USD/SEK

The dollar traded unchanged against almost all of its G10 peers during the European morning Thursday, in anticipation of the policy meetings of the Bank of England and the European Central Bank. The greenback was lower only against SEK.

Sweden’s central bank decided to hold the repo rate unchanged at 0.25%, saying that last month’s cut was enough to battle the deflationary risk. As in the previous forecast, Riksbank considered it appropriate to begin raising the repo rate near the end of 2015, when they expect inflation to be near their 2.0% target. This disappointed those who expected the Bank to start discussing non-standard measures to support economic activity and USD/SEK declined approximately 0.20% at the news. However, we still expect that the uncertainty over the Sep. 14 general election, the poor data coming from the country and the need for further policy easing to boost Sweden’s economy could weaken SEK in the coming days.

The markets were stable during the European morning as investors’ eyes are on the most important event of the day, the ECB meeting and President’s Draghi press conference following the decision. After Draghi’s speech at Jackson Hole, the chances to see further ECB action combined with the TLTROs in two weeks have risen. We expect some clarifications about the ABS purchases program at the press conference, which could be EUR-negative.

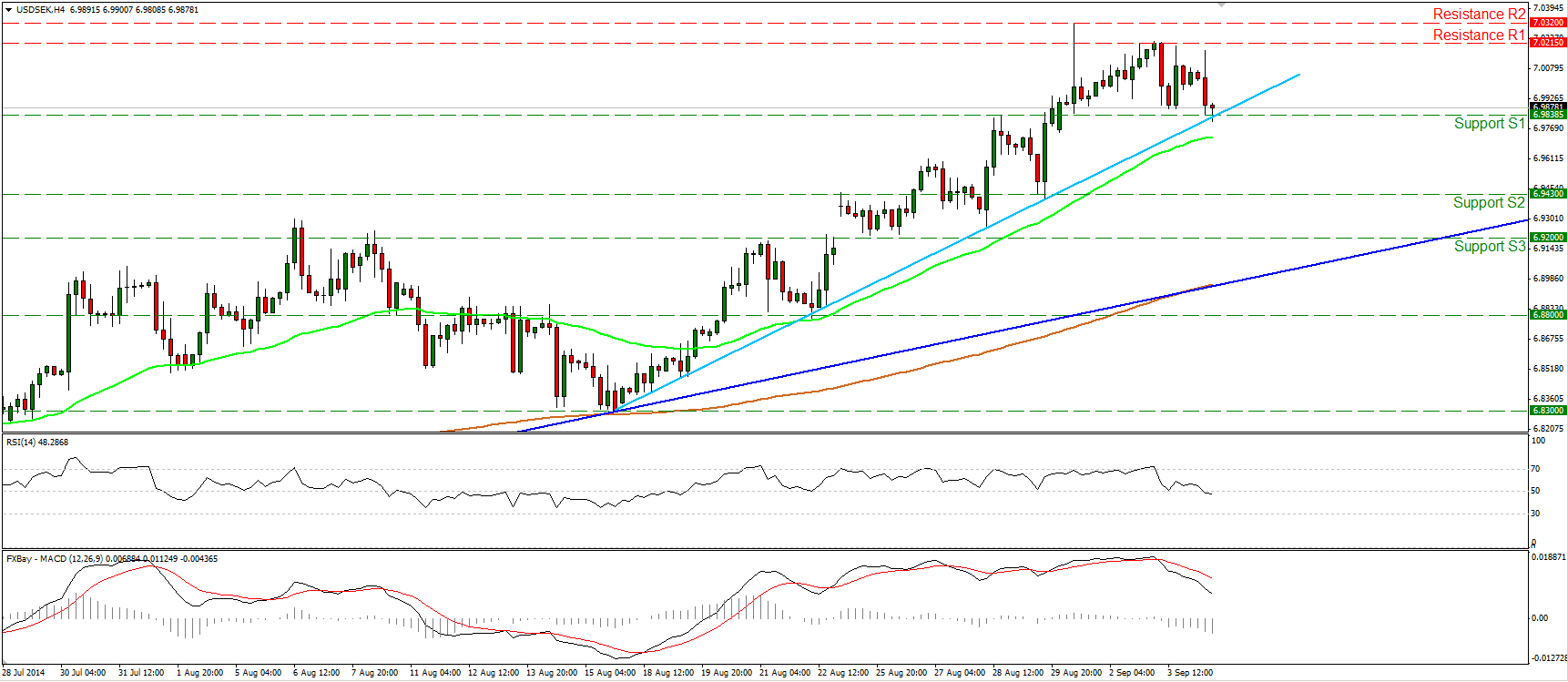

USD/SEK declined during the European morning Thursday, after the Riksbank kept its benchmark interest rate unchanged. At midday, the rate is sitting near the short-term uptrend line (light blue line drawn from at the low of the 15th of August) and the support bar of 6.9838 (S1). This keeps the near term upside path intact, but even if we see a dip below these levels, I would expect it to be limited to the 6.9430 (S2) barrier, or near the longer-term uptrend line (blue line taken from back the 19th of March). From a technical front, the picture remains positive as the rate rebounded from that long-term trend line five times since March (see the lows on the daily chart). The fundamentals are also in favor of a higher pair. Today’s meeting does not change my view on Sweden’s economic outlook, especially compared to the improving US economy. The 14-day RSI exited its overbought zone and is pointing down, while the daily MACD appears willing to move below its signal in the close future. But taking all the above in consideration, I would expect any possible pullback to provide renewed buying opportunities.

Support: 6.9838 (S1), 6.9430 (S2), 6.9200 (S3).

Resistance: 7.0215 (R1), 7.0320 (R2), 7.0775 (R3).

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.