Copper futures

The dollar traded unchanged or higher against most of its G10 peers during the European morning Friday. It was higher against NZD, CAD, CHF, EUR, JPY and GBP, in that order, and was virtually unchanged against AUD and NOK. The greenback was lower only against SEK.

The Germany Ifo Business Climate Index fell to 108.0 in July from 109.7 the previous month. This was the third consecutive drop in the index, since the geopolitical tensions are most likely impacting the German economy. The expectations index also declined for a third successive month, to reach its lowest level since August 2013. EUR depreciated approximately 0.15% at the release of the news, giving back all the gains that it made after Thursday’s strong PMI readings.

The first estimate of UK GDP for Q2 was +0.8% qoq, the same pace as the final Q1 figure and in line with the market forecast. Sterling strengthened slightly at the release but gave away all the gains immediately, as at this stage data content in the first estimate is less than half of the total required for the final Q2 output figure. GBP/USD continued to weaken, probably due to expectations of a rebound in the US durable goods orders for June, coming out later in the day.

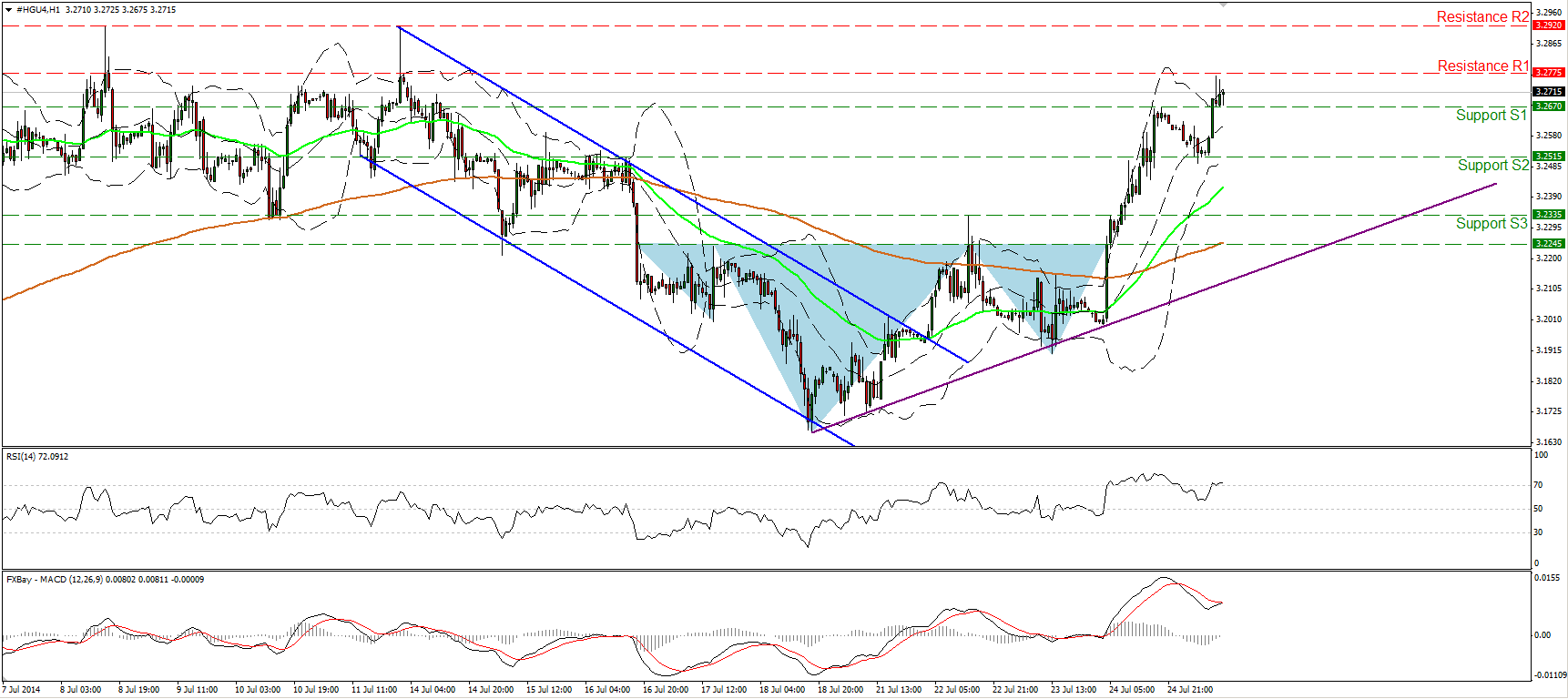

Copper has been the best-performing asset this week of the currencies and commodities that we track on a daily basis. The higher-than-expected rise in China’s PMI has pushed copper higher. The futures today continued yesterday’s rally and at the time of writing the price is trading marginally below the resistance barrier of 3.2775 (R1). During the Asian morning Thursday, the metal emerged above the 3.2245 hurdle, signaling the completion of an inverted head and shoulders formation and reversing the prior down path to an uptrend. The price structure remains higher highs and higher lows and a clear move above the 3.2775 (R1), is likely to target the resistance zone of 3.2920 (R2). Nevertheless, although the shot-term picture remains to the upside, zooming on the 30-minutes chart, the RSI fell below its 70 level, while negative divergence is identified between the MACD and the price action. This raises concerns for a possible corrective wave before the longs take over the reins again, as we expect.

Support: 3.2670 (S1), 3.2515 (S2), 3.2335 (S3).

Resistance: 3.2775 (R1), 3.2920 (R2), 3.3000 (R3).

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.