USD/CAD

The dollar traded higher against almost all of its G10 counterparts during the European morning Wednesday. It was stable against JPY, AUD and NZD.

The euro fell below our 1.2700 support level on an unconfirmed newswire report that at least 11 banks from six European nations are set to fail the stress tests conducted by the ECB and the European Banking Authority. The results of the test will be announced this Sunday. They are expected to show which of 130 biggest banks have valued their assets properly and which may need more capital to withstand another economic turmoil. The bigger the number of the stressed banks, the bigger the negative impact on euro.

The Bank of England remained divided on the future path of its interest rates, according the minutes of its latest Monetary Policy Committee (MPC) meeting. The same two members of the MPC voted again for a 25bps interest rate hike despite the recent poor UK data. In the absence of a change of view at the Bank, sterling jumped approximately 0.10% against the dollar but fell immediately after to break below our 1.6025 support level, where it gyrated at midday in Europe. Given the negative sentiment towards the pound, we could see GBP/USD test our next support of 1.5950 in the near future.

The Canadian dollar depreciated against the greenback ahead of the today’s Bank of Canada meeting. At their last meeting, the Bank extended the country’s interest rate pause another time and remained neutral. We expect that they will repeat themselves and remain on hold. Although widely expected, this result could prove negative for CAD. Much will depend however on what Governor Stephen Poloz says at the press conference following the rate decision.

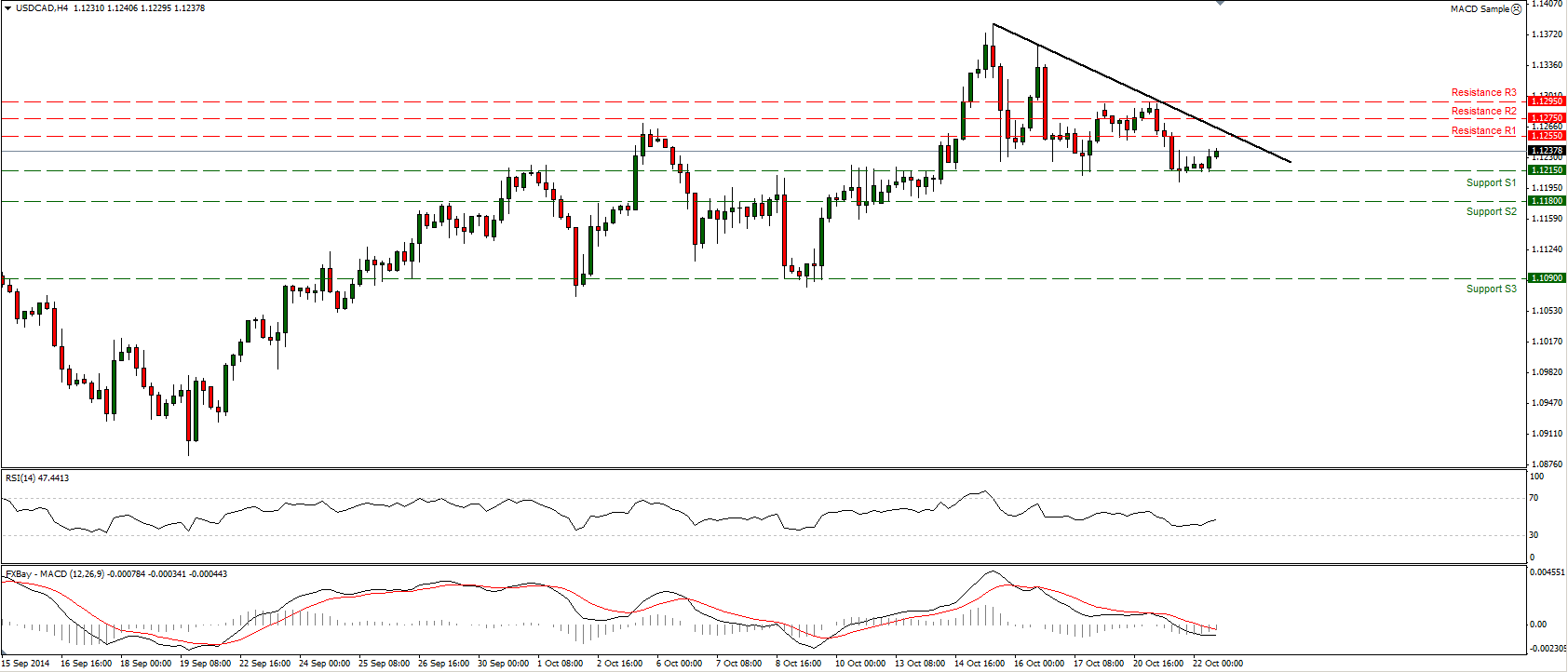

USD/CAD traded quietly during the European morning Wednesday, staying above the support barrier of 1.1215 (S1). Although the price structure on the 4-hour chart suggests a short-term downtrend as seen by the black downside line, on the daily chart, the overall picture shows an uptrend. The expectations that the Bank will remain on hold could push USD/CAD up to test our resistance of 1.1255 (R1). The RSI is approaching its 50 line and is pointing up, while the MACD, despite being in its negative territory, shows signs of bottoming and seems willing to cross its trigger line. These momentum indicators buttress my view that we could see a rise in the near future to at least the 1.1255 (R1) area. In the bigger picture, the larger trend remains to the upside in my view. The pair is still printing higher highs and higher lows and a result, I would expect any short-term declines to provide renewed buying opportunities.

Support: 1.1215 (S1), 1.1180 (S2), 1.1090 (S3) .

Resistance: 1.1255 (R1), 1.1275 (R2), 1.1295 (R3).

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.