NOK/SEK

The dollar traded unchanged or lower against most of its G10 peers during the European morning Monday. The greenback was lower against NOK, GBP, CHF, EUR and NZD, in that order, while it was higher only against SEK. It remained stable vs JPY, CAD and AUD.

The Norwegian krone was the main gainer during the European morning after the country’s manufacturing PMI for August beat expectations of a moderate decline and rose to 51.8 from 50.8 in July. NOK was further boosted by the slightly positive revision of July’s print. The strong reading added to the recent robust data from Norway and strengthened NOK.

On the other hand, Sweden’s manufacturing PMI declined to its lowest point for the year and to levels last seen in April 2013. On top of the poor figures from the largest Nordic economy, and the constant deflation risk in Sweden, the pressure on Riksbank to introduce further measures at its meeting this Thursday is growing every time a weak indicator is coming out. Following Riksbank’s unexpected 50bps rate cut in early July and the deterioration of the Swedish economy, the possibility that we might see additional action from the Nordic central bank is rising.

Given the divergence of the economic conditions between the two Nordic economies and the growing negative sentiment towards the Swedish krona, we believe it’s highly likely that NOK/SEK can appreciate further in the near-term.

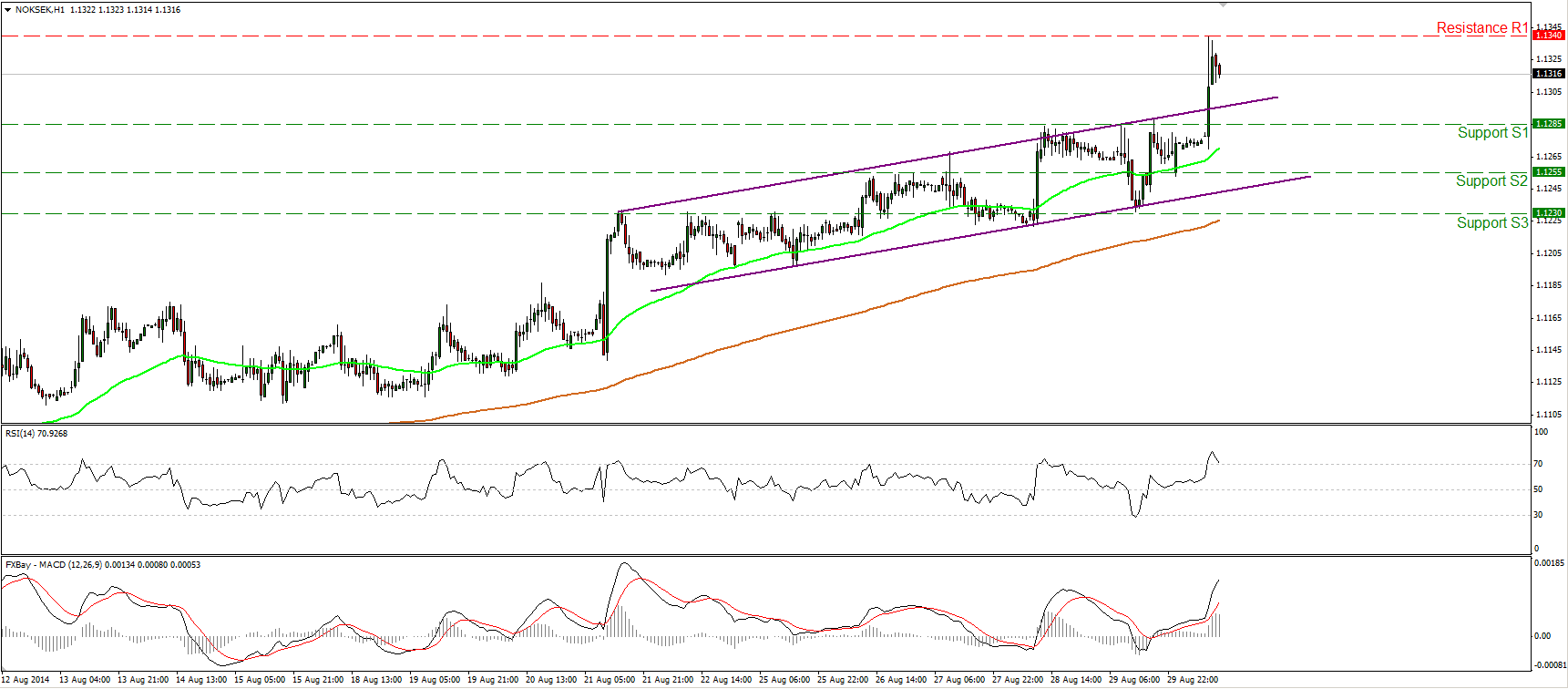

NOK/SEK surged during the European morning Monday, breaking above the 1.1285 line (resistance turned into support) and above the upper boundary of the purple upside channel. However, the rally was halted at 1.1340 (R1) and the profit taking has already started. The hourly MACD lies above both its zero and signal lines, confirming today’s strong bullish momentum, but the RSI appears willing to exit its overbought field. Taking our momentum signs into account, I would expect the profit taking to continue and cause a pullback, perhaps towards the upper boundary of the aforementioned channel or to test the 1.1285 (S1) barrier as a support. However, I believe that the short-term bias remains to the upside and such a pullback could provide renewed buying opportunities. A clear close above the 1.1340 (R1) hurdle is likely to see scope for extensions towards the key line of 1.1400 (R2). On the daily chart, I see a long-term uptrend being in effect since the beginning of February. This supports the case for a stronger pair in the future.

Support: 1.1285 (S1), 1.1255 (S2), 1.1230 (S3).

Resistance: 1.1340 (R1), 1.1400 (R2), 1.1450 (R3).

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.