During the past 10 days or so, there was the rare opportunity to hear the decisions of some of the world’s most important central banks within days of each other. The European Central Bank, the Bank of Japan, the Federal Reserve, the Swiss National Bank and the Bank of England all met and discussed policy within the same 8-day period. This was perhaps a lot of information to digest all at once, but some key conclusions have emerged behind the official policy statements and the carefully-crafted answers to journalists.

The first common conclusion is that the world’s major central banks sound concerned about the uncertainties in the global environment. While the theme of ‘we are doing ok at home – it is the rest of the world that has us worried’ was spoken more often than it should, there were mostly downgrades to inflation and growth forecasts across the board. The downgrades were not dramatic but they did convey a note of caution. At this point in time, it looks like every major central bank is keen to err on the side of caution, that is to say keep rates low for longer by delaying rate hikes or inject even more monetary stimulus even if it means using untested methods.

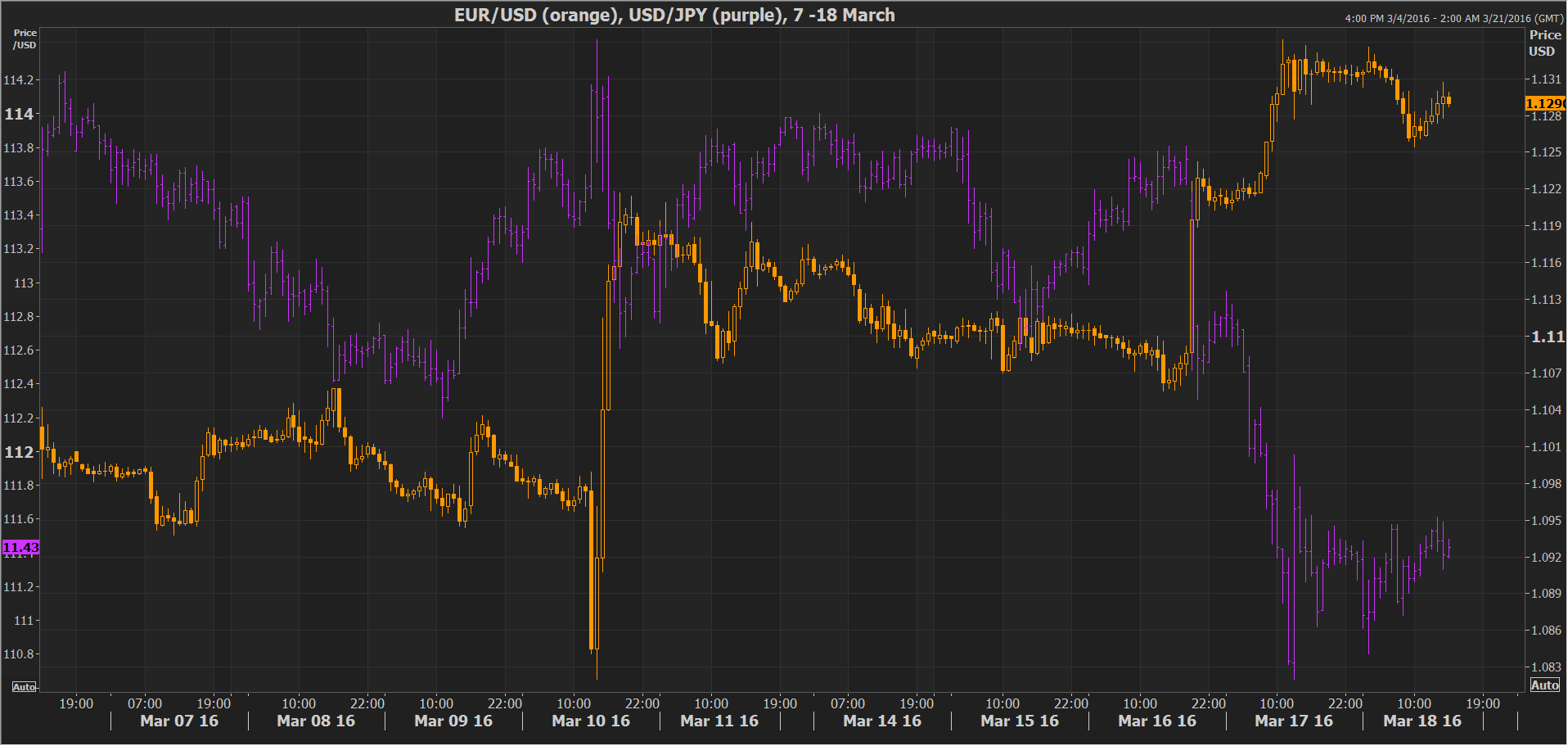

The second point that is worth making is that the market reaction to some of the central bank announcements – particularly that of the ECB – has been itself surprising. This has been particularly true in foreign exchange markets as both the euro and the yen, the currencies of those central banks that are injecting the most stimulus, appeared strong. One possible explanation is that currencies do not exist in a vacuum – they are always rising or falling against another currency. So what happens if all central banks are exceeding expectations in terms of either refusing to increase rates or pushing rates deeper into negative territory? It is very possible that this results in some choppy and surprising action. Expectations of deepening policy divergence have already resulted in sharp depreciation of the yen and the euro and a lot of ‘bad’ news were already priced in particularly for these two currencies. The fact that the ‘good’ news that were expected in currencies such as the US dollar and the UK pound for example, did not play out as initially expected, may also have led to the lack of direction for the pairs involving these currencies. For the pound of course the issue of the EU in/out referendum is also paramount during the period up to June.

Finally, it appears that under the current conditions for global monetary policy, ‘divergence’ for central banks that are leaning on tighter policy is less easy than first appears. The Federal Reserve’s latest meeting outcome is an interesting illustration of this. Whereas one could claim that domestic economic data for the United States such as core inflation and unemployment are calling for the normalization of monetary policy, policymakers are still reluctant. A possible justification is that during a period where major central banks such as the ECB and the Bank of Japan are keen to reduce rates further into negative territory, heading in the other direction by regularly raising rates as if nothing is happening, can attract a lot of unwanted short-term capital flows to your domestic currency. This could cause for example the US dollar to extend its current rally, potentially making the US ‘the consumer of last resort’ for the rest of the world. This is an outcome that the US would like to avoid, as the US Treasury Secretary himself stated in the recent G20 summit.

Besides the conflicting signals from currency markets, central bank ‘dovishness’ is more clearly portrayed by the significant recovery of risk asset prices in recent weeks, as most stock markets have erased the losses they had registered since the beginning of the year. This has happened despite the slight deterioration in growth forecasts, which shows that the recovery could be the result of fresh stimulus hopes. Therefore the “liquidity party” as one market participant called it, is continuing for now, after the brief scare during January and February when Chinese slowdown fears and falling oil prices were casting a cloud over investors.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.