USD/RUB

The dollar traded mixed against its G10 peers during the European morning Friday. It was higher against JPY and NOK, in that order, while it was lower against AUD, NZD, CAD, EUR and CHF. The greenback was stable vs SEK and GBP.

Among the EM currencies we track, RUB slid the most against the greenback. The Russian ruble tumbled as Russian President Vladimir Putin, his Ukrainian counterpart Petro Poroshenko and key EU leaders met at the sidelines of the Asia-Europe summit to discuss the Ukraine crisis. The peace talks follow the threat from Russian President that Europe faces “major transit risks” to the supply of natural gas through Ukraine. In a brief news conference after the talks, Italian Prime Minister Matteo Renzi said that he was “really positive” on the prospects for a solution to the conflict but big differences remained. On the other hand, a Russian spokesman described the conversation as being full of misunderstandings. The ruble, already suffering from low oil prices, fell more against the dollar as there was no clear sign of a breakthrough between the sides. In my view, the mixed signals from the talks, the low oil prices and the ongoing sanctions against Russia are expected to weigh more on the ruble and we could see the currency weaken further.

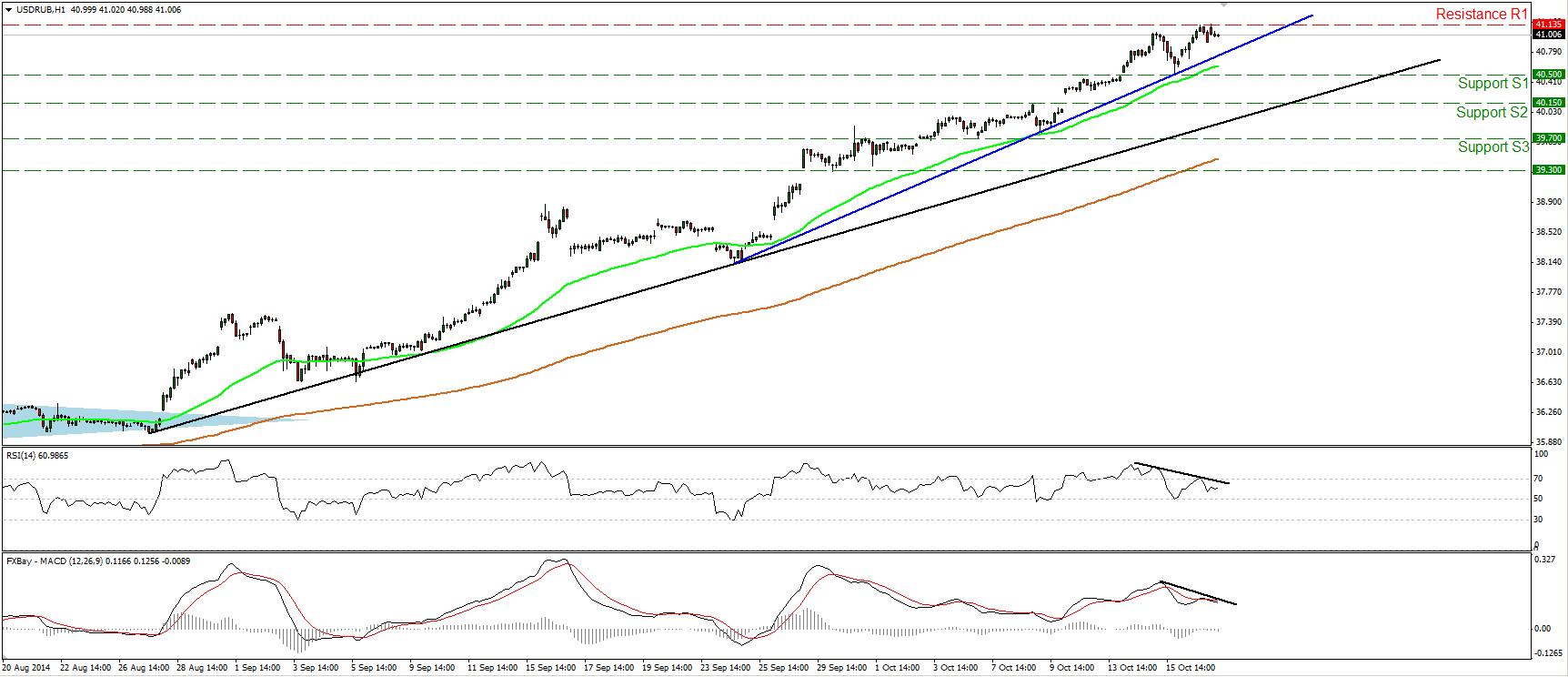

USD/RUB moved fractionally higher during the European morning Friday, but after testing again its all-time high it retreated somewhat. In my opinion, the pair has further upside to go, since the technical picture still suggests an uptrend. The price structure remains higher highs and higher lows above the short-term blue uptrend line and above both the 50- and 200-hour moving averages. However, I see negative divergence between both of our hourly momentum indicators and the price action. This makes me cautious of further pullback before the longs take control again, perhaps for another test at the support line of 40.500 (S1), determined by Wednesday’s lows. A clear and decisive move above the 41.135 (R1), the all-time high, is needed to confirm a forthcoming higher high and signal the continuation of the uptrend.

Support: 40.500 (S1), 40.150 (S2), 39.700 (S3)

Resistance: 41.135 (R1) (All-time high)

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.