USD/NOK

The dollar traded lower against most of its G10 peers during the European morning Friday. It was higher against GBP and JPY, in that order, while it was unchanged vs NOK.

The euro was resilient after all of the German regional CPIs escaped from deflationary territory on a yoy basis. These figures indicate that the national inflation rate, due out late this afternoon, is also likely rebound from deflation. The data add to the growing body of evidence that Germany, the bloc’s largest economy, is strengthening again. This also increases the likelihood that Monday’s Eurozone CPI is likely to show deflation moderating somewhat, which could support EUR.

The Swedish krona gained the most after the country’s Q4 GDP showed a strong 1.1% qoq expansion, more than double the 0.5 qoq pace of Q3 and faster than market expectations. USD/SEK tumbled around 0.70% at the news and dipped below our support of 8.3100, but bounced up to trade above that level again. Despite the strong economic growth, the fact that the Swedish central bank is still fighting with deflationary pressures and can unexpectedly introduce additional expansionary measures is likely to keep SEK under selling pressure. Therefore, we could treat the current setback in USD/SEK as renewed buying opportunity.

NOK was unchanged after Norway’s unemployment rate declined in February, while retail sales plunged in January. The country’s economics are in a good condition overall compared to its peers. The unemployment rate seems to have stabilized near 3% while inflation is just below Norges Bank’s 2.5% target. The only drawback is the low oil prices, which are likely to keep NOK under selling pressure until they stabilize.

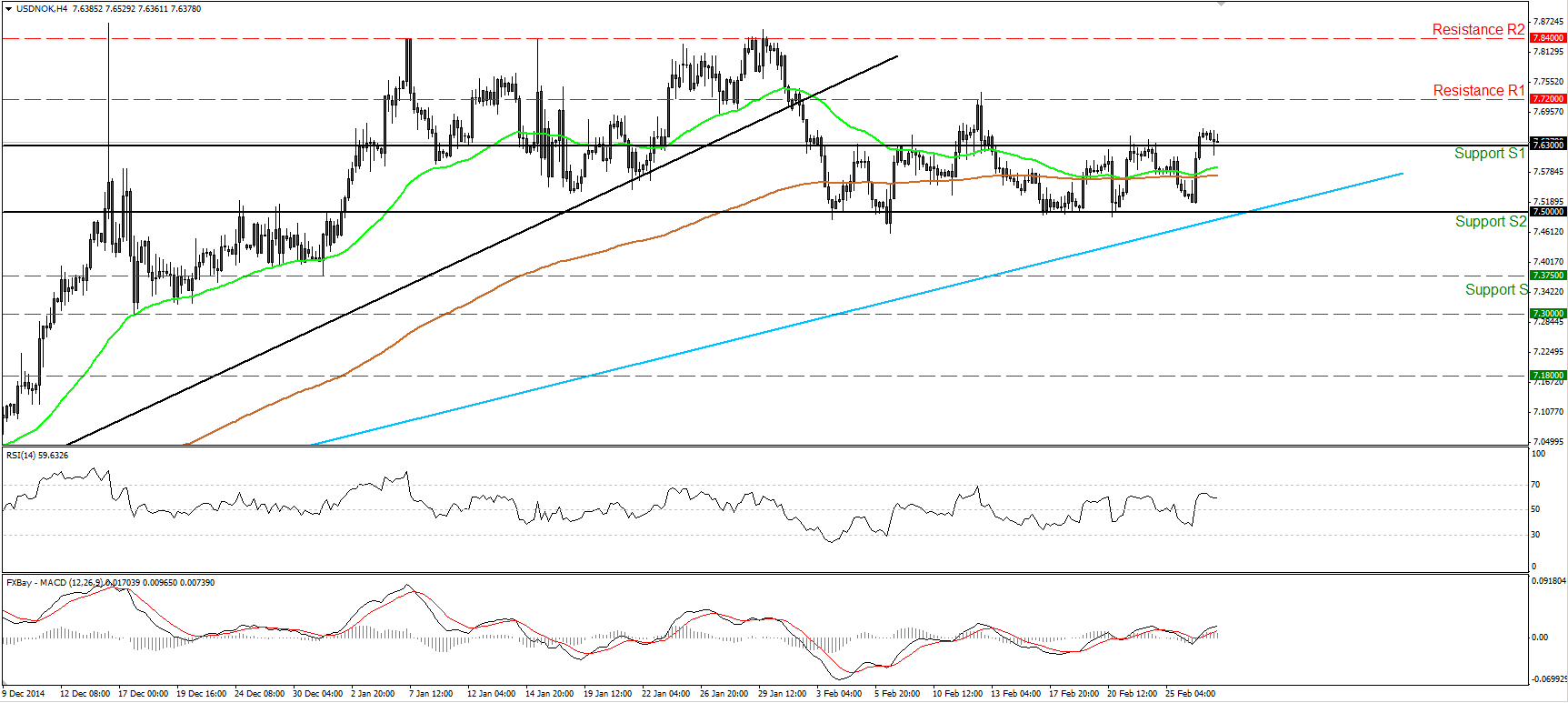

USD/NOK surged on Thursday after finding support slightly above the key support zone of 7.5000 (S2) and the long-term uptrend line (light blue line). The rally drove the rate above the resistance (now turned into support) hurdle of 7.6300 (S1), which happens to be the upper bound of the short-term sideways path the rate had been trading for the last couple of weeks. Today, during the European morning, the rate traded quietly above that line, but I believe yesterday’s move could encourage the bulls to target the resistance line of 7.7200 (R1). On the daily chart, since the rate is trading above the aforementioned long-term uptrend line, I would consider the overall upside path to stay intact. Moreover, our momentum studies support my view that we are likely to see a higher rate in the not-too-distant future. The 14-day RSI is back above its 50 line, while the MACD bottomed marginally below its zero line, turned positive and crossed above its trigger line.

Support: 7.6300 (S1), 7.5000 (S2), 7.3750 (S3).

Resistance: 7.7200 (R1), 7.8400 (R2), 8.0000 (R3).

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.