USD/CAD

The dollar traded mixed against its major G10 peers during the European morning Thursday, ahead of the 2nd estimate of the US Q2 GDP. The forecast is for the growth rate to be revised up, to show that the US economy expanded at a faster pace from the already encouraging growth figure seen in the first estimate. This is in line with the Fed's expectations for a stronger growth in Q2, and could support USD. The greenback was higher against EUR, JPY and GBP, in that order, while it was lower vs CAD, NZD, NOK and AUD. It was virtually unchanged against SEK and CHF.

Eurozone's M3 money supply accelerated to 5.3% yoy in July from a revised 4.9% in June, beating expectations of an unchanged reading. More importantly however, was the further increase of the flow of credit to the private sector. The growth rate of loans ticked up to 1.9% yoy in July from 1.7% a month ago, which suggest that the ECB's QE and targeted LTRO programs may have started to work. As a result, spending could pick up and boost prices. Business investment may strengthen as well.

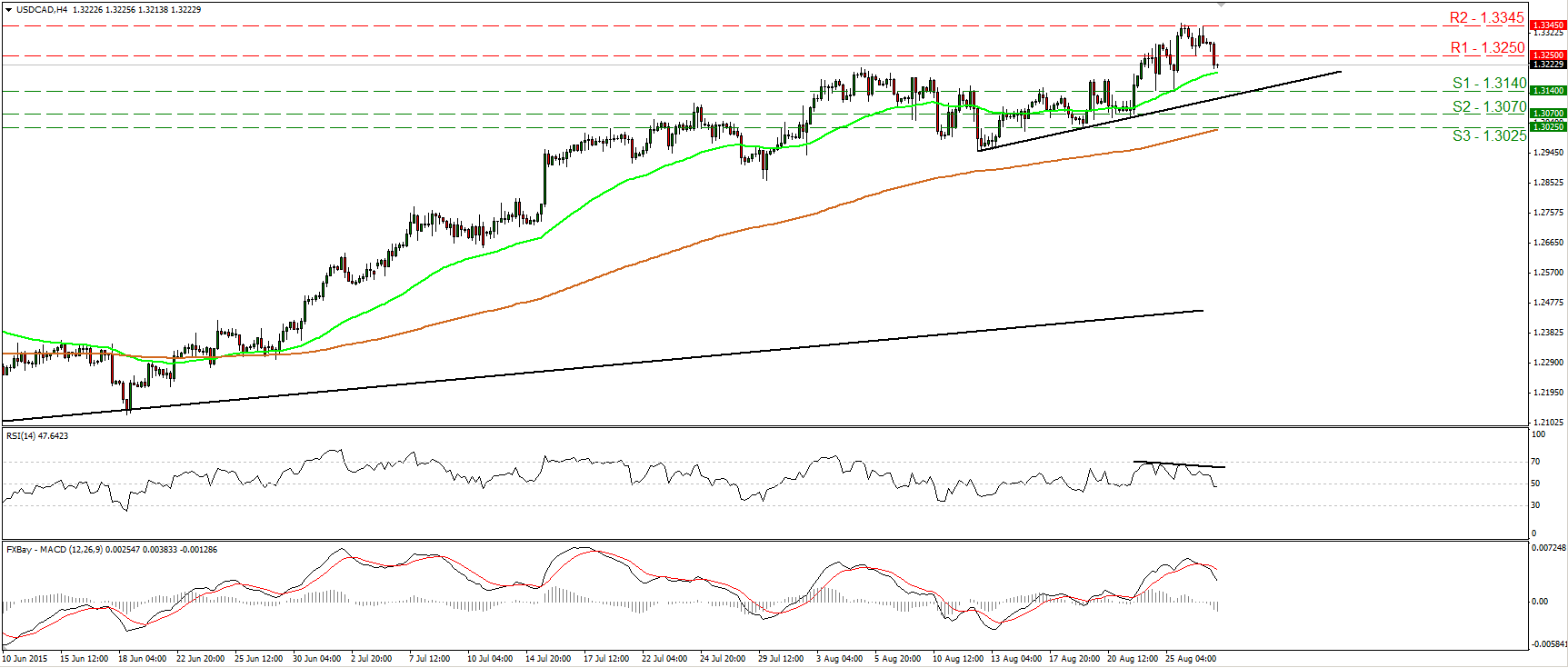

USD/CAD traded lower during the European morning Thursday, breaking below the support (now turned into resistance) barrier of 1.3250 (R1). The short-term trend remains positive in my view, as marked by the uptrend line taken from the low of the 12th of August. However, I see signs that the current pullback may continue for a while, perhaps to challenge once again the 1.3140 (S1) support barrier. The RSI edged lower and fell below its 50 line, while the MACD, although positive, has topped and fallen below its trigger line. Moreover, there is negative divergence between the RSI and the price action. On the daily chart, I still see a major uptrend. The pair is still trading above the uptrend line taken from back the low of the 14th of July 2014. As a result, I would treat any future near-term declines as a corrective move of that long-term upside path.

Support: 1.3140 (S1), 1.3070 (S2), 1.3025 (S3)

Resistance: 1.3250 (R1), 1.3345 (R2), 1.3500 (R3)

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.