AUD/NZD

The dollar traded lower against almost all of its G10 peers during the European morning Tuesday. It was stable only vs EUR.

JPY gained the most against the dollar after the Japanese Prime Minister Shinzo Abe said that the weaker yen burdens households and small firms by pushing up their fuel cost. On top of that, Bank of Japan Governor Haruhiko Kuroda said there was no need to adjust monetary policy. Since the Bank believes that the inflation target of 2% can be achieved, its massive stimulus program will remain in place but there is no intention to expand it soon.

UK industrial production was unchanged mom in August in line with market expectations. On the other hand, the yoy rate accelerated and the previous figure was revised up, adding somewhat to Cable’s recent advance. However, given the other recent soft data coming from the UK, I would see the minor bounce as a renewed selling opportunity.

The Reserve Bank of Australia held its cash rate unchanged at 2.5% as expected and removed the sentence where it said that the rate “remains above most estimates of its fundamental value.” The Bank attributed the recent decline in the currency in a large part to USD strengthening and reiterated that the exchange rate “remains high by historical standards”. RBA Governor Glenn Stevens made no new attempts to talk down the AUD/USD, in contrast to the Reserve Bank of New Zealand’s recent verbal intervention calling for a “significant downward adjustment” to NZD. Both Governors want their countries’ currencies to weaken, nevertheless only the RBNZ has actually intervened in the market to achieve this. Thus I would expect AUD/NZD to appreciate.

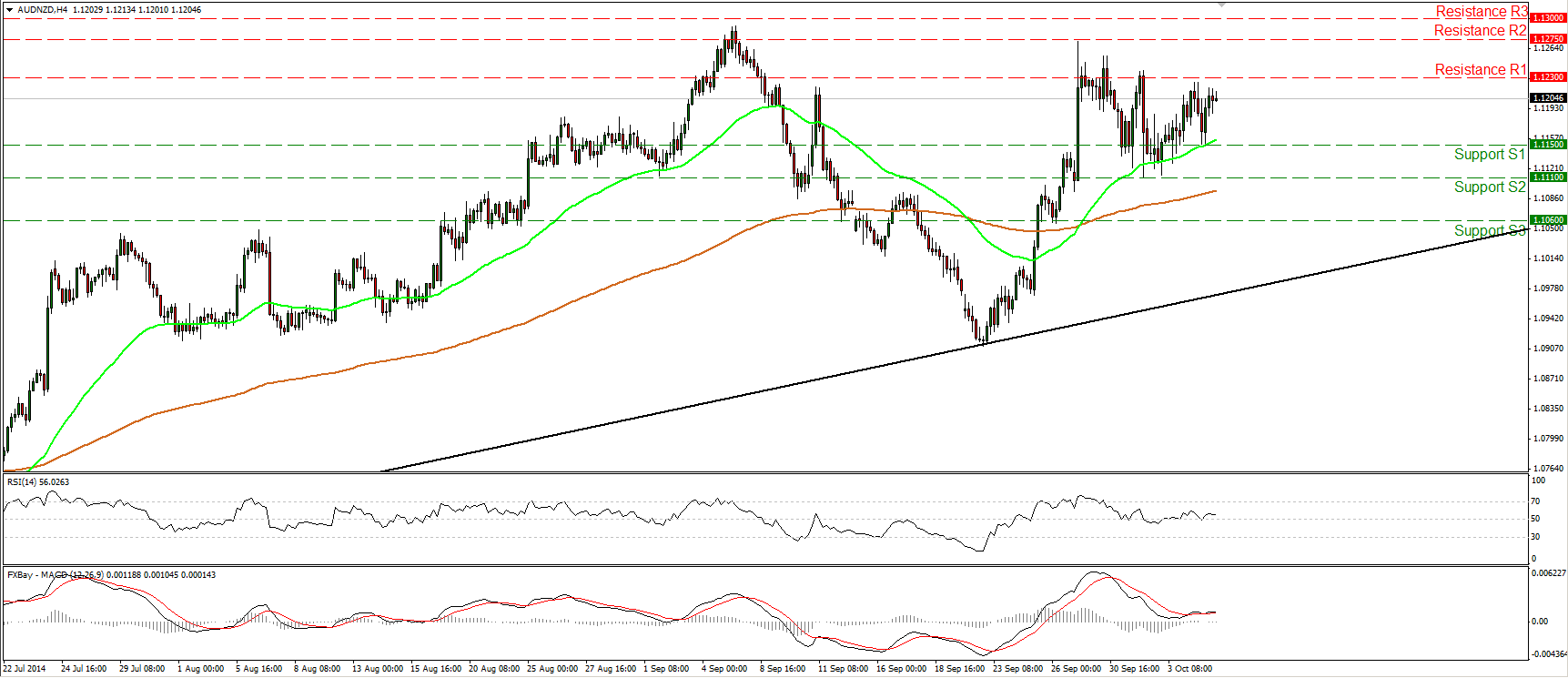

AUD/NZD moved higher during the European morning Tuesday, after finding support near the 1.1150 (S1) line. At midday, the rate is trading slightly below the resistance of 1.1230 (R1). A clear and decisive upside break of that line could trigger extensions towards the next obstacle at 1.1275 (R2). The momentum studies are both positive, as the RSI moved higher after finding support at its 50 line while the MACD remains above both its zero and trigger lines. In the bigger picture, as long as the pair remains above the longer-term black uptrend line (drawn from back at the low of the 10th of July), and above both the 50- and the 200-day moving averages, I would consider the overall trend to be to the upside.

Support: 1.1150 (S1), 1.1110 (S2), 1.1060 (S3) .

Resistance: 1.1230 (R1), 1.1275 (R2), 1.1300 (R3).

Recommended Content

Editors’ Picks

AUD/USD: Further losses retarget the 200-day SMA

Further gains in the greenback and a bearish performance of the commodity complex bolstered the continuation of the selling pressure in AUD/USD, which this time revisited three-day lows near 0.6560.

EUR/USD: Further weakness remains on the cards

EUR/USD added to Tuesday’s pullback and retested the 1.0730 region on the back of the persistent recovery in the Greenback, always against the backdrop of the resurgence of the Fed-ECB monetary policy divergence.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

Bitcoin price dips to $61K range, encourages buying spree among BTC fish, dolphins and sharks

Bitcoin (BTC) price is chopping downwards on the one-day time frame, while the outlook seen in the one-week period is a horizontal trade. In this shakeout moment, data shows that large holders are using the correction to buy up BTC.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.