EUR/GBP

The dollar was higher against almost all of its G10 peers during the European morning Monday, ranging from +0.15% against SEK, to +0.30% vs NOK. The greenback was virtually unchanged against AUD and GBP, in that order, while it was slightly lower vs NZD.

The British pound strengthened initially after the country's manufacturing PMI beat expectations and rose to 51.9 in July from 51.4 previously vs the forecast of a rise to 51.5. In the following minutes however, the currency gave back all the gains and fell back to trade unchanged against the USD. Investors seem to be cautiously positioning themselves ahead of the action-packed day this Thursday, when the BoE will release its rate decision, the minutes of that meeting showing members votes, and the quarterly Inflation Report, all at the same time. With several members adopting a more hawkish stance recently, we will be watching if this will be reflected in the rate votes. In such case, this will most likely be GBP bullish, which we prefer to express against the commodity currencies AUD, NZD and CAD.

EUR continued its choppy price action after the French, German and Eurozone's final manufacturing PMIs for July came in line or slightly above the initial estimate. EUR/USD found support at our 1.0960 support line and bounced a bit higher, while the move was limited way below the psychological round figure of 1.1000. Given the current neutral picture, I would prefer to wait for the US personal income and personal spending released later in the day to determine the short-term direction of the pair.

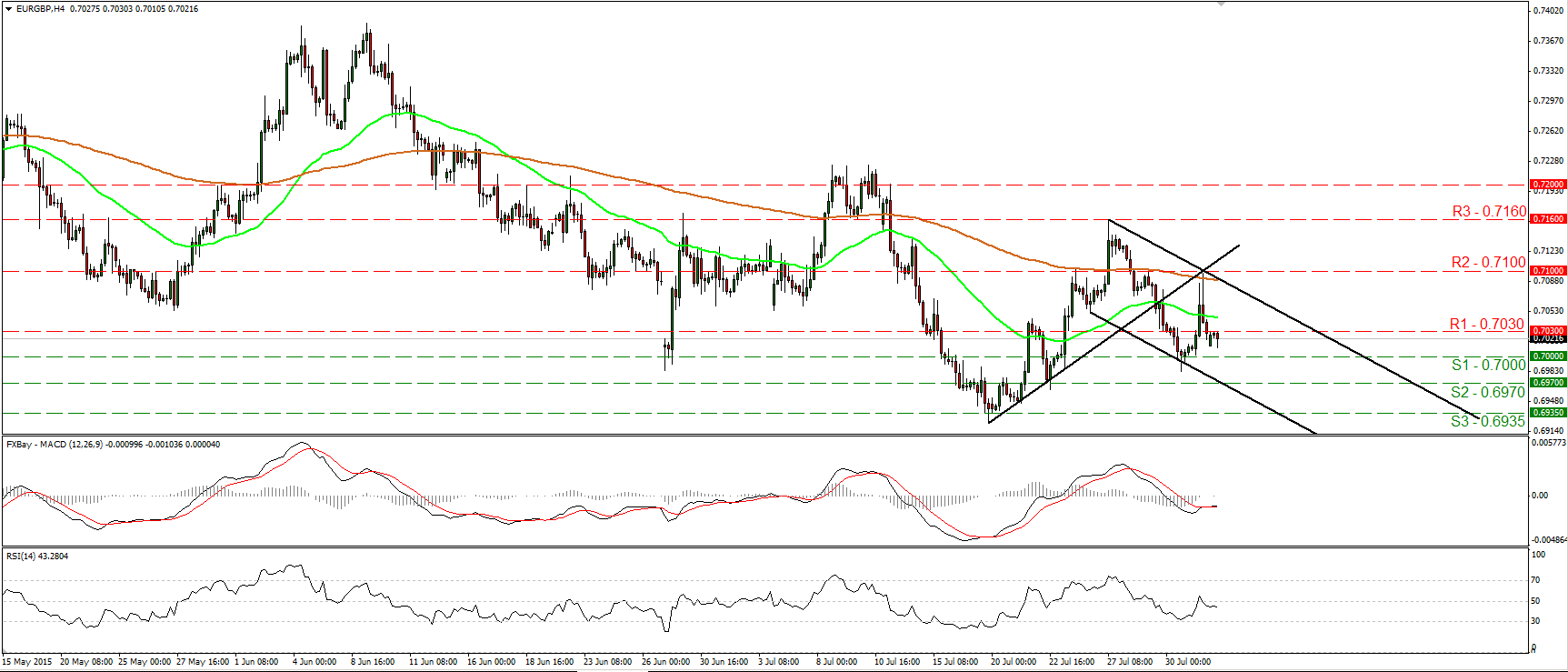

EUR/GBP traded somewhat lower during the European morning Monday, after it hit resistance at the 0.7030 (R1) barrier. The rate is trading below the prior uptrend line taken from the low of the 17th of July and within the downside channel that has been containing the price action since the 24th of July. As a result, I would consider the short-term outlook to remain negative. I would expect a break below the psychological round figure of 0.7000 (S1) to open the way for the next support at 0.6970 (S2). The RSI fell below its 50 line and points somewhat down. The MACD also detects negative momentum, but stands above its trigger line and points sideways. This makes me believe that it is better to wait for a clear move below 0.7000 (S1) before trusting the down road again. On the daily chart, the price structure remains lower peaks and lower troughs. Therefore, I believe that the overall picture is negative as well.

Support: 0.7000 (S1), 0.6970 (S2), 0.6935 (S3)

Resistance: 0.7030 (R1), 0.7100 (R2), 0.7160 (R3)

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.