USD/SEK

The dollar traded mixed against its G10 peers during the European morning Tuesday. It was higher against EUR and CHF, in that order, while it was lower against NZD, AUD, CAD and SEK. The greenback was stable vs NOK, JPY and GBP.

The German ZEW survey for April was mixed: the current situation index improved for the 6th consecutive time, but the expectation index declined a bit after five monthly gains, possibly reflecting concerns over Greece. EUR/USD started strengthening well before the announcement and in the event, it jumped briefly when the indicator was released. However, the rate quickly gave back its gains despite the strong readings. While the overall strong ZEW survey reflect the firming momentum of the German recovery and add to the recent encouraging data, it is not enough to reverse the longer-term down path of EUR/USD, in our view.

The Swedish krona strengthened after the country’s official unemployment rate declined in March on both an NSA and SA basis. Along with the country’s recent return to inflation, the decline in the unemployment rate could keep SEK supported somewhat. However, a weak currency is needed to support the country’s economic recovery and Riksbank has said it is ready to take further expansionary measures if needed, even outside of the meeting schedule, to ensure that inflation rises towards the target. Therefore, we remain bearish on SEK.

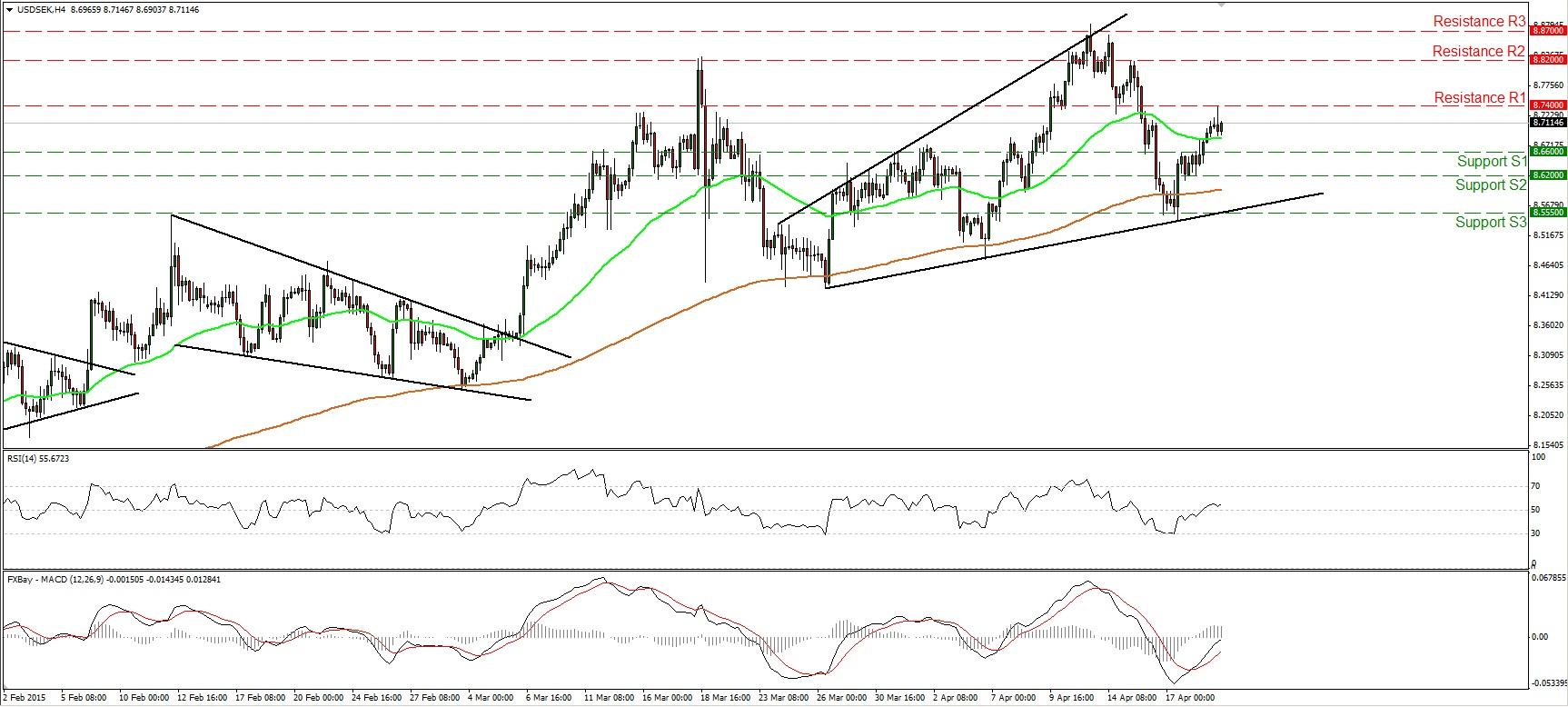

USD/SEK traded somewhat lower during the European morning Tuesday, after hitting resistance at 8.7400 (R1). Nevertheless, having in mind that the rate has been trading in a minor-term uptrend since it rebounded from the black diagonal support line, I would expect the rate to trade higher in the near term. A clear move above the 8.7400 (R1) hurdle is likely to see scope for more bullish extensions, perhaps towards the next obstacle at 8.8200 (R2). Our short-term momentum studies detect positive momentum and corroborate my view. The RSI lies above its 50 line and points somewhat up, while the MACD, already above its trigger line, is headed towards its zero line and could cross above it soon. In the bigger picture, USD/SEK has been in an uptrend since March 2014, and this keeps the overall outlook positive. However, there is negative divergence between our daily oscillators and the price action, indicating decelerating upside momentum.

Support: 8.6600 (S1), 8.6200 (S2), 8.5550 (S3).

Resistance: 8.7400 (R1), 8.8200 (R2), 8.8700 (R3).

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.