USD/NOK

The dollar traded mixed against its G10 peers during the European morning Friday, reflecting the restrained mood ahead of the US nonfarm payrolls for August, due out later in the day. It was higher against SEK and NOK, in that order, while it was lower against AUD, CHF, EUR and JPY. The greenback was virtually unchanged against CAD, NZD and GBP.

The Swedish krona weakened after the country’s industrial production unexpectedly contracted in July. The worse-than-expected figure added to the recent evidence of a slowdown in Sweden’s economy and pushed SEK down vs USD, sending the pair to levels last seen back in July 2012. As we said in previous comments, we still expect that the uncertainty over the Sep. 14 general election, on top of the weak data coming from the country and the need for further policy easing to boost Sweden’s economy could weaken SEK further down the road.

Although the recent data coming from Norway were mostly strong, the industrial production in July reading disappointed by showing a large drop. Ahead of the US employment report later in the day and expectations of a slowdown in Norway’s inflation, due out next week, we could see USD/NOK to appreciate and test the strong resistance and psychological zone of 6.3000.

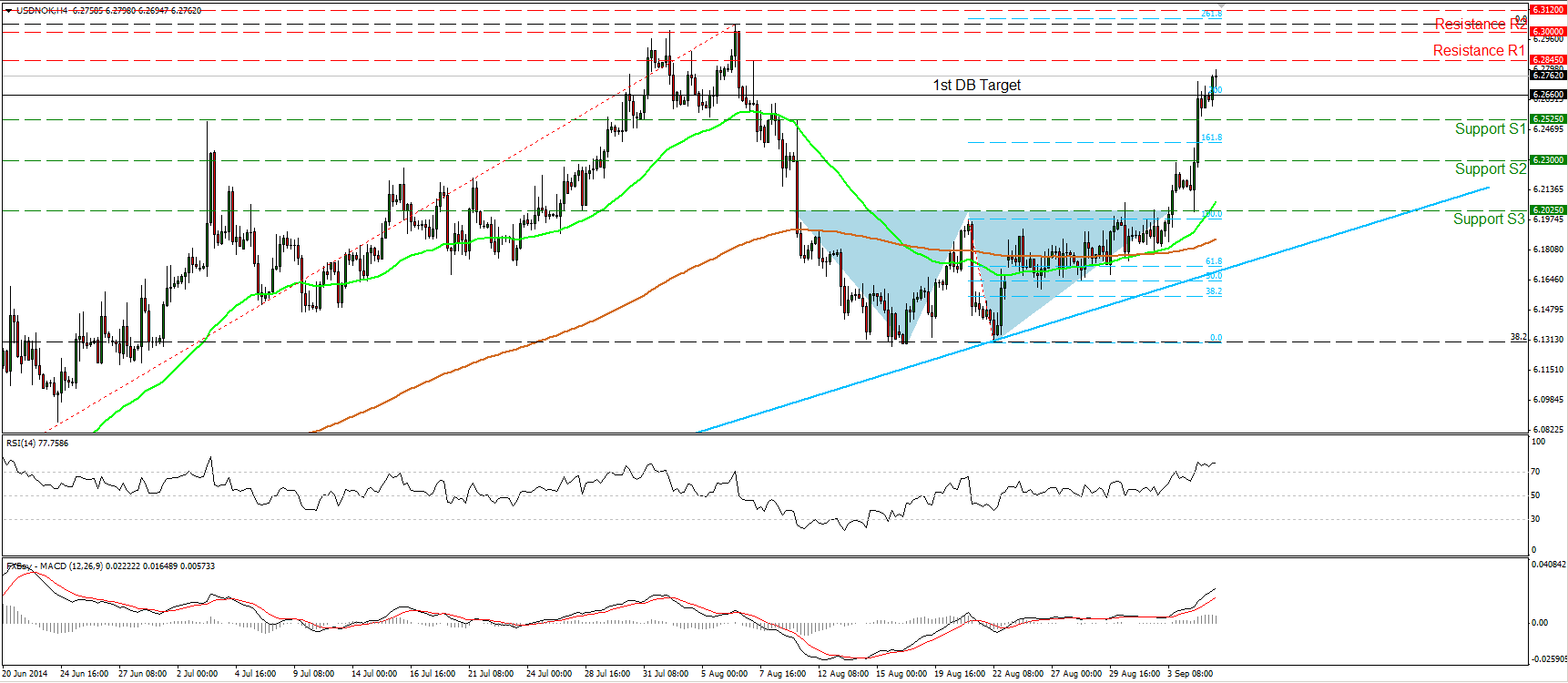

USD/NOK surged on the 3rd of September violating the 6.2025 line and completing a double bottom reversal formation. The two bottoms were formed at the 38.2% retracement level of the 8th May – 6th August uptrend, signaling that the 6th - 18th August down move was just a corrective phase. Today, during the European morning, the pair extended the recent bullish wave, reaching and breaking above the 1st price objective of the double bottom pattern (6.2660). Taking all the above into account, I would consider the near-term bias to be to the upside and I would expect another leg higher, towards the key resistance zone of 6.3000 (R2), slightly below 261.8% extension level of the double bottom’s width. Nevertheless, having in mind that the recent rally was too steep and that the RSI lies within its overbought territory, I would be cautious of a possible pullback before we experience further upside. On the daily chart, the rate is trading above both the 50- and the 200-day moving averages and above the light blue trend line, drawn from back at the low of the 8th of May. This supports my view for further bullish extensions, at least towards the strong resistance area of 6.3000 (R2).

Support: 6.2525 (S1), 6.2300 (S2), 6.2025 (S3).

Resistance: 6.2845 (R1), 6.3000 (R2), 6.3120 (R3).

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.