USD/NOK

The dollar traded higher against most of its G10 peers during the European morning Wednesday. It was lower against JPY and GBP, in that order, while it was stable vs CHF.

Eurozone’s final service-sector PMI was revised up in January, another support of the bloc’s economic sentiment following the unchanged manufacturing PMI on Monday. German PMI was also revised up, consistent with the moderate growth in domestic demand, while the French PMI fell slightly below expectations of an unchanged reading. EUR/USD remained elevated above 1.1400 and could advance a bit more given the strong data and the near-term positive bias towards the pair.

The UK service-sector PMI rose in January, well above market consensus of a moderate increase. Following the upside surprise in the manufacturing index on Monday and the increase in the construction PMI on Tuesday, the rise in the service sector confirmed the improving momentum in Q1. These figures show a strong UK outlook and could strengthen further GBP, at least temporarily.

The People’s Bank of China (PBoC) cut the reserve requirement ratio (RRR) by 50 bps to 19.5% from 20%. Following the recent weak data, the step was taken to boost lending into the real economy and stimulate growth. Rather than acting on interest rates, the Bank chose to use the RRR to release more liquidity into the markets. AUD and NZD jumped amid expectations that the growth of Australia’s and New Zealand’s biggest trade partner will support their exports.

The Norwegian krone has been strengthening following the oil rebound. Norway is Europe’s largest oil producer and its revenues, as well as investments in the oil sector, are directly affected from oil prices. The country’s economics are in a very good condition overall, compared to its peers. The unemployment rate seems to have stabilized near 3%, while inflation is just below Norges Bank’s 2.5% target. Therefore, as long as oil prices are rising, this is likely to keep NOK under buying pressure.

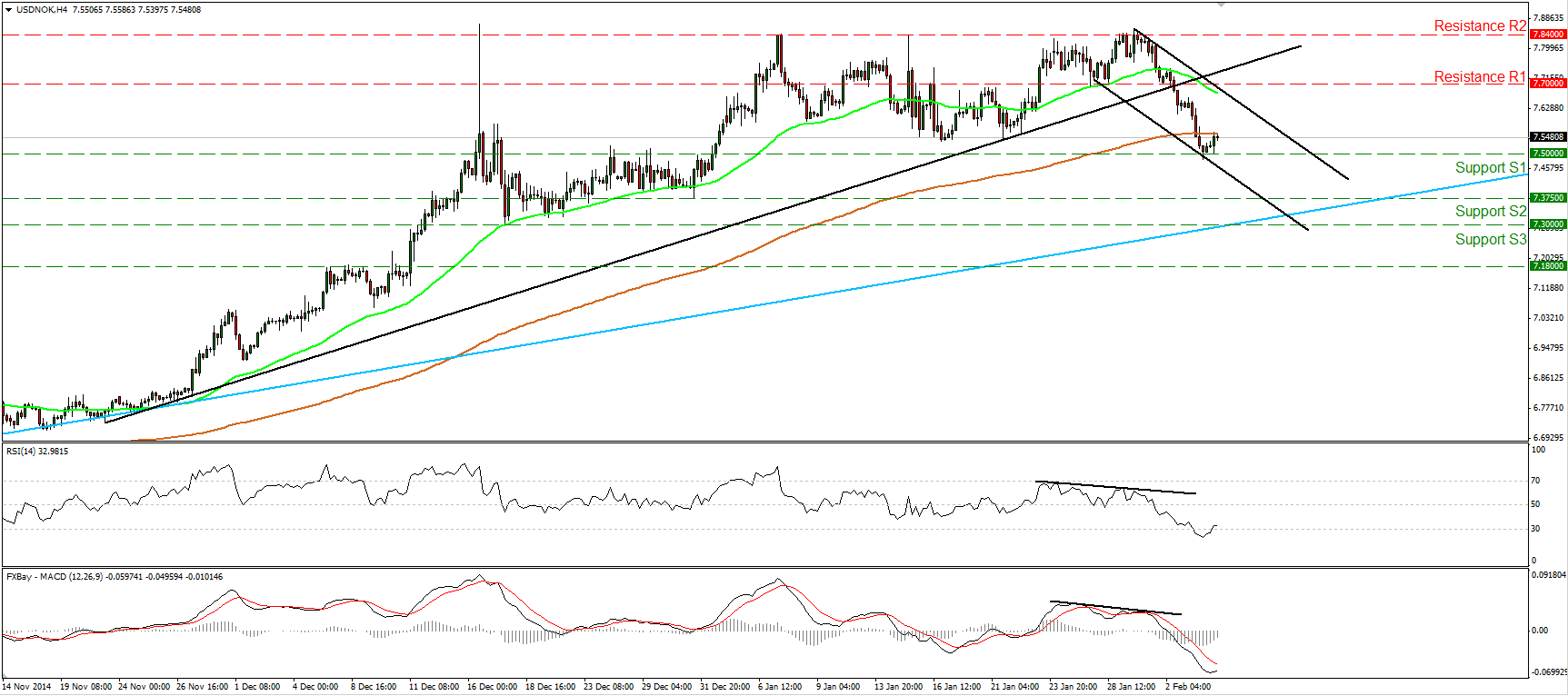

USD/NOK stopped falling today and edged somewhat higher after hitting support at around 7.5000 (S1). However, the fact that the pair is trading below the short-term black uptrend line make me believe that the downside corrective move has further to go. A clear move below 7.5000 (S1) is likely to signal further retracement and perhaps set the stage for a test near the 7.3750 (S2) barrier or the longer-term uptrend line drawn from back at the low of the 3rd of September (light blue line). As for the broader trend, as long as USD/NOK is trading above that longer-term uptrend line, I would consider the overall path to be to the upside and I would see the recent declines as a corrective phase.

Support: 7.5000 (S1), 7.3750 (S2), 7.3000 (S3).

Resistance: 7.7000 (R1), 7.8400 (R2), 8.0000 (R3).

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.