USD/CAD

The dollar traded unchanged or lower against almost all of its G10 counterparts during the European morning Wednesday. It was lower vs CHF, EUR and NOK, in that order, while it was unchanged against SEK, NZD, CAD, GBP and JPY. The greenback was slightly higher only against AUD.

Later in the day, the Bank of Canada meets to decide on its key policy rate. We don’t expect much new information at today’s meeting and the market consensus is for the Bank to remain on hold. Therefore, the impact on CAD will depend on the tone of the statement accompanying the decision where BoC Governor Poloz could reiterate his bullish view on the economy’s prospects. Such an event along with improved activity data could support CAD, at least temporarily.

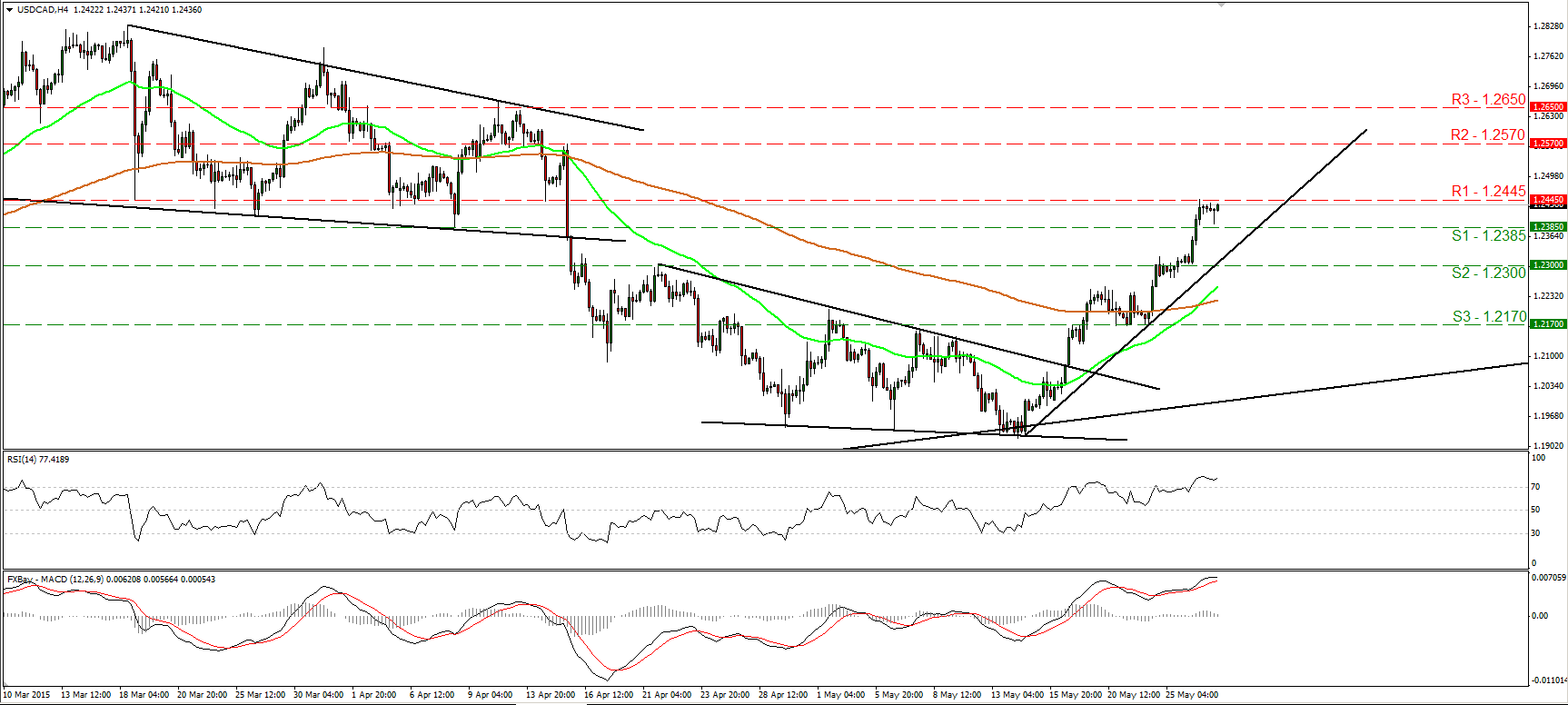

USD/CAD started trading higher after exiting a falling wedge formation on the 18th of May. Since then, the pair has been printing higher peaks and higher troughs, and as a result I would consider the short-term picture to be positive. During the European morning Wednesday, the pair is struggling below the resistance barrier of 1.2445 (R1), where an upside break could set the stage for extensions towards our next resistance at 1.2570 (R2), defined by the peak of the 15th of April. Nevertheless, bearing in mind that the BoC is likely to come out with an optimistic statement later in the day, and taking into account that our short-term oscillators provide weakness evidence, I would be mindful that a pullback could be looming before buyers take in charge again. The RSI topped within its overbought territory, while the MACD has also topped and could fall below its trigger line soon. A break below 1.2385 (S1) could confirm the pullback case and perhaps extent the correction towards 1.2300 (S2). As for the broader trend, on the 14th of May, the rate rebounded from the longer-term uptrend line taken from the low of the 11th of July. This keeps the overall picture of USD/CAD to the upside as well.

Support: 1.2385 (S1), 1.2300 (S2), 1.2170 (S3).

Resistance: 1.2445 (R1) 1.2570 (R2), 1.2650 (R3).

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.