USD/NOK

The dollar traded lower against almost all of its G10 counterparts during the European morning Thursday. It was stable only against AUD and JPY.

In Norway, the country’s central bank left the key policy rate unchanged at 1.5%. Norges Bank Governor Oystein Olsen noted that the outlook for inflation and output is little changed since June. Therefore the Executive Board decided to keep the key rate unchanged with prospects to remain at the present level to the end of 2015. NOK strengthened approximately 0.50% against the dollar at the announcement. Nonetheless, given the stance of the Bank to keep rates unchanged and the likelihood that the Fed will begin tightening in the first half of 2015, the divergent policies may push USD/NOK up.

UK retail sales rose 0.2% mom in August, a slowdown from a downwardly revised +0.4% mom in the previous month. The below-consensus figure weakened sterling somewhat, however GBP recovered immediately since investors’ eyes are most likely on the Scottish referendum outcome.

The European Central Bank announced that it allotted EUR 82.6bn at its first TLTRO at a fixed rate of 0.15%. The first allotment came in below estimates of EUR 100bn-300bn indicating that ECB President Mario Draghi has more to do to meet his stimulus target. The low demand indicates that banks are waiting for the Asset Quality Review (AQR) results published next month before taking up any additional liquidity. As a result, the low allotment now may hint a higher demand at the next allotment in December.

Swiss National Bank reaffirmed its minimum exchange rate of CHF 1.20 per EUR and left the target range for the three-month Libor unchanged at 0.0-0.25%. SNB repeated that for this purpose it is prepared to purchase foreign currencies in unlimited quantities and will take further measures if necessary. The Bank left inflation forecast for the current year unchanged, while it lowered its forecasts for 2015 and 2016.

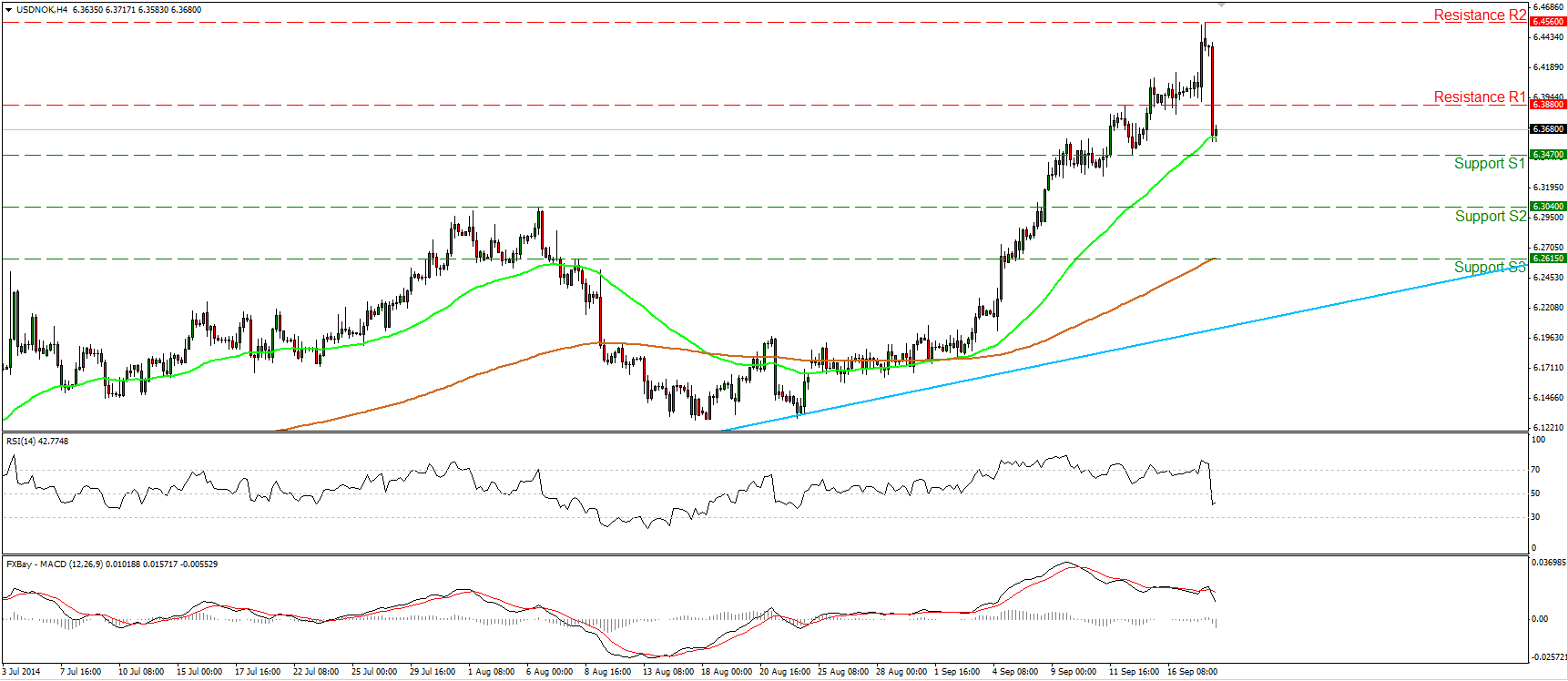

USD/NOK plunged during the European morning Thursday, breaking below the 6.3880 line. The rate is now trading near the 50-period moving average, slightly above the support barrier of 6.3470 (S1). Having in mind that we have negative divergence between our near term momentum studies and that on the daily chart I see a possible tweezers top candlestick pattern being formed (if today’s candle closes negative), I would expect the decline to continue, perhaps below the 6.3470 (S1) support hurdle. Our daily momentum studies also support the notion. The 14-day RSI exited its overbought zone and is now pointing down, while the daily MACD shows signs of topping and could move below its trigger in the following days. Nevertheless, I still see a longer-term uptrend for USD/NOK. The rate is printing higher highs and higher lows above the light blue uptrend line drawn from back at the low of the 8th of May. As a result, I would see any possible future setbacks as a corrective move and a renewed buying opportunity.

Support: 6.3470 (S1), 6.3040 (S2), 6.2615 (S3)

Resistance: 6.3880 (R1), 6.4560 (R2), 6.5530 (R3)

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.