DAX futures

The dollar traded higher against most of the other G10 currencies during the European morning Monday. It was lower only against AUD and NZD and virtually unchanged versus CHF.

In the final round of the Greek presidential elections, Prime Minister Samaras failed to get enough support for his candidate, Stavros Dimas. He needed only 180 votes to be elected, but once again managed to gather only 168. This means Greece will have a snap election, probably on Jan 25th or Feb 1st. The Athens stock exchange index started collapsing well ahead of the voting procedure started and extended its plunge up to approximately 11% as the voting was in progress. While PM Samaras still has a significant chance of winning this elections, the odds favor the leftwing party of SYRIZA.

SYRIZA is an acronym for Coalition of the Radical Left. Indeed in its early days SYRIZA did present some radical views, and there are no doubt some radical groups within the coalition. But in fact, the party’s positions are different from those of the European political elite but not that radical. SYRIZA head Alexis Tsipras has been moving steadily towards the middle. Tsipras says the party wants to stay in the euro and in the Eurozone, but to renegotiate the terms on which they have borrowed money. With Greece’s debt/GDP ratio at 175% despite years of extreme austerity, they argue that the country’s debt is impossible to repay. This is probably true, but the lenders have to argue otherwise because it would be politically inconvenient to admit it. They would have to admit that the Eurozone is not properly designed, that their recipe for fixing the problems of the peripheral economies won’t work, and that ultimately the taxpayers of the EU as a whole will have to pick up the tab.

The reason SYRIZA is perceived as a threat to Europe is not only because of what it stands for, but also what it means for other anti-austerity parties in Europe. For example, Podemos, a new left-wing party in Spain, is leading in the opinion polls even though it was formed only a year ago. Spain has to hold a general election sometime this year. As Reuters said recently about Podemos:

Podemos, the Spanish word for “we can,” wants to clean up politics, which is good. But its leaders sympathize with Venezuelan-style Chavismo: The party wants to cut the retirement age to 60, audit the country’s debt before writing part of it off and guarantee everybody a minimum income. If such a program ever became policy, Spain would be heading for default and exit from the eurozone.

Then there’s UKIP in Britain and the Alternative for Germany (AfD) in Germany, just to name two more.

The concern therefore is not only what a SYRIZA victory would mean for Greece, but also what these new political parties that are challenging the political establishment mean for Europe. That’s why SYRIZA is such a big risk factor for the euro. As Nobel Prize-winning economist Paul Krugman said:

It would be a terrible thing if any of these groups — with the exception, surprisingly, of Syriza, which seems relatively benign — were to come to power. But there’s a reason they’re on the rise. This is what happens when an elite claims the right to rule based on its supposed expertise, its understanding of what must be done — then demonstrates both that it does not, in fact, know what it is doing, and that it is too ideologically rigid to learn from its mistakes.

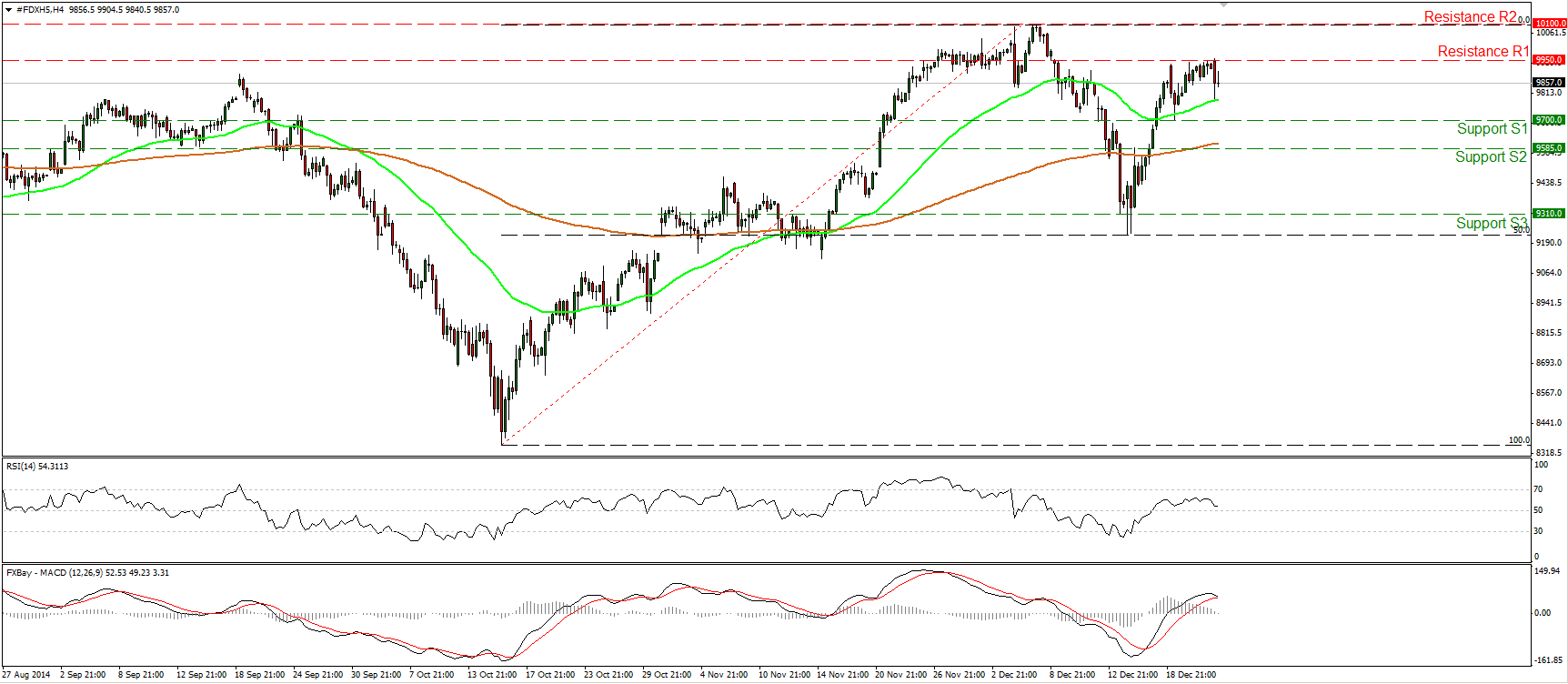

DAX futures slid during the European morning Monday after hitting resistance at 9950 (R1). Although the decline was halted near the 50-period moving average, I see signs that the pullback may continue, perhaps for another test at the 9700 (S1) support zone. The RSI turned down and is approaching its 50 line, while the MACD has topped and appears ready to dip below its signal line. Nevertheless, taking a look at the daily chart, I believe that the overall bias remains to the upside and I would expect any possible extensions of today’s setback to provide renewed buying opportunities. This notion is also supported by our daily oscillators. The 14-day RSI stands above its 50 line, while the daily MACD is positive and appears able to move above its signal line in the close future.

Support: 9700 (S1), 9585 (S2), 9310 (S3)

Resistance: 9950 (R1), 10100 (R2) (All-time high)

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.