Japan's factory output dips more than expected as risks emerge

Global developments

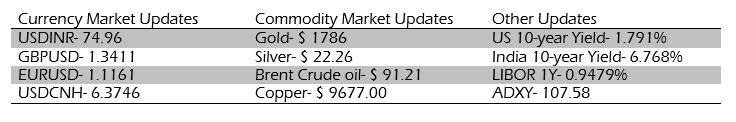

What a start to the new year it has been from the financial markets' point of view! Investors are not likely to get any respite from volatility anytime soon as we step into another action-packed week with several risk events lined up. We have the ECB and BoE rate decisions on Thursday and the US January jobs report on Friday. While the ECB is expected to maintain the status quo, the BoE is likely to raise rates by 25bps to 0.5%. Markets will also keep an eye on US-Russia tensions around Ukraine. The risk sentiment that had been soured by a more hawkish than expected Fed policy recovered a bit towards the end of the week. The Dow and S&P500 ended 1.7% and 2.4% higher respectively. The Nasdaq which had been hammered down close to 15% YTD ended 3% higher. US long-term yields have retreated 3-4bps. The Euro has recovered from lows of around 1.1120 seen on Friday. Markets will continue to focus closely on the US labor market and inflation data to assess whether the Fed would be able to deliver the tightening it is communicating now. Crude prices have inched higher with Brent now at USD 91.3 per barrel.

Domestic developments

December core sector data, April-December fiscal deficit data are due today. The economic survey would be tabled in the Lok Sabha today which would present the developments on the economic front in the year gone by and also the growth expectations for FY'23. The union budget for FY'23 would be tabled to tomorrow.

Equities

16850 is an extremely crucial support for the Nifty. We have been seeing mean-reverting moves in the last three sessions. While on Wednesday and Thursday markets recovered from being deep in negative territory, on Friday the Nifty gave up gains intraday to end flat at 17101. Asian equities are trading with a positive bias.

Bonds and rates

The benchmark security was partly devolved in Friday's auction. The activity in bond markets is likely to remain muted ahead of the budget on Tuesday. The yield on the 10y benchmark had ended at 6.75%. 3y and 5y OIS also climbed 4bps each to 5.40% and 5.73% respectively.

USD/INR

The Rupee strengthened despite overall Dollar strength due to month-end exporter Dollar selling. We are likely to see similar price action today. 75.30 is a key resistance for USD/INR. 1y forward yield ended at 4.53% on Friday while 3m ATMF implied vols eased 6bps to end at 4.77%.

Strategy: Exporters are advised to cover on spots levels. Importers are advised to cover on dips towards 73.80 - 73.90 level. The 3M range for USDINR is 73.80 – 76.00 and the 6M range is 73.50 – 76.50.

Author

Abhishek Goenka

IFA Global

Mr. Abhishek Goenka is the Founder and CEO of IFA Global. He pilots the IFA Global strategic direction with a focus on relentlessly improving the existing offerings while constantly searching for the next generation of business excellence.