EUR/GBP

The dollar traded unchanged or higher against its G10 counterparts during the European morning Friday. It was higher against NOK, EUR, SEK, AUD, NZD and CAD, in that order, while it was unchanged vs GBP, CHF and JPY.

EUR continued plunging despite the better-than-expected preliminary Eurozone composite PMI for January. Even though the overall figure managed to remain in expansionary territory for the 19th consecutive month, it was not enough to overcome the psychological impact of the marginal decline in German manufacturing PMI from 51.2 to 51.0. The overall poor PMIs are consistent with a slowing in the pace of the Eurozone’s recovery and could keep EUR under selling pressure.

On the other hand, UK retail sales beat expectations and rose 0.2% mom in December from 1.7% mom previously. On top of Wednesday’s wage data, which showed some signs of recovery, consumers are probably benefitting from cheaper fuel prices and may remain a strong driver of the UK economic recovery. Nonetheless, expectations that inflation will continue to drift lower are likely to push GBP/USD even lower. On the other hand, the better fundamentals compared with the Eurozone are likely to maintain the downward path of EUR/GBP, in our view.

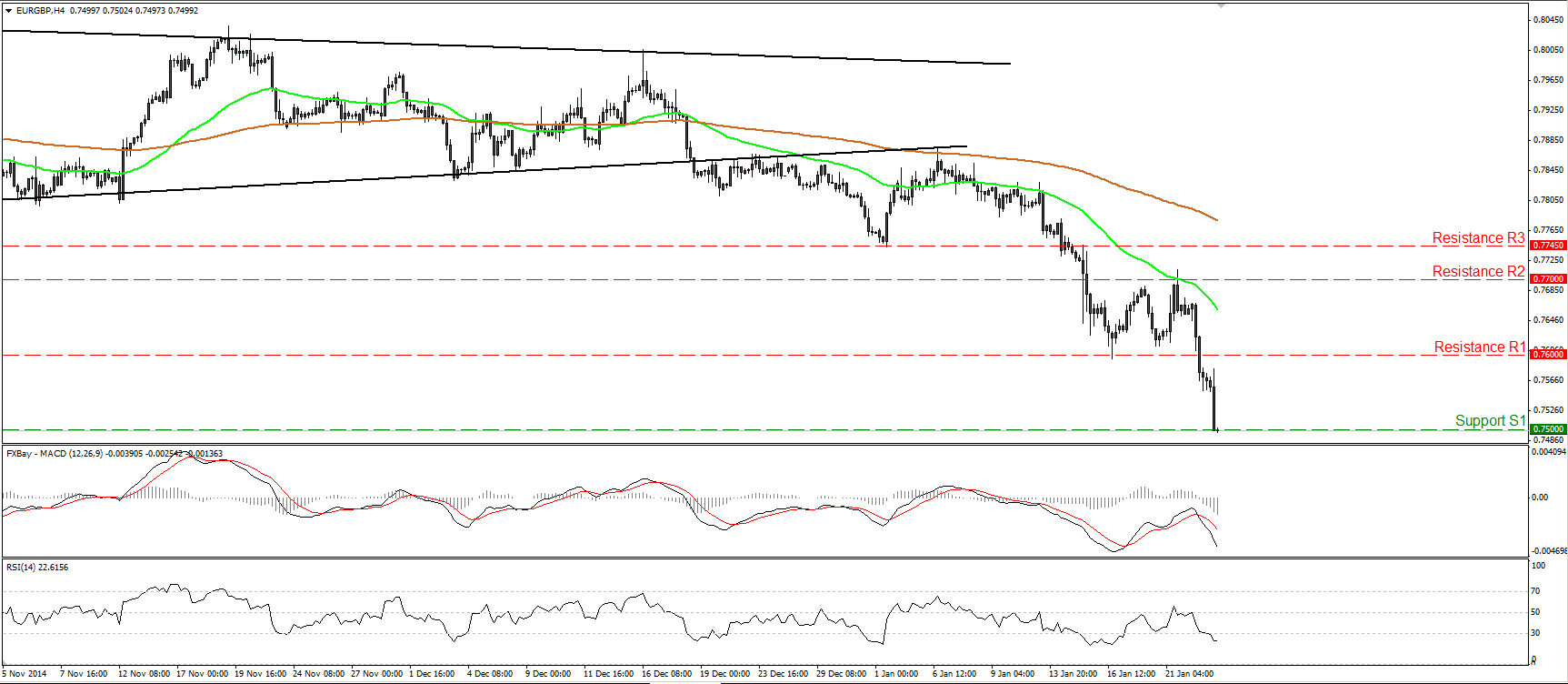

EUR/GBP tumbled during the early European morning and is currently testing the psychological support barrier of 0.7500 (S1). The intraday bias remains to the downside and therefore I would expect a break below 0.7500 (S1) to pull the trigger for the 0.7400 (S2) area, determined by the lows of February 2008. The accelerating downside momentum is visible on our near-term momentum studies as well. The RSI dipped within its oversold territory and is pointing down, while the MACD moved deeper into its negative territory, pointing south as well. As for the bigger picture, the downside exit of the triangle pattern on the 18th of December signaled the continuation of the longer-term downtrend, thus the overall outlook stays negative in my view.

Support: 0.7500 (S1), 0.7400 (S2), 0.7230 (S3)

Resistance: 0.7600 (R1), 0.7700 (R2), 0.7745 (R3)

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.