AUD/USD

The dollar traded mixed against its other G10 counterparts during the European morning Tuesday. It was higher against CHF, EUR and CAD, in that order, while it was lower against AUD, NZD and GBP. The greenback traded nearly unchanged against NOK, JPY and SEK.

The UK service-sector PMI came at 59.1 in July from 57.7 in the previous month. The strong figure reached an eight-month high, exceeding the forecast of a moderate increase to 58.0. The robust reading was in contrast to the recent weak data indicating a slight slowdown in the British economy. Sterling jumped approximately 0.20% at the release of the data, driving Cable to resume its uptrend after last Friday’s lower-than-expected manufacturing PMI.

The Euro fell fractionally below 1.3400 during the European morning after the bloc’s final service-sector PMI declined to 54.2 in July, from the preliminary 54.4. The market reacted the most to the release of Italy’s below consensus figure and at the anticipation of an overall lower print coming out from Eurozone. The pair traded around the 1.3395 level at the time of writing, reversing most of the Friday’s gains against the greenback. Given that, later in the day, the US ISM non-manufacturing index is forecast to have risen in July, I would expect EUR/USD to continue declining, at least towards the support zone of 1.3365, marked by the lows of the 30th of July.

The Reserve Bank of Australia kept its key policy rate at a record low and repeated its stance that “On present indications, the most prudent course is likely to be a period of stability in interest rates.” In a largely unchanged statement the Bank decided to leave the cash rate at 2.5% indicating that rates will probably stay on hold for some time. Aussie weakened slightly at the release of the statement but recovered all the losses and advanced even more in the following minutes to enter the gainers list against the dollar.

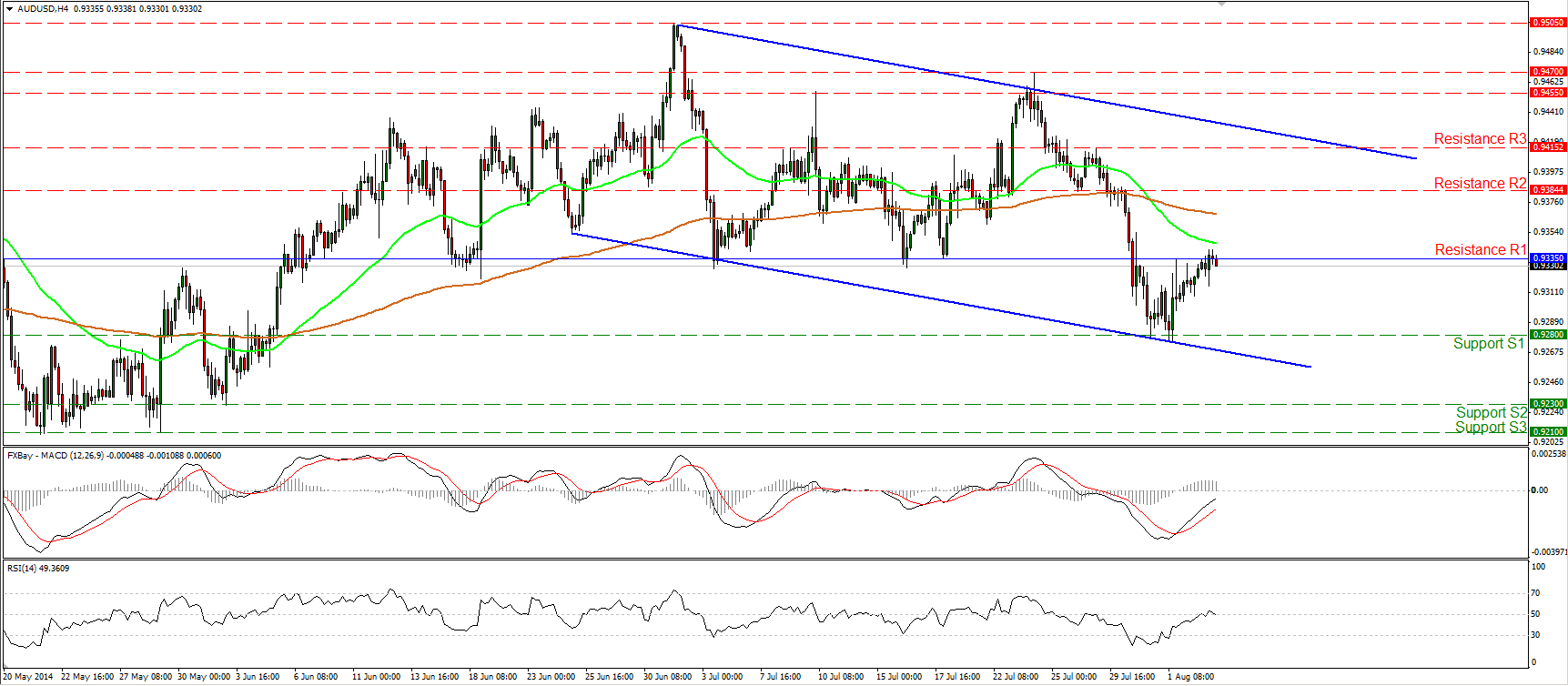

AUD/USD rebounded from the 0.9280 (S1) barrier and the downward sloping support line during the European morning Tuesday, the rate reached our resistance zone of 0.9335 (R1). Taking into account that the 0.9335 level acted as a strong support before its downside violation, I would expect it to act as strong resistance and prevent the rate from moving higher. If the bears manage to take the reins near that line, I would expect them to push the pair lower, perhaps for another test near the 0.9280 (S1) support level. Although the MACD lies above its signal line, the RSI seems willing to re-cross below 50. Zooming on the 1-hour chart, I can see negative divergence between the price action and both our hourly momentum indicators, adding to my view that the forthcoming wave could be to the downside.

Support: 0.9280 (S1), 0.9230 (S2), 0.9210 (S3).

Resistance: 0.9335 (R1), 0.9384 (R2), 0.9415 (R3).

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.