NZD/USD

The dollar traded unchanged or lower against its G10 counterparts during the European morning Thursday. It was lower against NZD, JPY, CAD, AUD and NOK, in that order, while it remained stable against GBP, EUR, CHF and SEK.

Germany’s economy contracted more than expected while France’s stagnated, missing estimates of moderate growth. This will most likely force the French government to cut their growth forecasts as it is very difficult to reach their current target of +1.0% GDP growth. The below-estimate data coming from the euro-area’s largest economies dragged the Eurozone’s preliminary growth down to a flat reading in Q2 from +0.2% qoq in Q1. The miss was widely expected after the earlier soft German and French data, but EUR did not weaken, probably due to the relief that the bloc did not record a contraction in Q2.

Taking into account that the tit-for-tat sanctions with Russia have yet to be seen in the data, we believe that growth in Q3 is likely to print even lower, supporting our view that the Eurozone has lost momentum. The bloc’s single currency will most likely weaken as the sluggish economy will increase pressure on the ECB to introduce further easing. It seems that ECB President Draghi’s comments on the ABS purchase programme -- “it’s done with the expectation of using it but no final decision has been taken” -- will bring the final decision “closer” after Thursday’s poor data.

The New Zealand dollar traded higher against the dollar during the European morning, after the country’s Q2 retail excluding inflation came in strong. Sales rose 1.2% qoq, from an upwardly revised +0.8% qoq in Q1.

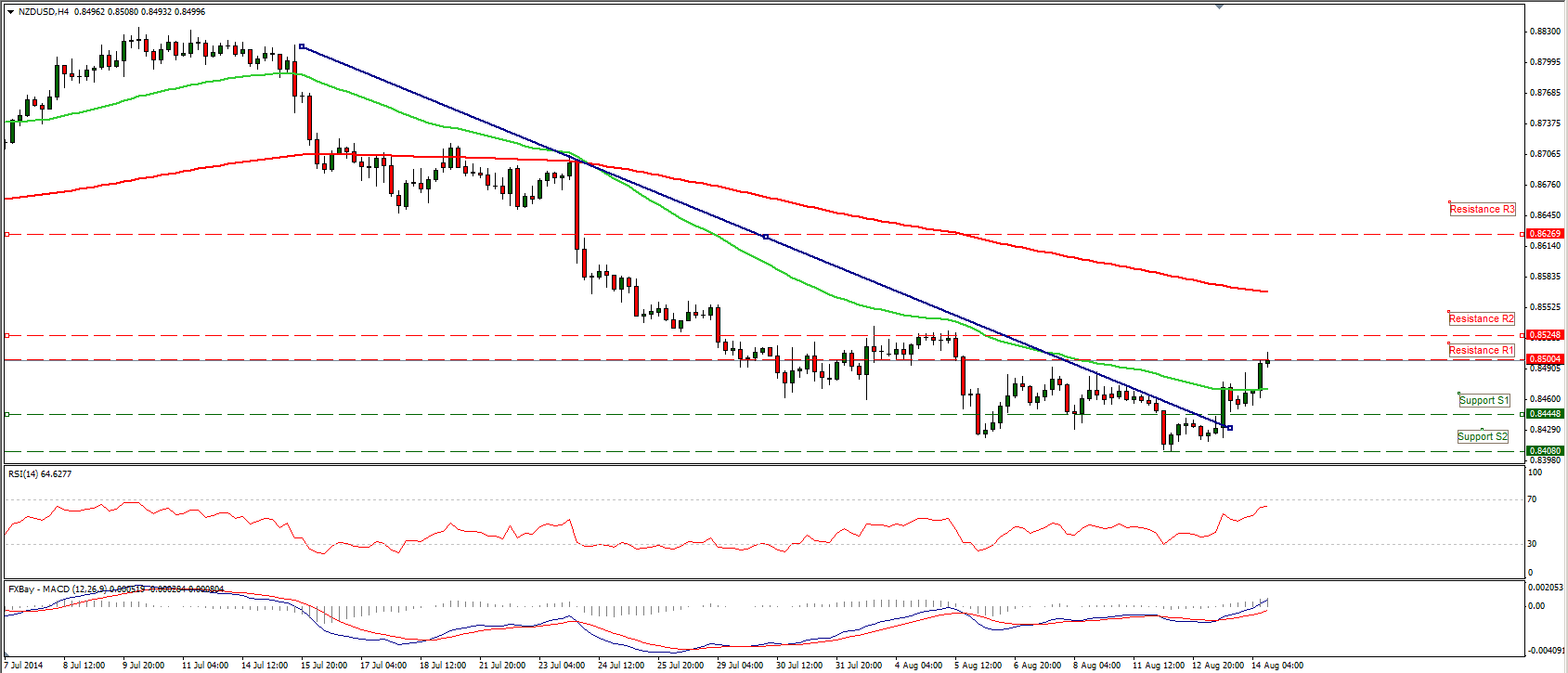

NZD/USD moved higher during the European morning, moving towards our resistance level of 0.8500 (R1) and reversing the recent downtrend movement shown with the blue line. A clear break above could trigger further extensions towards our next resistance of 0.8525 (R2). The daily MACD remains below the zero line but it’s pointing up, ready to cross its trigger line, and the 14-day RSI moved above its oversold area, heading to hit its 50 line. Both our momentum studies support the view that kiwi is gaining momentum. However, a clear break above the 0.8525 (R2) is needed to support the reverse of the recent downtrend.

Support: 0.8450 (S1), 0.8400 (S2), 0.83370 (S3)

Resistance: 0.8500 (R1), 0.8525 (R2), 0.8625 (R3)

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.