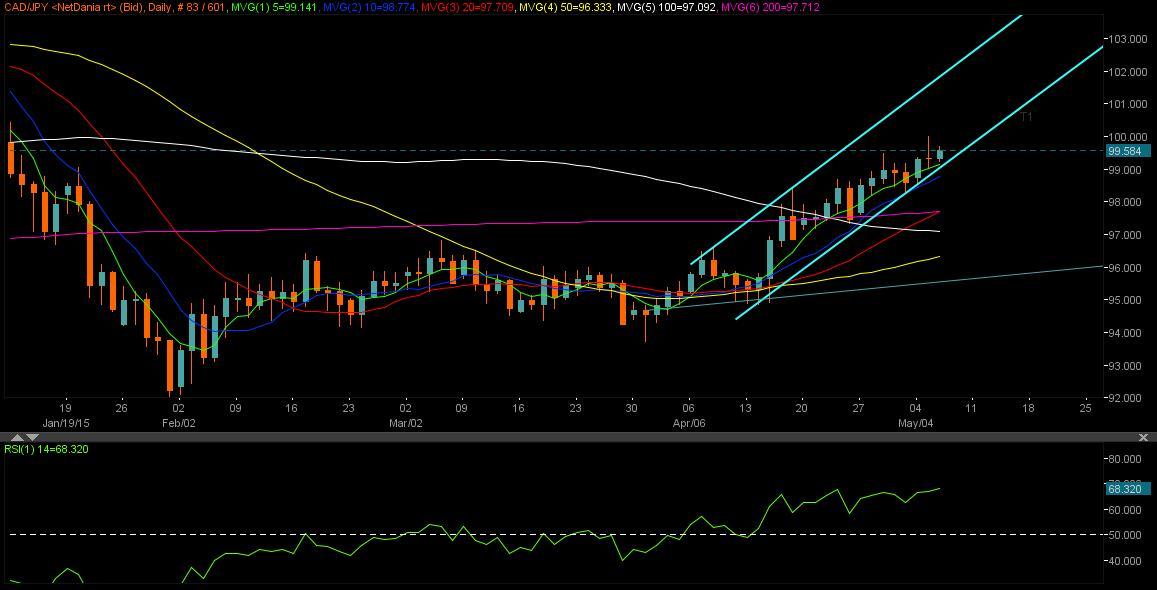

In continuation with previous report titled ‘CAD/JPY Forecast: could test 99.70 today’ published on May 1, we keep our bullish take on CAD/JPY intact and anticipate CAD/JPY could rise to the channel trend line resistance 101.85 levels this week, with the downside cushioned by major support zone formed around 99.05-99.15 levels where 5-DMA and channel trend line support converge.

CAD/JPY continues to ride higher over past two weeks largely on the back of the recent strength seen in the Canadian dollar supported by strengthening oil prices and upbeat fundamentals from Canada. While pro-CAD stance by Bank of Canada’s Poloz also supports the cross.

Jane Foley, Senior Currency Strategist, Rabobank notes, “The BoC has taken a more objective approach to the value of the CAD and decided to look through ‘the effects of the recent depreciation of the CAD’. The market has inferred that the BoC is not positioning itself to follow its January ‘insurance’ interest rate cuts. This conclusion has added further support to the CAD.”

On the macroeconomic front, we have a busy CAD calendar later this week, with Ivey PMI reading due later today followed by building permits data on Thursday and the key labour market report on Friday.

Though, Tuesday’s Canada’s trade numbers witnessed a big miss with overall imports climbed 2.2%, while exports ticked up 0.4%, leading to a $3 billion deficit in March, today Ivey PMI is expected to show a slight rebound in April to 50.1 from a drop to 47.9 seen in March.

Moreover, Canada housing market is expected to show an improvement as the building permits data due tomorrow is expected the permits to have risen 2.1% in March compared to -0.9% in Feb. While Jobs report Statistics Canada releases the jobs report for April Friday early US session. The March numbers showed a gain of 29,000 jobs, driven by gains in part-time work. The report will provide the first glimpse of how the economy is faring in the second quarter after a difficult first three months of the year.

With the above Canadian macro releases expected to rebound and hence show case improved economic outlook in Canada, the CAD/JPY cross is likely to benefit.

Despite expectations of upbeat Canadian fundamentals, the major driver for the Canadian dollar is likely to be rising crude oil prices.

US oil continues its upsurge and trades at five month highs after a combination of shrinking US crude reserves and a falling greenback, while Middle East tensions also kept the prices underpinned. Saudi Arabia, the world's largest crude exporter, announced it lifted the official selling price to customers in Europe and North America as a result of stronger demand.

Moreover, fresh tensions in Libya raised concerns that supply from the crude-rich Middle East region may be disrupted. Several protests have led to a shutdown of oil deliveries to a port in the eastern part of the country.

Adding to the positive mood, the American Petroleum Institute said on Tuesday that US crude reserves fell by 1.5 million barrels in the week to May 1. Furthermore, EIA weekly crude stockpiles report to be published later today, which is expected to show a 1.3 million barrel rise in US stockpiles for past week.

On the JPY-side of the story, USD/JPY has been in a range of 300 pips during the last month, and every attempt at a possible trend development has been killed at the beginning one way or another. As the most important short-term support at 118.50 was able to hold prices, the yen rebounded strongly from it and moved even higher as the closest resistance now lies at 120.50

Hence, the USD/JPY pair is likely to keep the 119-120.50 range towards the later part of the week and may witness limited volatility ahead of today’s ADP private payrolls report, which is considered a forerunner of the most influential labor report - Friday's non-farm payrolls.

Technically, on daily chart, the CAD/JPY pair extends gains and edges towards previous highs around the 100 mark. As mentioned earlier, the pair finds good support at 99.05-99.15 zone. The daily RSI at 68.70 aims higher indicating more room for upside. Also, the weekly RSI turned sharply higher at 58.80 also bolsters the case for extended Bull Run. Hence, we anticipate that the CAD/JPY cross could rise to 101.85 levels within this week, with the key support at 99. A break below the crucial support zone, the pair could drop to 98.30 below which floors would open for a test of 97.50 levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.