USD/RUB

The dollar traded mixed against its G10 peers during the European morning Wednesday. It was higher against NOK, EUR and CHF, in that order, while it was lower against AUD, NZD and SEK. The greenback was virtually unchanged against GBP, JPY and CAD.

The euro fell against the dollar after manufacturing growth in the Eurozone slowed further in September. The final German manufacturing PMI contracted for the first time since June 2013. The poor data confirm that the bloc’s manufacturing economy has lost the growth momentum seen earlier in the year. On top of the slowdown in inflation rate, the weak manufacturing data trigger concerns of stagnation and added further selling pressure on euro.

The Norwegian krone was another loser against the greenback after that country’s manufacturing PMI missed expectations of a moderate decline and fell again below the 50 line. USD/NOK rose to trade a few pips below our 6.4600 resistance level. However, given the Norges Bank’s announcement yesterday that it would begin buying the equivalent of NOK 250mn per day from this month, I would remain cautiously bearish towards USD/NOK as this move by the Bank is NOK-supportive in the near term.

On the other hand, Sweden’s manufacturing PMI improved in September from its lowest point last seen in April 2013. This is the second major indicator that comes strong from the country, following the general elections in September. Nevertheless, I would remain cautious on SEK. I expect the industrial production figure to be released on Friday and the CPI in two weeks to give a better view on the country’s conditions.

The Russian ruble hit a new low vs the dollar yesterday after speculation emerged that the country’s central bank is considering introducing temporary capital controls. The pair remained at high levels today even though the Bank issued a statement assuring no limitations on capital flows will be imposed.

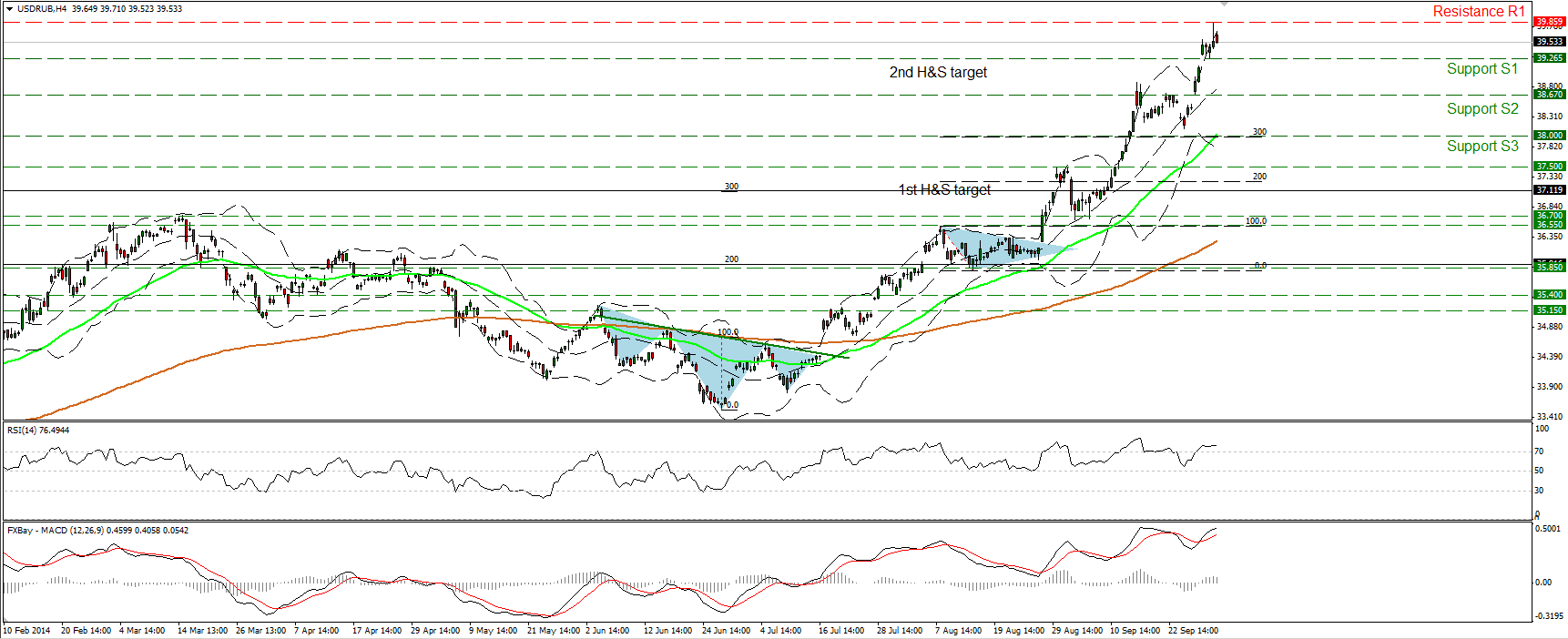

USD/RUB remained just below its yesterday’s all-time high 39.860 (R1) level and traded near those levels during the European morning Wednesday. After the completion of a triangle formation, the price structure remains higher highs and higher lows above both the 50- and the 200-period moving averages and this keeps the overall outlook to the upside. The MACD, already within its positive field, lies above its trigger line, while the RSI remains above 70 and is pointing slightly up. This indicates accelerating bullish momentum. I would like to see a decisive move above the psychological level of 40.000 (R2) for further bullish extensions.

Support: 39.265 (S1), 38.670 (S2), 38.000 (S3) .

Resistance: 39.860 (R1), since the pair is printing new all-time highs, no resistance is identified from past market activity. A possible second resistance stands at the psychological level of 40.000.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.