Copper futures

The dollar traded mixed against its G10 peers during the European morning Tuesday. It was higher against SEK, NOK, JPY and GBP, in that order, while it was lower against AUD and CAD. The greenback remained stable vs EUR, CHF and NZD.

The Swedish Krona plunged against the dollar to its lowest level since August 2010, after Sweden’s central bank surprised investors with a bigger-than-expected rate cut. The Riksbank cut its main repo rate 25bps to zero and revised the rate path pushing the first hike into 2016 from end 2015 previously, in order to fight the country’s deflation. The inflation rate dropped six times so far this year and recently surprised the markets by falling deeper into deflation at -0.4% yoy. With interest rates at zero, it seems that the Bank is left with unconventional measures in case inflation does not pick up. Ahead of the release, USD/SEK was trading near our 7.2800 support zone and after the numbers were out, it shot up to catch and break our resistance of 7.3355. If deflation persists, I would expect extensions towards the 7.4500 zone.

Copper climbed near its highest level in almost two weeks as reports of strikes at two big mines in Peru and Indonesia, fueled supply concerns. Workers in those mine stations are planning to go on strike next month reducing copper supply. If the strikes take place and last more than expected, we could see the prices to move further up.

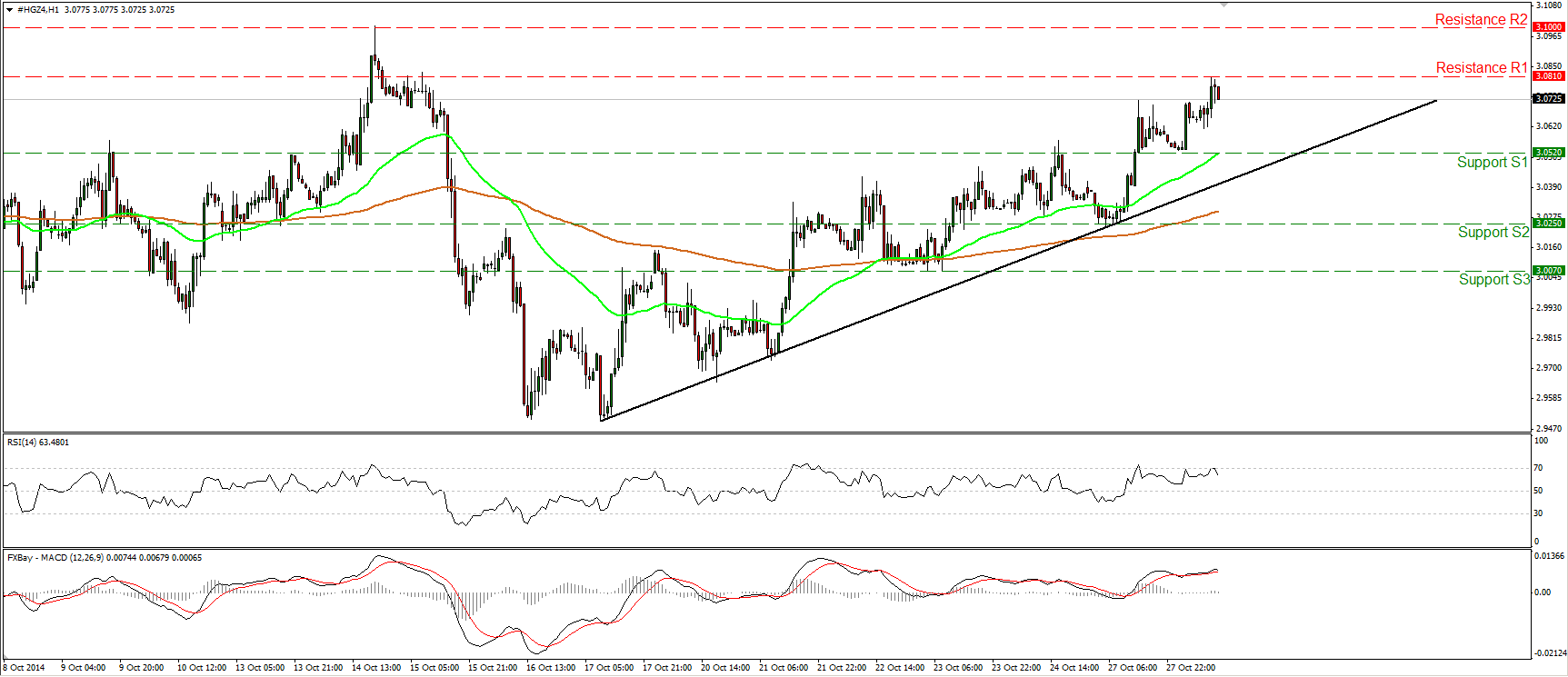

Copper futures moved higher after finding support at 3.0520 (S1), but the advance was halted at 3.0810 (R1). On the 1-hour chart, the price is trading above the black uptrend line, taken from back at the low of the 17th of October, and above both the 50- and the 200-hour moving averages. As a result, I would consider the short-term picture of copper to be to the upside. An upside violation of the 3.0810 (R1) barrier could see scope for larger bullish extensions, perhaps towards the 3.1000 (R2) key resistance line, defined by the high of the 14th of October. However, our momentum studies give me reasons to be careful of a possible pullback before the next bullish leg. The 14-hour RSI hit its 70 line and turned down, while the MACD could fall below its trigger line any time soon. In the bigger picture, on the daily chart, the price structure is lower highs and lower lows suggesting a downtrend. Consequently, I would treat the uptrend seen on the 1-hour chart, as a corrective wave of the larger down path. Only a clear close above the 3.1000 (R2) obstacle and the long-term downtrend line (drawn from back the high of the 14th of July) could signal a trend reversal on the daily chart and probably flip the overall outlook of Copper futures to the upside.

Support: 3.0520 (S1), 3.0250 (S2), 3.0070 (S3).

Resistance: 3.0810 (R1), 3.1000 (R2), 3.1250 (R3).

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.