AUD/NZD

The dollar was unchanged or higher against most of its G10 counterparts during the European morning Monday. It was higher against NZD, AUD, GBP and CAD, in that order, while it was lower vs SEK.

Cleveland Fed President Loretta Mester speaking at a conference in Paris said that it is appropriate for the Fed to raise rates this year. She also added that the Fed won’t necessarily move on rates in June but it remains a viable option for an interest rate hike. This comment failed to support the dollar however because she also said that the level of the dollar is one of the conditions Fed officials look at and that a strong dollar will affect US exports. Her views on the dollar were similar to those that Chicago Fed President Evans and Atlanta Fed President Lockhart, two voting members of the FOMC, expressed on Friday. In addition, she mentioned that the global economic conditions are also going to be taken into account, despite the fact that the Fed only included the word “international” for the first time in their January statement. The fact that she is not a voting member this year make me believe that the market could see through these comments and USD could regain its lost ground. Perhaps Fed Vice Chair Stanley Fischer will clarify matters when he speaks later today at the Economic Club of New York.

Kiwi gave back all its Asian session gains and fell back to trade to levels before large stops triggered above 0.7610 in NZD/USD. Recently, the RBNZ kept its key policy rate on hold but maintained an upward bias for the future path of the rates. With this in mind, NZD is likely to remain strong, especially against AUD, where another rate cut seems inevitable to boost the country’s economy.

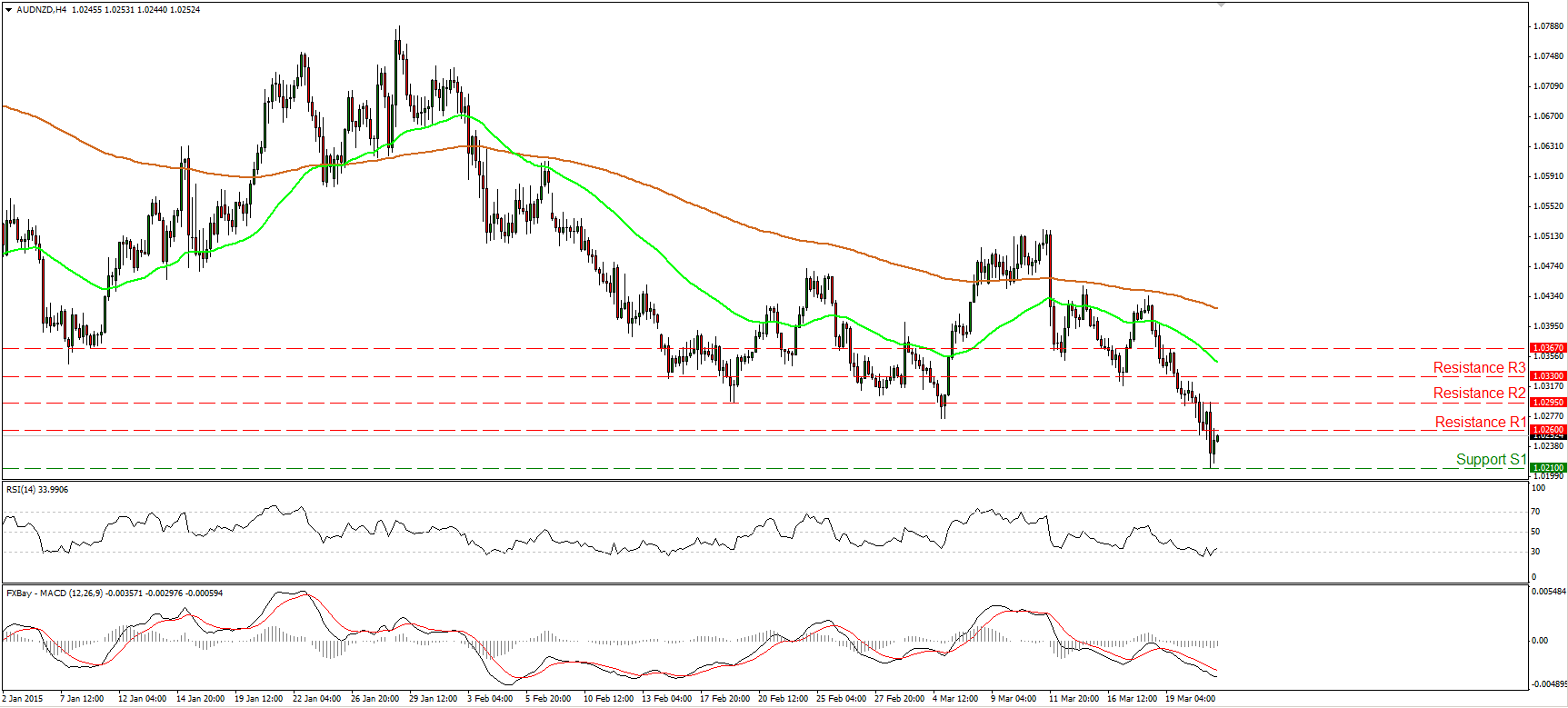

AUD/NZD moved somewhat higher during the European morning Monday, after printing a new all-time low at 1.0210 (S1). On the 4-hour chart, the price structure suggest a near-term downtrend. Taking a look at our momentum studies though, further extensions of the minor bounce might be on the cards, perhaps above the 1.0260 (R1) barrier. The RSI rebounded from marginally below its 30 line and is now pointing up, while the MACD has bottomed and could move above its trigger line any time soon. A move above the 1.0260 (R1) line, could extend the upside correction towards the next resistance at 1.0295 (R2). However, I would expect sellers to eventually regain control at some point in the not-too-distant future and to drive the battle below 1.0210 (S1). I believe that such a dip could set the stage for larger declines towards parity (1.0000 (S2).

Support: 1.0210 (S1) (all-time low), 1.0000 (S2) (parity).

Resistance: 1.0260 (R1), 1.0295 (R2), 1.0330 (R3).

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.