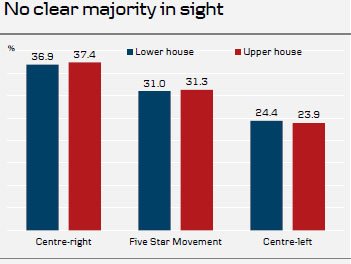

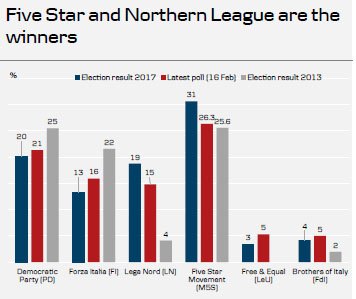

The result of the Italian parliamentary election appears to be a hung parliament, as earlier polls pointed to already. Anti-establishment parties such as the Five Star Movement and Northern League nevertheless registered strong gains, but none of the three major political blocs seem to be able to secure an outright majority (see chart). At the time of writing, the Five Star Movement was projected to get around 31% of the votes and the Northern League around 19%, whereas the PD party's result disappointed with 20% (see chart).

At this stage it is difficult to say which party will get the mandate by the president to form a new government, but overall a grand coalition or centre-right coalition together with some smaller parties still seems most likely, in our view. Even in the case of a euro-sceptic coalition of Five Star and Northern League emerging, we still think that the actual euro exit risk is low. However, such an outcome would still be the most adverse one for markets, given the combination of reform roll-back and significant fiscal easing, which could bring Italy's debt woes quickly back into focus (see also Italian Election Monitor - The good, the bad and the ugly scenarios for Italy, 25 February 2018).

New elections cannot be ruled out

First coalition debates are likely to be starting behind the scenes already, despite the inconclusive result. The next important date on the election agenda is 23 March, when both houses of parliament will come together for the first time and speakers of the houses are elected, which is a necessary precondition for President Sergio Mattarella to start the formal consultation process aimed at forming a new government. After a deal is found, the new government has to secure a confidence vote in parliament, leaving us to conclude that it is unlikely that we will have a new Italian government in place before May or June this year. Should renewed coalition building efforts fail, new elections held in H2 18 cannot be ruled out either, in our view.

Markets await more clarity

The reaction in FX markets to the eurosceptic shift in Italy so far has been muted, as investors await more clarity on the composition of the next government. EUR/USD trades still around the 1.23 level at the time of writing and the muddy outcome should keep the cross in the recent range, in our view. In the fixed income market, the Italian election is not a positive for the peripheral spreads this morning, but it is mainly an Italian ‘problem'. Hence, we expect Italy to lose relative to Spain and Portugal as well as the core EU markets. We expect the 10Y spread between BTPS and Germany to open up some 5bp wider on the back of the election result, and given the big gains for populist parties, it is difficult to see this as a positive factor for Italian government bonds going forward. That said, other factors are also at play such as the SPD joining Angela Merkel in a grand coalition in Germany, which will be positive for the EU. Hence, together with the centre-right coalition in Italy winning the most votes but without having a majority, this should limit the potential spread widening between Italy and Germany.

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.